Chinese New Year is over, and I am going to report my Financial Goals Progress for February 2025. As you can see from the above, the total value of my financial assets declined slightly from 87.03% to 86.58%. The decline is attributed to the decrease in total value of my stock portfolio. I shall share more about this in the later part of this post.

Before that, do you know what are financial goals and why am I tracking this monthly? Financial goals are objectives that I have set in order to achieve financial success. Setting financial goals is important as it provides direction and motivation for managing money effectively. By establishing clear financial goals, I can track my progress, make informed decisions, and work towards achieving financial stability and security. My financial goal to stash sufficient money (target) which can help me to retire early in Singapore.

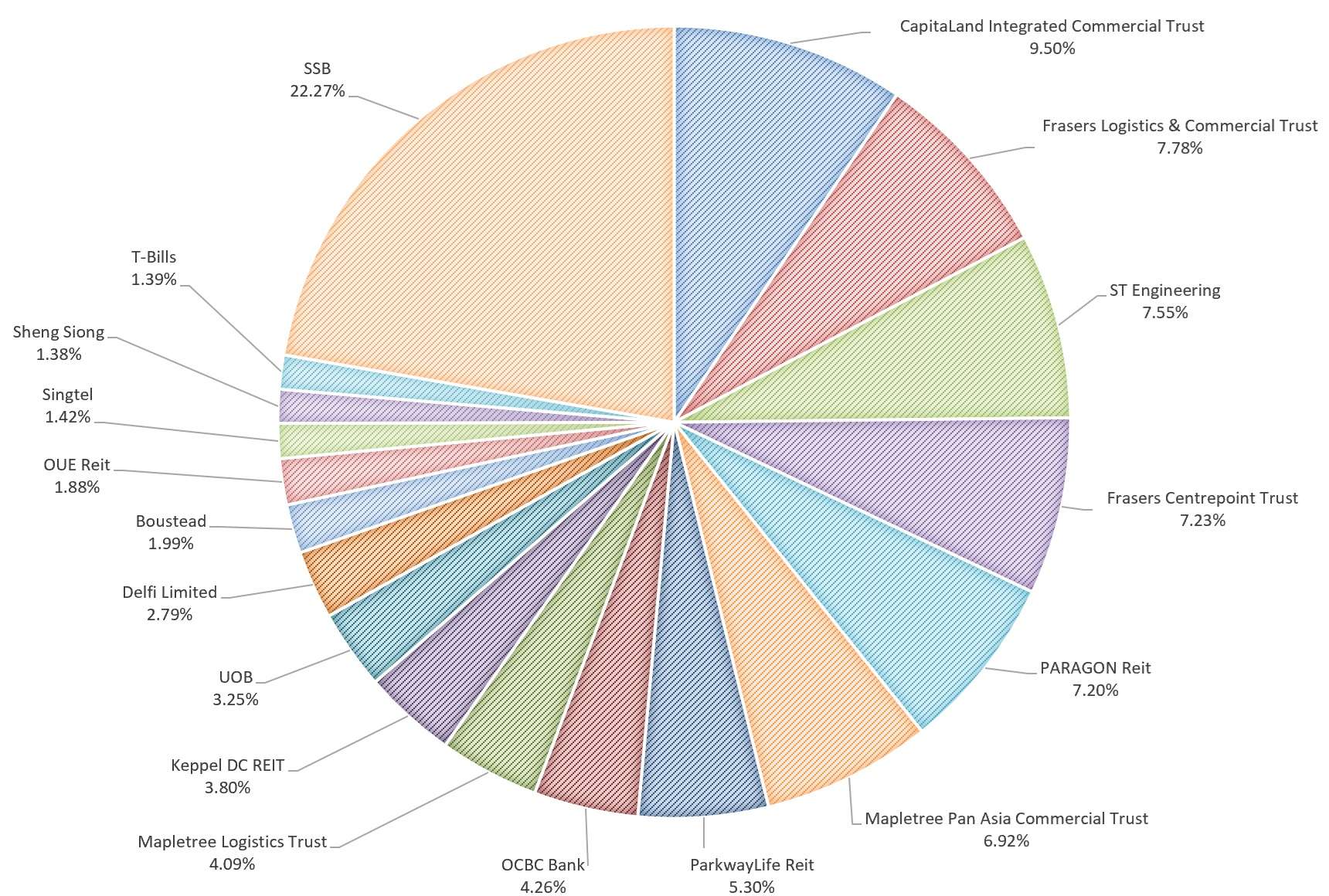

How do I count the total value of my financial assets? The total value of my financial assets is based on insurance savings, savings accounts (POSB, OCBC, CIMB, UOB, Trust), Fixed Deposits, Singapore Savings Bonds, Singapore Treasury Bills, current value of my stocks, and funds in Supplementary Retirement Scheme account.

