The effective interest rate for SSB SBMAR25 GX25030N is 2.97% if you held it for 10 years. The interest rates for this month’s issue of the SSB (Singapore Savings Bond) had recovered 0.15% from 2.82% offered by SBFEB25. The yield is higher than what was offered by Singapore Treasury Bills (SGS T Bills) BY25100H at 2.95% per annum

Singapore Savings Bonds are low risk investments, thus making them a popular investment option among risk-averse investors looking to grow their savings over time. The return increases as you hold them longer. The limit an individual can purchase is S$200,000 inclusive of both cash and SRS.

What are Singapore Savings Bonds?

Singapore Savings Bonds are a type of government bond issued by the Monetary Authority of Singapore that offers individuals a safe and flexible way to save money. The “step up” feature of the SSB facilitates long term investment which means the return increases the longer you hold them for.

These bonds have a low minimum investment amount, starting at just $500, and offer a higher interest rate than traditional savings accounts.

Investors can purchase Singapore Savings Bonds directly from the government and hold them for up to 10 years, earning regular interest payments along the way.

Singapore Savings Bonds SSB Calculator

Monetary Authority of Singapore (MAS) had come up with a Singapore Savings Bonds Calculator which you can use to calculate how much interest you would earn if you held Singapore Savings Bonds February 2025 for 10 years.

