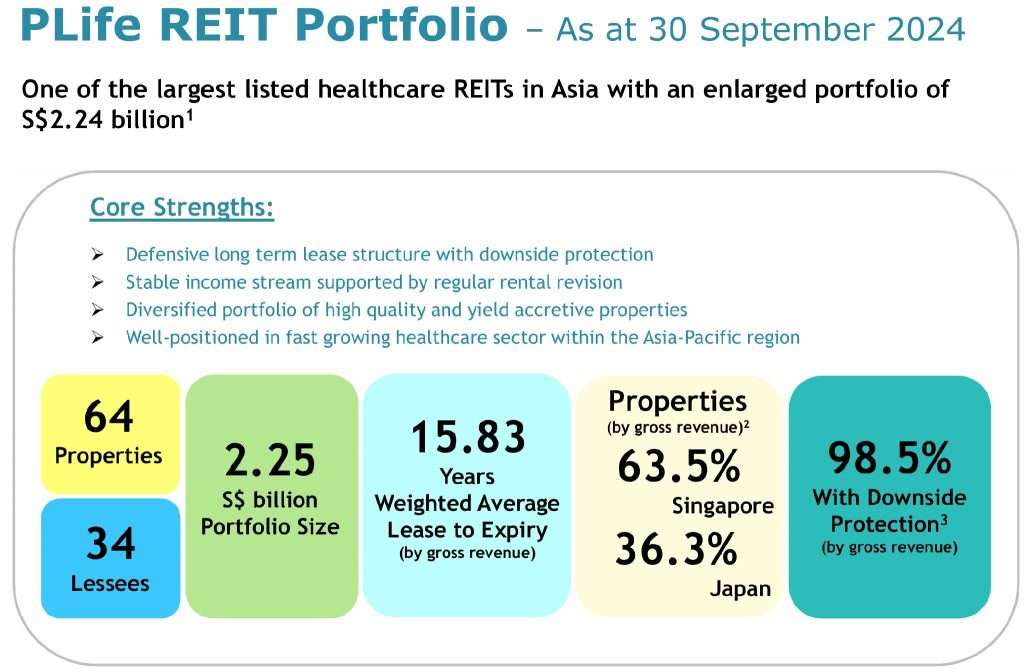

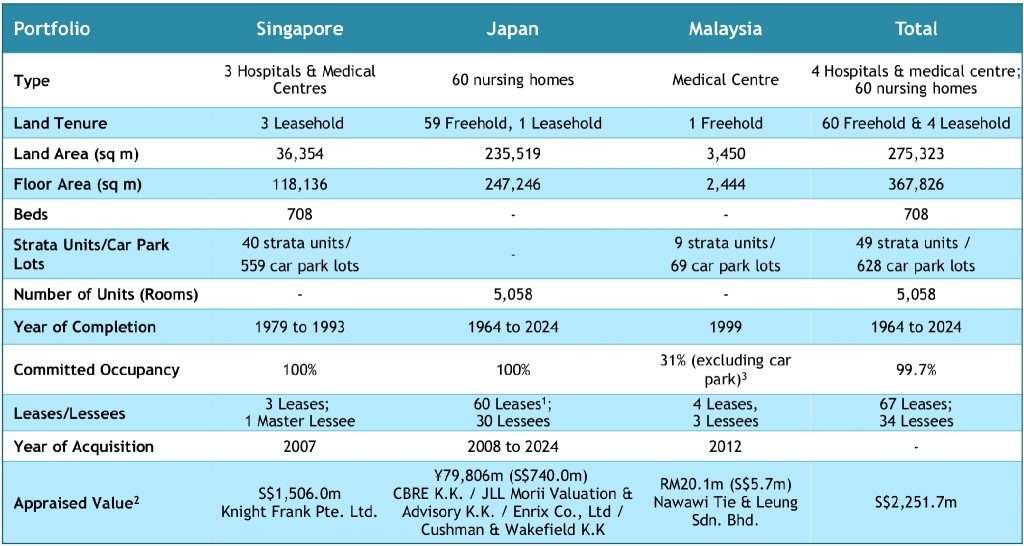

On 16th October 2024, ParkwayLife REIT released their 3Q2024 Business Update. ParkwayLife REIT is one of the largest listed healthcare REITs in Asia with an enlarged portfolio of S$2.24 billion. In Japan, it has 59 high quality nursing home properties worth S$717.2 million. Because of the step-up rent for its nursing home, ParkwayLife REIT is able to grow its Distribution Per Unit (DPU) year-on-year since IPO.

