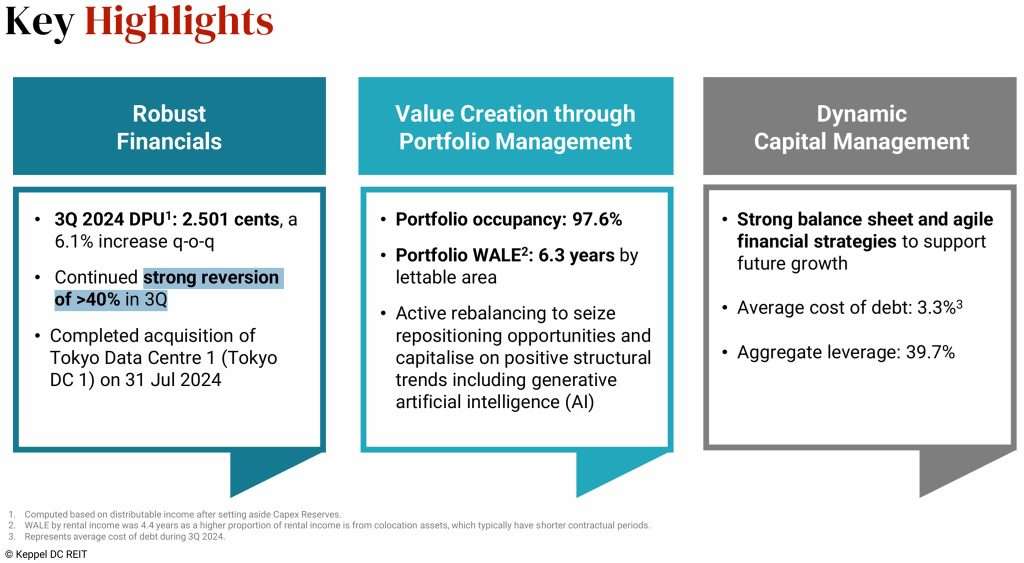

On 18th October 2024, Keppel DC REIT announced its 3Q2024 operational updates. Distribution Per Unit (DPU) increased 0.4% year-on-year to 2.501 cents in 3Q2024. If you compare with 2Q2024, DPU improved 6.1%.

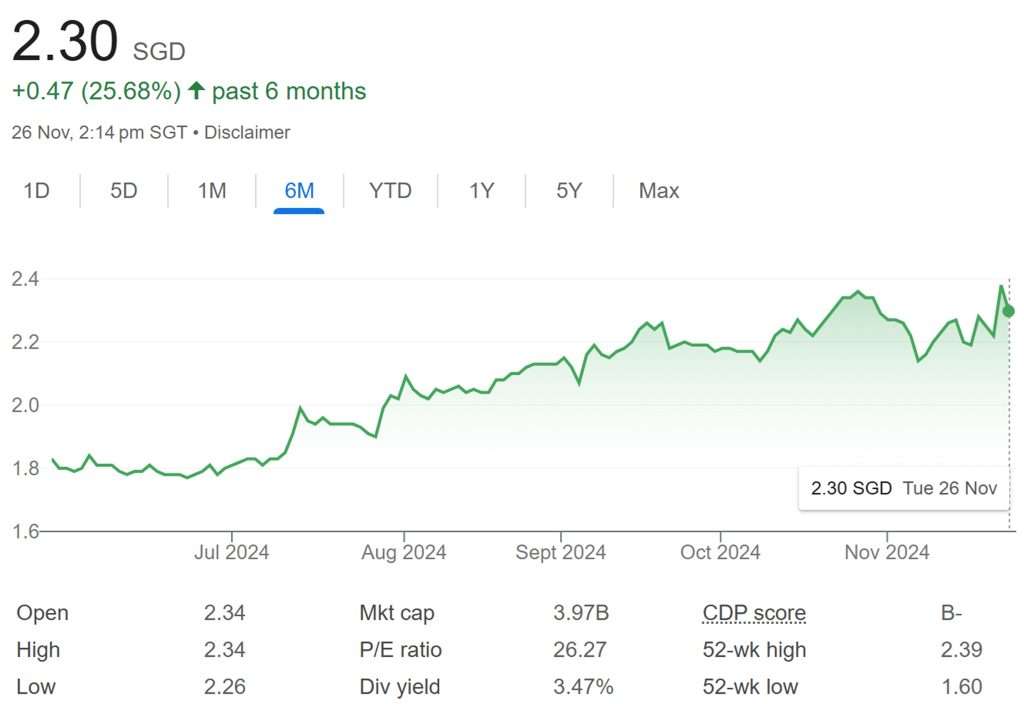

Currently, Keppel DC REIT makes up only 2.78% of my stock portfolio. What is Keppel DC REIT’s current share price? Based on the share price, what is its current dividend yield? All these are important for me to consider if I want to increase my stake in Keppel DC REIT.

Previously, Keppel DC REIT is facing headwinds. Has Keppel DC REIT financial performance improved in 3QFY24? Let us take a look below at its latest operational updates.

Keppel DC REIT 3Q2024 Financial Performance

In 3Q2024, Gross Revenue was up 8.9% year-on-year to S$76.9 million. The higher gross revenue was attributed to the strong reversions and escalations across Keppel DC REIT’s portfolio and the contribution from Tokyo DC 1. The gains were partially offset by the divestment of Intellicentre Campus.

