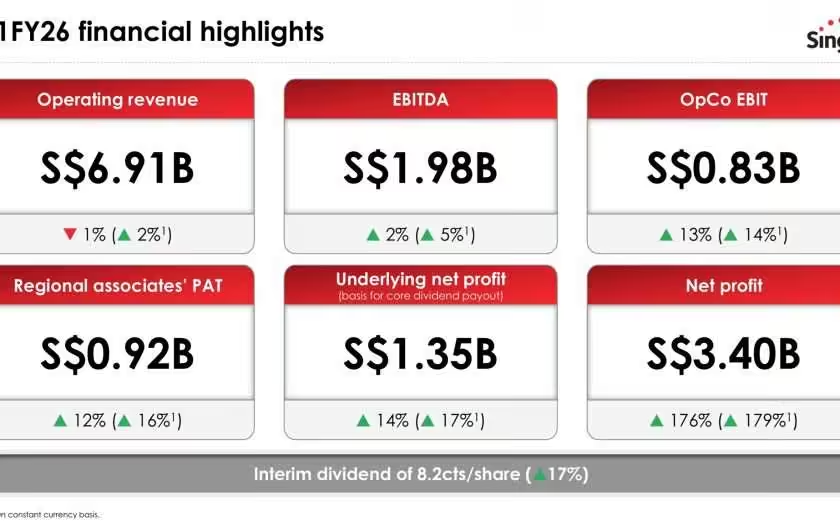

Singtel’s H1FY26 financial results mark a pivotal moment in its transformation journey, showcasing the strength of its diversified portfolio and strategic execution amid macroeconomic headwinds. The Group reported a net profit of S$3.40 billion, a …

Continue reading