On 7th May 2025, UOB Group (UOB) shared their 1Q25 financial performance. UOB posted S$1.5 billion in net profit for the first quarter of 2025 (1Q25), unchanged year-on-year. On a quarter-on-quarter basis, Net Profit after Tax declined by 2%. At this point of writing, UOB makes up 3.11% of my stock portfolio. Are you wondering what is UOB’s share price and dividend yield?

Before we look at UOB share price on whether it crashed due to decline in quarter-on-quarter profit, let us take a look at UOB’s revenue growth drivers. According to the presentation slides, UOB’s strong earnings were driven by broad-based income and franchise growth. As you can see below, UOB’s net fee income rose 20% year-on-year to a new high of S$694 million. Net interest income also increased 2% from the year before.

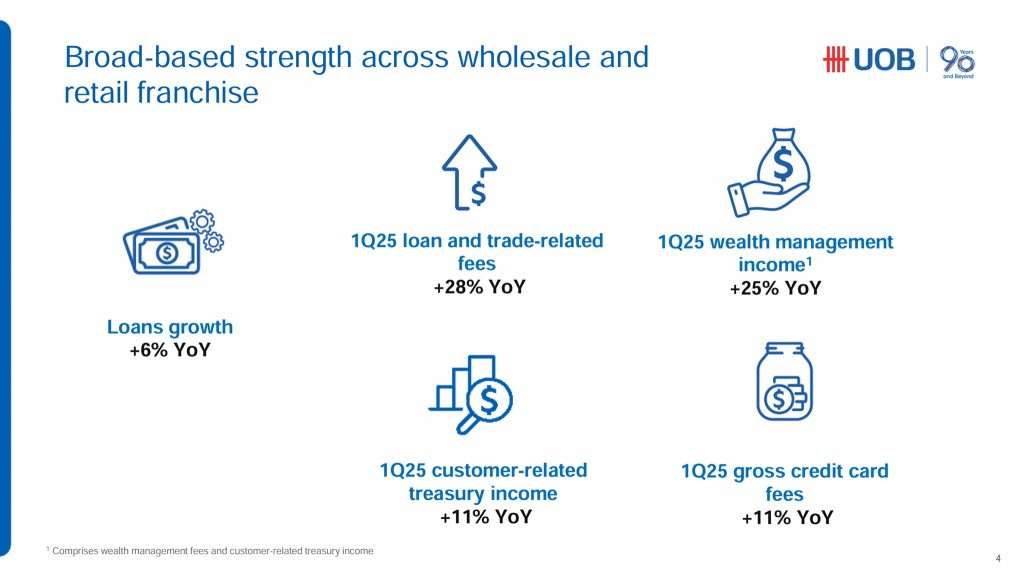

The strong earnings were driven by robust loans growth. Loans grew 6% year-on-year. Trading and investment income grew 27% QoQ from stronger customer treasury income and good performance from trading and liquidity management activities.

UOB Dividend

Below is the historical dividend payout by UOB to investors. In 2024, UOB paid out a total of S$2.30 per share. You can also observe that UOB increased its dividend payout year-on-year.

Financial Year: 2024

Total Dividend Payout: 2.30 SGD per share (Interim: 88 cents, Final: 92 cents, Special: 50 cents)

Financial Year: 2023

Total Dividend Payout: 1.70 SGD per share (Interim: 85 cents, Final: 85 cents)

Financial Year: 2022

Total Dividend Payout: 1.30 SGD per share (Interim: 60 cents, Final: 70 cents)

Financial Year: 2021

Total Dividend Payout: 1.20 SGD per share (Interim: 60 cents, Final: 60 cents)

Financial Year: 2021

Total Dividend Payout: 0.78 SGD per share (Interim: 39 cents, Final: 39 cents)

UOB Current Dividend Yield

In this section, let us take a look at UOB dividend yield. As you can see from the above price chart, UOB share price dipped after the financial updates came out but recovered to close the day at S$34.49. Based on UOB current share price of S$34.49 and FY2024 full year dividend payout of S$2.30, UOB current dividend yield is 6.67%.

Excluding the special dividend, UOB FY2024 full year dividend payout would be S$1.80. Based on the dividend payout of S$1.80 per share, UOB current dividend yield would be 5.22%.

At current share price, I am of the opinion that the current dividend yield is decent. Having said this, I probably will wait for the next market crash before accumulating more of bank stocks in my stock portfolio.

With Trump around, the stock market will definitely be volatile and there will be more opportunities!