Finance costs increased marginally mainly due to acquisition of Tokyo DC 1, partially offset by interest savings from loan repayments.

As a result of higher distributable income and DPU underpinned by strong reversions including reversion of more than 40% for a major Singapore contract renewal in 3Q2024 as part of the Keppel leases, Distribution Per Unit (DPU) improved 0.4% year-on-year to 2.501 cents.

| 3Q2024 (S$’000) |

3Q2023 (S$’000) |

Change (%) | |

| Gross Revenue | 76,945 | 70,676 | 8.9 |

| Net Property Income | 64,457 | 64,585 | (0.2) |

| Property Expenses |

(12,488) | (6,091) | > 100.0 |

| Finance Costs | (13,014) | (12,837) | 1.4 |

| Distributable Income | 44,719 | 43,876 | 1.9 |

| Distribution Per Unit (“DPU”) (cents) | 2.501 | 2.492 | 0.4 |

Debt

As of 30th September 2024, Keppel DC REIT’s aggregate leverage (gearing ratio) stood high at 39.7%. Aggregate leverage refers to the total amount of debt a company has taken on in relation to its total assets. This measure is important for investors and analysts to assess a company’s financial health and risk level.

A high aggregate leverage ratio can indicate that a company is relying heavily on debt to finance its operations, which may make it more vulnerable to economic downturns or interest rate increases.

On the other hand, a low aggregate leverage ratio may signal that a company has strong financial stability and a lower risk of default. Overall, understanding a company’s aggregate leverage can provide valuable insights into its financial position and help stakeholders make informed decisions.

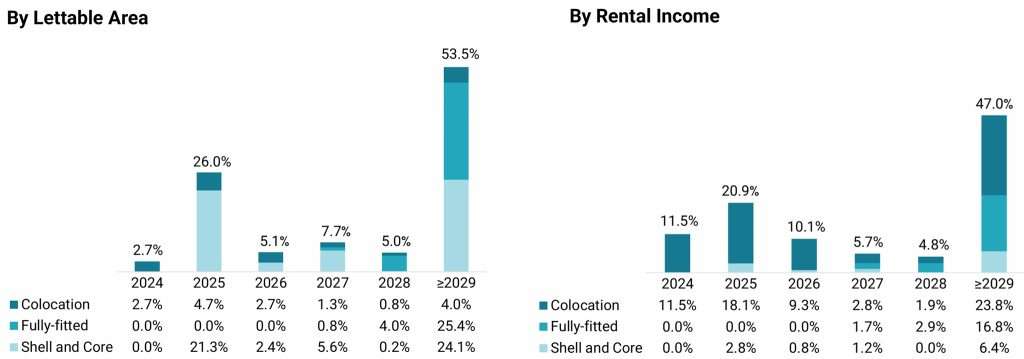

Based on the above chart, Keppel DC REIT’s debt maturity is well spread with no debt requiring refinancing in 2024.

Keppel DC REIT’s Weighted Average Debt tenor is 3.4 years. Weighted average debt tenor is a financial metric used to analyse the average maturity of a company’s debt obligations. It is calculated by taking the sum of each debt instrument’s outstanding balance multiplied by its remaining time to maturity and then dividing that by the total outstanding debt balance.

This metric provides insight into how long a company has to repay its debts, with a higher weighted average debt tenor indicating a longer period to meet obligations.

Companies with a longer weighted average debt tenor may have more flexibility and less refinancing risk compared to those with shorter tenors.

Occupancy

Keppel DC REIT’s overall portfolio occupancy stood at 97.6%. Weight Average Lease Expiry (WALE) is healthy at 6.3 years. The Weight Average Lease Expiry is a metric used in the real estate industry to calculate the average length of time until all leases in a property expire, weighted by the size of each lease. This metric is helpful for property owners and investors to gauge the stability and predictability of their rental income.

A higher Weight Average Lease Expiry indicates longer lease terms and less turnover of tenants, which can be seen as a positive sign of a property’s financial health. On the other hand, a lower Weight Average Lease Expiry may suggest higher tenant turnover and potentially more risks for the property’s income stream. By analysing this metric, property owners can make more informed decisions about their investments and property management strategies.

Keppel DC REIT Share Price and Dividend Yield

Keppel DC REIT share price is currently trading at S$2.30. Based on Keppel DC REIT share price of S$2.30 and FY23 full year DPU of 9.383 cents, this translates to a current dividend yield of 4.08%. In my opinion, the current dividend yield is not very attractive.

Keppel DC REIT 3Q2024 Operational Updates

To summarize Keppel DC REIT’s 3Q2024 operational updates, the pros are:

- Gross Revenue was up 8.9% year-on-year to S$76.9 million.

- Distribution Per Unit (DPU) increased 0.4% year-on-year to 2.501 cents.

- Overall portfolio occupancy stood healthy at 97.6%.

- Strong reversions including reversion of more than 40%.

- Debt maturity is well spread with no debt requiring refinancing in 2024.

The cons are:

- Finance costs rose more than 100%.

- High gearing ratio of 39.7%.

- Unattractive current dividend yield of 4.08% based on S$2.30 per share.

If you would like to learn more about REITs, please read 6 Terms to Know as a REIT Investor.