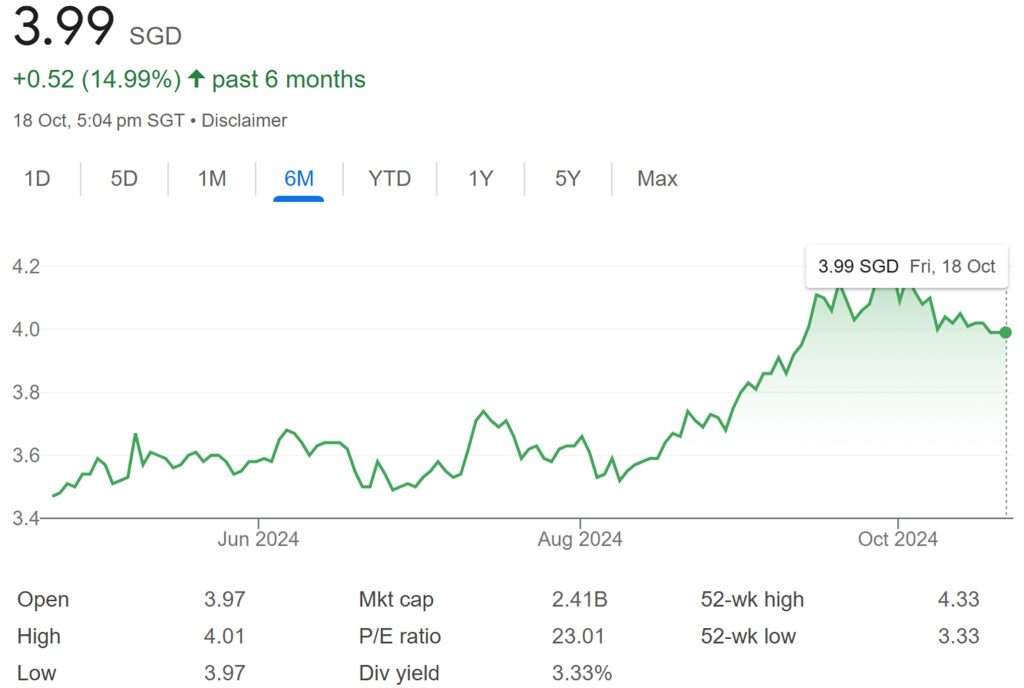

ParkwayLife REIT makes up 5.54% of my stock portfolio in terms of value. I have always wanted to increase my stake in ParkwayLife REIT but the share price has been very resilient and thus did not open an opportunity. What is ParkwayLife REIT’s current share price and current dividend yield?

Let us take a look into its latest business updates.

3Q2024 Financial Performance

Year To Date (YTD), Gross revenue and NPI have reduced by 2.2% and 2.1% respectively as compared to YTD in 3Q2023. The decline is mainly due to depreciation of the Japanese Yen but was offset by the contribution from one nursing home acquired in August 2024 and two nursing homes acquired in October 2023.

Finance costs have increased significantly by 7.7%. The increase is due to the funding of Capex and new acquisitions in 2023 and 2024 and higher interest costs from Singapore dollar debts and Japanese Yen debts. Notwithstanding, interest cost on loans drawn down to fund Capex has no distribution impact as they are not subject to deduction when computing distributable income

to Unitholders.

YTD, distribution per unit increased by 2.8% to 11.30 cents.

| YTD 3Q2024 (S$’000) |

YTD 3Q2023 (S$’000) |

Change | |

| Gross Revenue | 108,475 | 110,890 | (2.2%) |

| Net Property Income | 102,352 | 104,548 | (2.1%) |

| Finance Costs | (8,291) | (7,695) | 7.7% |

| Amount Available for Distribution | 68,337 | 66,506 | 2.8% |

| Distribution Per Unit (“DPU”) (cents) | 11.30 | 10.99 | 2.8% |

Debt

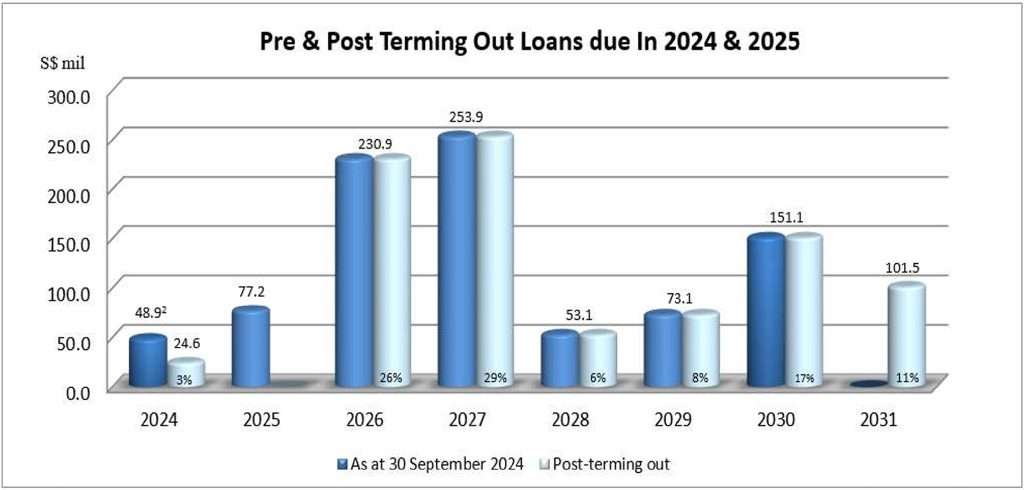

As of 30th September 2024, ParkwayLife REIT’s gearing stood healthy at 37.5%. There is ample debt headroom of $321.3 million and $590.1 million before reaching 45% and 50% gearing respectively.

Current weighted average term to maturity stood at 3.0 years. The weighted average term to maturity refers to the average time remaining until the principal amount of the REIT’s debt obligations are due. It is a measure of the REIT’s debt structure and gives an idea of how long the REIT has to manage its debt repayments.

Occupancy

As of 30th September 2024, ParkwayLife REIT’s overall portfolio occupancy stood strong at 99.7%.

ParkwayLife REIT’s Current Dividend Yield

On 18th October 2024, ParkwayLife REIT’s share price close at S$3.99. Based on the current share price and FY23 full year distribution of 14.77 cents, ParkwayLife REIT’s dividend yield is 3.70%.

Summary of ParkwayLife REIT 3Q2024 Business Update

Since this is a business update, there not much financial information to analyse. Based on the above, the pros are:

- YTD, distribution per unit increased by 2.8% to 11.30 cents.

- Gearing continued to stand healthy at 37.5%.

- Overall portfolio occupancy stood strong at 99.7%.

The cons are:

- Gross revenue and NPI have reduced by 2.2% and 2.1% respectively.

- Finance costs have increased significantly by 7.7%.

- Current dividend yield is low at 3.70% because of higher share price.