On 23rd July 2025, Mapletree Logistics Trust announced their 1QFY25/26 financial results. To recap, the manager of Mapletree Logistics Trust adopted the strategy to divest assets with older specifications and of limited redevelopment potential as part of their portfolio rejuvenation. The strategy has been ongoing for almost a year. As a unitholder of Mapletree Logistics Trust, I am curious to know whether its divestment strategy is working and what lies ahead for Mapletree Logistics Trust based on Mapletree Logistics Trust quarterly report. What is Mapletree Logistics Trust share price and target price?

During the quarter, Mapletree Logistics Trust completed the divestments of 1 Genting Lane and 8 Tuas View Square in Singapore. Post quarter-end, the manager completed another two divestments, namely 31 Penjuru Lane in Singapore and Subang 2 in Malaysia.

As of 30th June 2025, Mapletree Logistics Trust has a portfolio of 178 properties in Singapore, Australia, China, Hong Kong SAR, India, Japan, Malaysia, South Korea and Vietnam with assets under management of S$13.0 billion.

Now, let us take a look at its latest financial results.

Mapletree Logistics Trust 1QFY25/26 Financial Results

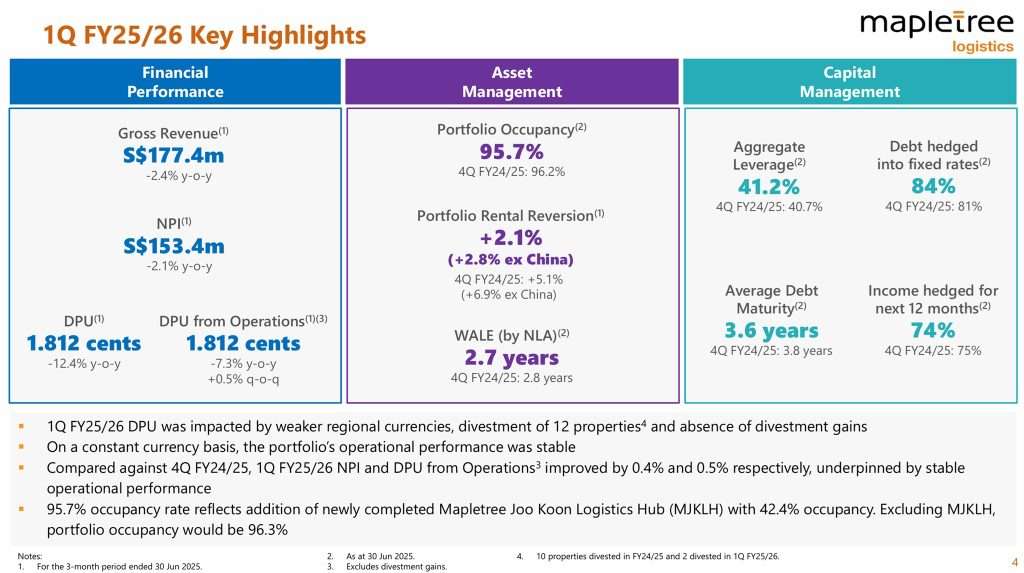

In 1QFY25/26, Mapletree Logistics Trust’s gross revenue was lower mainly due to lower contribution from China and the absence of revenue contribution from divested properties. Another reason was the currency weakness mainly CNY, HKD, KRW, AUD and VND offset by JPY and MYR). The lower gross revenue was mitigated by higher contribution from Singapore, Australia, and Hong Kong SAR and from the contribution from acquisitions completed in 1Q FY25/26. The impact of currency weakness was partially mitigated through the use of foreign currency forward contracts to hedge foreign-sourced income.

Property expenses decreased due to the absence of expenses from divested assets, currency depreciation against the SGD and lower property-related taxes and loss allowances.

Borrowing costs rose 2.3% year-on-year to S$39.4 million. The increase was due to incremental borrowings to fund 1Q FY24/25 acquisitions, capex and Mapletree Joo Koon Logistics Hub. Another reason was due to the replacement hedges at higher cost and higher base rates for JPY loans. The increase in borrowing costs were partly offset by loan repayments with proceeds from divestments and lower base rates on unhedged SGD borrowings.

Notwithstanding the weakness, a distributable income of S$97.6 million and Distribution Per Unit (“DPU”) of 1.812 cents for 1QFY25/26 was announced. Distribution Per Unit fell 12.4% year-on-year.

| 1QFY25/26 (S$’000) |

1QFY24/25 (S$’000) |

% Change | |

| Gross Revenue | 177,398 | 181,696 | (2.4) |

| Property Expenses |

(23,987) | (25,001) | (4.1) |

| Net Property Income | 153,411 | 156,695 | (2.1) |

| Borrowing Costs | (39,356) | (38,453) | 2.3 |

| Amount Distributable | 97,609 | 109,785 | (11.1) |

| Distribution Per Unit (“DPU”) (cents) | 1.812 | 2.068 | (12.4) |

Debt

As of 30th June 2025, Mapletree Logistics Trust’s total debt outstanding decreased by S$43 million q-o-q to S$5,539 million. However, its aggregate leverage still stood high at 41.2%. This was an increase of 0.5% as compared to 4QFY24/25. The increase was mainly due to foreign currency impact from the weakening of regional currencies on overall portfolio asset value.

