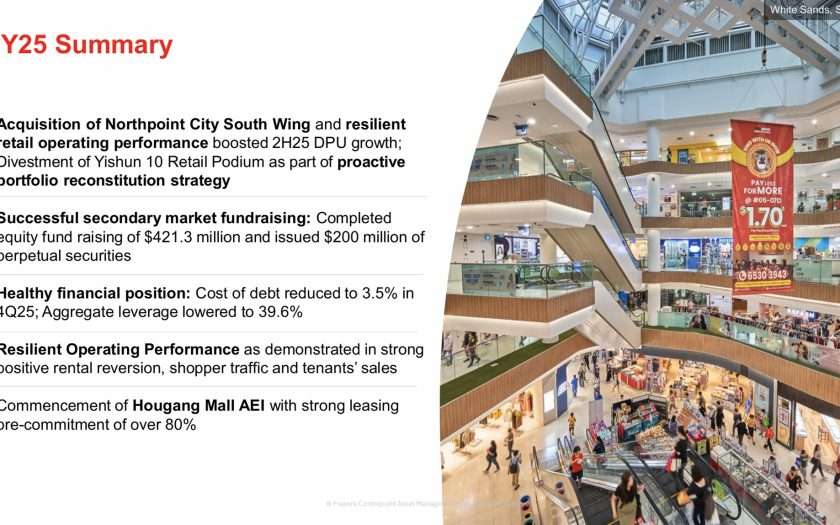

On 23rd October 2025, Frasers Centrepoint Trust (FCT) announced its 2H2025 financial results. This also makes up FCT’s FY25 full year financial results. In FY25, Frasers Centrepoint Trust (FCT) declared a total Distribution Per Unit …

Continue reading