Manulife Goal 2024 (V) is a short-term Endowment plan that provides guaranteed returns of 2.58% p.a. at the end of 3 years. If you include the non-guaranteed component, you can earn up to 2.78% per annum based on the higher illustrated investment rate of return (IIRR) of 3.07% per annum. The non-guaranteed maturity bonus will be 0.48% of the single premium.

Manulife Goal 2024 (V) is a short-term Endowment plan that provides guaranteed returns of 2.58% p.a. at the end of 3 years. If you include the non-guaranteed component, you can earn up to 2.78% per annum based on the higher illustrated investment rate of return (IIRR) of 3.07% per annum. The non-guaranteed maturity bonus will be 0.48% of the single premium.

Similar to earlier tranches, Manulife Goal 2024 (V) may not offer you the best guaranteed returns in town but one of the advantages of this plan is that it only requires a low minimum single premium of S$5,000 via cash or Supplementary Retirement Scheme (SRS) to get started. As endowment plans are a form of insurance, you are covered for death benefit at 101% of single premium. The application for Manulife Goal 2024 (V) is easy with guaranteed acceptance and no health check-ups are required.

Manulife Goal 2024 (V) is issued and underwritten by Manulife (Singapore) Pte. Ltd. (“Manulife”) (Reg. No. 198002116D) and distributed by DBS. Thus, you can find this Manulife Goal 2024 (V) (3 years) | DBS Singapore.

What are Endowment Plans?

Again, if you are not familiar with Endowment plans, they are life insurance saving plans offered by insurance companies to help you with wealth accumulation. If you want to retire early, Endowment plans are also a great way to accumulate a larger nest egg for your retirement years.

The aim of wealth accumulation plan is to help policyholders save towards specific financial goals. Policy holders can contribute a regular amount for a designated period of time or pay a lump sum upfront at the start of the policy.

Upon maturity of the policy, you will be given a lump sum payout with the guaranteed return. It is best to study the plan carefully as certain endowment plans offers non-guaranteed returns.

In this case, Manulife Goal 2024 (V) offers you 2.58% p.a. guaranteed return upon maturity in 3 years.

Manulife Goal 2024 (V) versus Singapore Savings Bond (SBJUL25 GX25070Z)

Singapore Savings Bonds are a type of government bond issued by the Monetary Authority of Singapore that offers individuals a safe and flexible way to save money. If you hold and sell the current issue (SBJUL25 GX25070Z) after 3 years, the average return per year is 2.06%.

| Year from issue date | Interest % | Average return per year %* |

| 1 | 2.06 | 2.06 |

| 2 | 2.06 | 2.06 |

| 3 | 2.06 | 2.06 |

Needless to say, Manulife Goal 2024 (V) offers higher guaranteed returns of 2.58% per annum as compared to 2.06% p.a. that is offered by Singapore Savings Bond.

Comparing Manulife Goal 2024 (V) with GSX Digital Bank

GXS Bank is a digital bank, and it holds a banking licence issued by the Monetary Authority of Singapore. GSX Digital Bank is backed by a consortium consisting of Grab Holdings Inc. – Southeast Asia’s leading super app, and Singtel – Asia’s leading communications technology group.

GSX Digital Bank pays you 1.68% per annum for money in the main account. For the savings pockets, the interest rate is 1.98% per annum. The boost pocket pays you 2.08% per annum.

Manulife Goal 2024 (V) is the clear winner here against the current issue of Singapore Savings Bond.