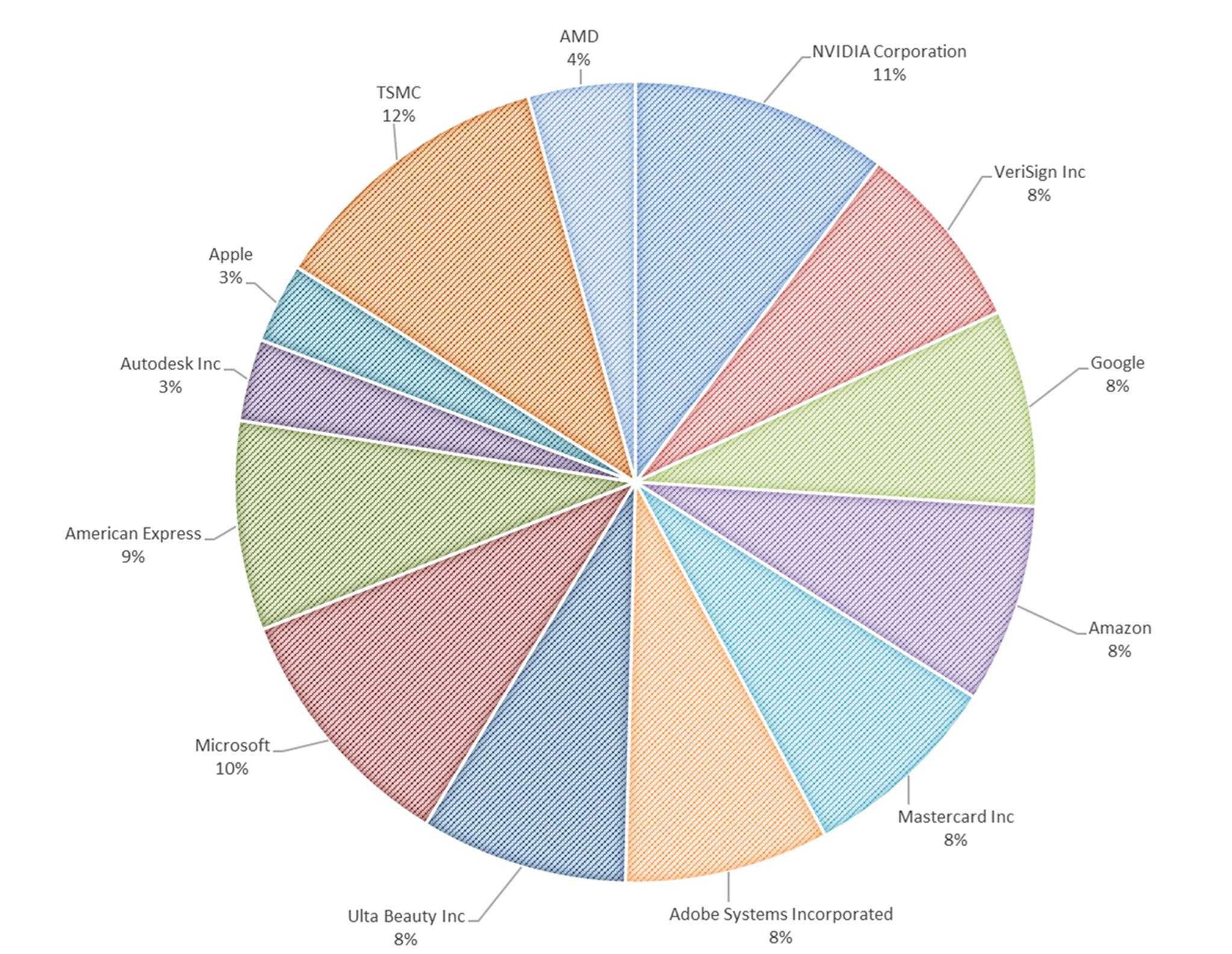

Updates on My Stock Portfolio

Now, back to the topic on why the total value of my stock portfolio declined. Yesterday, share prices of stocks fell amid Trump’s tariffs and investor’s worry on technology supporting artificial intelligence. Tomorrow, NVIDIA is expected to release their 4th quarter results. If you look at my US stock portfolio, the majority is made up of technology stocks such as NVIDIA, TSMC, Google, Apple, Amazon and Adobe. Any bad news on technology sector will impact the total value of my stock portfolio.

In February, Paragon REIT announced their plans to privatize. The plan to privatize is most likely to go through and I am looking forward to receiving the cash from the privatization of Paragon REIT.

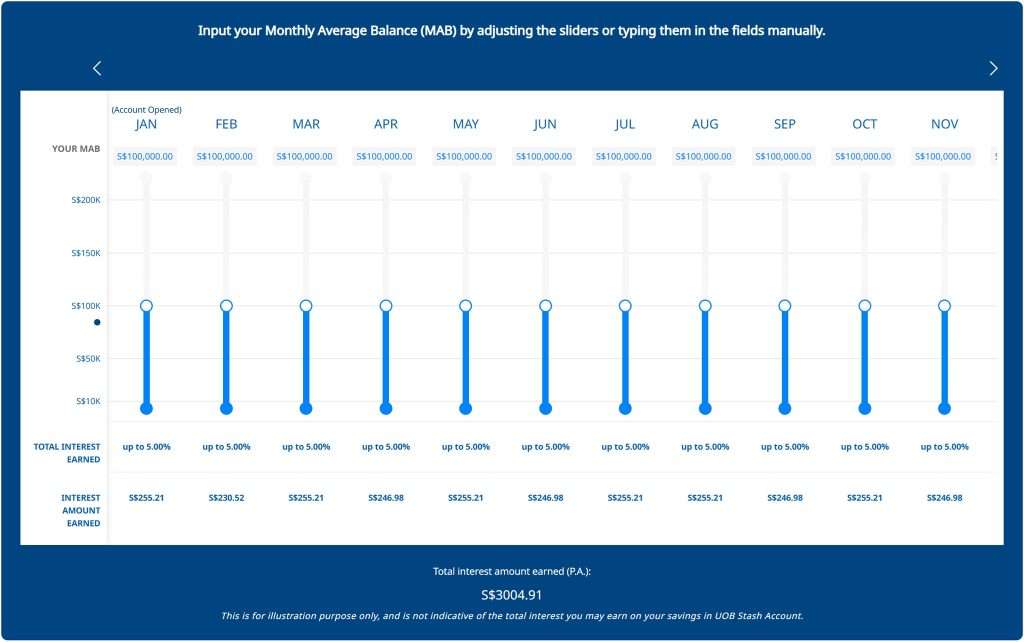

Updates to my UOB Stash Account

In January, I opened a UOB Stash Account. The interest rates offered by fixed deposits had fallen and thus I am parking my money into UOB Stash as the interests offered are higher if you have 100K. The last tranche of my fixed deposit will mature at the end of March, and I shall deploy them to UOB Stash.

Regarding any spare cash above 100K, I will continue to look for high yielding accounts to deposit the money. Recently, I found the eSaver Savings Account Bonus Interest Promotion which gives you 2.90% per annum for just two months. Alternatively, I may consider doing a placement with UOB SGD United Money Market Fund given the low risk and returns of above 3% per annum.

With falling interest rates, I believe everyone like me is looking for the best place to park your money to earn extra cash. If you have any good ideas, please share them with me.