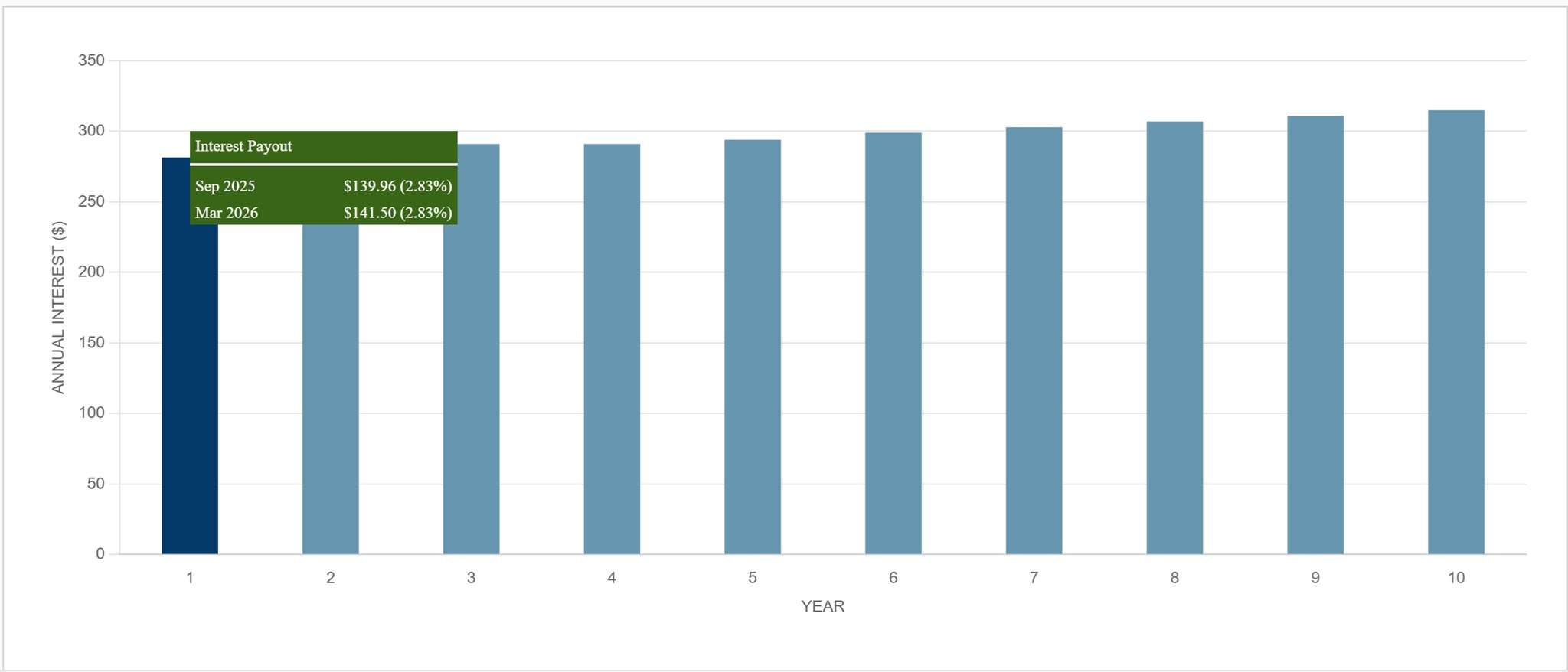

Let us use an investment of S$10,000 as an example. If you purchase SSB Singapore (SBMAR25 GX25030N) and held it for 10 years, you will receive a total earning of S$2,981.46. Based on the SSB Calculator, you will receive an estimate of S$281.46 per year until maturity in March 2035 depending on the interest rate for that year.

Below is the interest per year for SSB SBMAR25 GX25030N.

| Year from issue date | Interest % | Average return per year %* |

| 1 | 2.83 | 2.83 |

| 2 | 2.89 | 2.86 |

| 3 | 2.91 | 2.88 |

| 4 | 2.91 | 2.88 |

| 5 | 2.94 | 2.89 |

| 6 | 2.99 | 2.91 |

| 7 | 3.03 | 2.93 |

| 8 | 3.07 | 2.94 |

| 9 | 3.11 | 2.96 |

| 10 | 3.15 | 2.97 |

*At the end of each year, on a compounded basis.

How to Buy Singapore Savings Bonds

To buy Singapore Savings Bonds, you first need to have an individual CDP account with the Central Depository (CDP). You can apply for the bonds through ATMs of participating banks, internet banking services, or through the DBS/POSB, OCBC, or UOB websites. Simply log in to your bank account and follow the instructions to subscribe to the bonds.

The minimum amount you can invest in Singapore Savings Bonds is $500, and you can apply for up to $200,000 worth of bonds in each issue. The bonds are issued monthly, and the interest rates are adjusted every year. Once you have successfully subscribed to the bonds, you will receive your interest payments twice a year, with the principal amount being repaid at the end of the bond’s 10-year tenure.

For more details, refer to How to Buy.

How to Sell Singapore Savings Bonds

To sell Singapore Savings Bonds, you can do so through the ATMs of participating banks, such as DBS/POSB, OCBC, and UOB. Simply log in to your bank account through the ATM and follow the instructions to sell your bonds.

You can also sell your Singapore Savings Bonds through SRS Operator if you hold them under the Supplementary Retirement Scheme.

For more details, refer to How to Redeem.

How To Track Singapore Savings Bonds?

To track your Singapore Savings Bonds, you can visit the official website of the Monetary Authority of Singapore (MAS) where they provide regular updates on the issuance and performance of the bonds.

![]() I use Stocks Café to track my SSB Singapore purchases. If you like to know more about Stocks Cafe, please read up my previous review of Stocks Cafe.

I use Stocks Café to track my SSB Singapore purchases. If you like to know more about Stocks Cafe, please read up my previous review of Stocks Cafe.

Will I Buy SSB SBMAR25 GX25030N?

If you have that extra cash, SBMAR25 is worth considering given that the cut off yield of recent issues of SGS T Bills are almost the same. The cut off yield of SGS T Bills are not known until the auction results are released. If you wish to take a bet at SGS T Bills, I think that is fine too as the yield is not too far off.

I have yet to review the latest fixed deposit promotions offered by Singapore banks. If the interest rates offered by Singapore banks are lower and I wanted to lock in the interest rate of 2.97% p.a. for 10 years, then investing into SBMAR25 is my preferred option.

If you have 100K, then take a look at UOB Stash where this simple savings account is offering you higher interest rates.

Until then, l will continue to hunt for the best place to park my money!