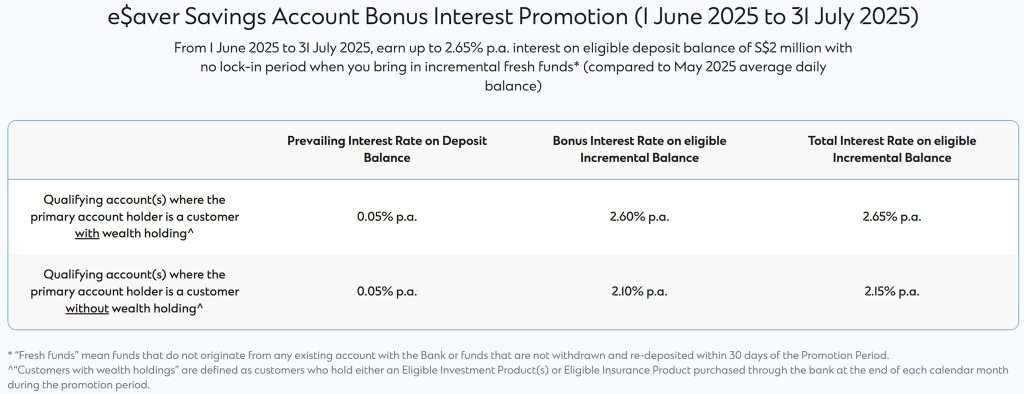

Comparing Manulife Goal 2024 (V) with eSaver SCB

eSaver is a high yield savings account by Standard Chartered Bank (SCB) Singapore. It gives you up to 2.65% per annum. From 1st June 2025 to 31st July 2025, you can earn up to 2.65% per annum interest. This applies to an eligible deposit balance of up to S$2 million, with no lock-in period. You must bring in incremental fresh funds. However, only customers with wealth holdings are eligible to earn the promotional interest rate of 2.65% per annum.

if you are not a customer with wealth holdings, you will earn 2.15% per annum.

Unless you are a customer with wealth holdings with Standard Chartered Bank (SCB) Singapore, I would put my money in Manulife Goal 2024 (V) for the guaranteed return of 2.58% per annum as compared to eSaver’s 2.15% per annum.

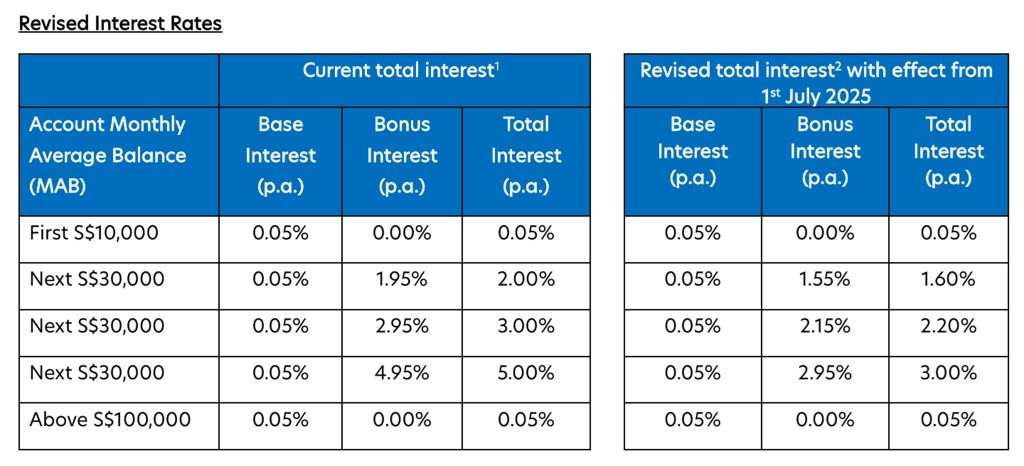

Comparing Manulife Goal 2024 (V) with UOB Stash Account

Above are the revised tiered interest rates offered by UOB Stash Account effective from 1st July 2025. With the revised interest rates, you can earn up to S$2,040 interest a year with a deposit balance of S$100,000 in your UOB Stash Account by simply maintaining or increasing your Monthly Average Balance (MAB) each month.

Based on the revised rates, UOB Stash Account interest rates work out to be estimated 2.04% per annum.

Manulife Goal 2024 (V) is the clear winner against UOB Stash Savings Account.

Summary of Manulife Goal 2024 (V)

Based on the comparison of Manulife Goal 2024 (V) endowment plan, you can see that the returns are higher than most high yield savings account and even Singapore Savings Bond. Buying endowment plans can be a great way to grow your savings too.

Below is a summary of the benefits of Manulife Goal 2024 (V) endowment plan.

- Guaranteed maturity yield of 2.58% p.a. and non-guaranteed maturity yield of up to 0.15% p.a.

- 100% capital guaranteed after 3 years upon policy maturity.

- Coverage for death benefit at 101% of single premium.

- Easy application with guaranteed acceptance and no health check-ups.

- Minimum single premium of S$5,000 via cash or Supplementary Retirement Scheme (SRS).

This is not a sponsored post and solely based on my own research and opinion. With falling interest rates, I believe everyone like me is looking for the best place to park your money to earn extra cash.