Despite a high aggregate leverage, Mapletree Logistics Trust’s debt maturity profile remains well-staggered with healthy average debt duration of 3.6 years. Having a well-staggered debt maturity profile is crucial for Mapletree Logistics Trust to manage its debt obligations effectively. By spreading out debt repayments over different time periods, Mapletree Logistics Trust can avoid liquidity crunches and reduce the risk of default.

Furthermore, a well-staggered debt maturity profile allows Mapletree Logistics Trust to take advantage of changes in interest rates. If interest rates drop, Mapletree Logistics Trust with debt maturing in the future can refinance at lower rates, reducing their interest expenses.

Maintaining a well-staggered debt maturity profile is a sound financial strategy that can help ensure the long-term sustainability of the Mapletree Logistics Trust’s finances.

The manager assured that there is ample liquidity with available committed credit facilities of S$818 million to refinance S$318 million (or 6% of total debt) debt due in FY25/26.

Occupancy

As of 30th June 2025, Mapletree Logistics Trust’s portfolio overall occupancy stood at 95.7%. This was slightly lower than the occupancy of 96.2% achieved in 4QFY24/25.

The manager shared that Mapletree Joo Koon Logistics Hub was completed in May 2025 with occupancy of 42.4%. Excluding Mapletree Joo Koon Logistics Hub, Mapletree Logistics Trust’s portfolio occupancy would be 96.3%.

Rental Reversions

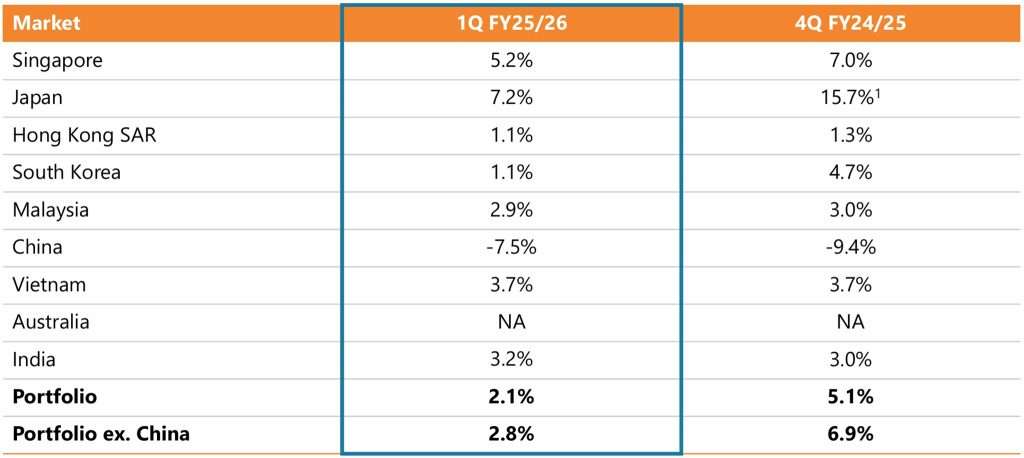

Rental reversion refers to the change in rental rates when leases are renewed. A positive rental reversion means the new rental rate is higher than the previous rate. A negative rental reversion happens when the new rental rate is lower than the previous rate. Whether the rental reversion is positive or negative depends on the market demand and supply.

Mapletree Logistics Trust maintained its positive rental reversions across all markets except China. However, the good news is that China’s rental reversion continued improving trend with -7.5% registered in 1Q FY25/26.

Lease Expiry

Weighted average lease expiry for the portfolio stood at approximately 2.7 years. As you can see from the chart above, overall lease expiry remains well staggered.

Mapletree Logistics Trust Share Price and Dividend Yield

The formula for calculating the current dividend yield is straightforward. It is calculated by dividing the annual dividends per share by the current market price per share. Here is the formula in mathematical terms:

As you can see from the above 6-months price chart, Mapletree Logistics Trust share price has been creeping up slowly since April 2025. Based on the research by various analysts, Mapletree Logistics Trust has a target price of S$1.483.

Mapletree Logistics Trust share price closed at S$1.19 on Friday. Based on Mapletree Logistics Trust’s FY24/25 full year distribution of 8.053 cents and current share price of S$1.19, Mapletree Logistics Trust’s current dividend yield is 6.77%.

Summary of Mapletree Logistics Trust 1QFY25/26 Financial Results

In my opinion, Mapletree Logistics Trust’s current quarter result remained negative. Let me summarize the pro and cons.

The pros are:

- Healthy average debt duration of 3.6 years with ample liquidity with available committed credit facilities of S$818 million to refinance S$318 million (or 6% of total debt) debt due in FY25/26.

- Portfolio occupancy remained resilient at 95.7%.

- Excluding China, portfolio rental reversion was positive 2.8%. Lease expiry remains well staggered

- Current dividend yield is high at 6.77%.

The cons are:

- Gross Revenue and Net Property Income fell 2.4% and 2.1% year-on-year respectively.

- Distribution Per Unit fell 12.4% year-on-year.

- High gearing ratio of 41.2% and it continue to grow 0.5% as compared to previous quarter.

Again, I seriously hope Mapletree Logistics Trust can take a look at managing its growing debt!