The effective interest rate for the Singapore Savings Bond SBDEC25 (GX25120E) is 1.85% if held to maturity over 10 years. While overall SSB rates have been trending downward, this tranche reflects a modest recovery. Curious about the yield if you redeem after just one year? You do earn an annual return of 1.35%.

Further down this post, we will explore the year-by-year interest breakdown for SBDEC25. Thanks to the “step-up” feature, returns increase the longer you hold the bond, making it ideal for long-term savers.

Singapore Savings Bonds, issued by the Monetary Authority of Singapore (MAS), offer a safe and flexible way for individuals to grow their savings. With a low entry point of just $500, they provide better returns than traditional savings accounts and can be held for up to 10 years, delivering semi-annual interest payments.

Why consider Singapore Savings Bonds?

Despite relatively modest yields, SSBs are low-risk investments, perfect for conservative investors seeking steady growth. The longer you hold them, the higher your effective return. Each individual can invest up to S$200,000, inclusive of both cash and SRS contributions.

In the next section, we will walk through how to calculate your potential returns using the MAS SSB Calculator.

Calculating Returns Using Singapore Savings Bonds (SSB) Calculator

To help investors easily estimate their returns, the Monetary Authority of Singapore (MAS) offers a Singapore Savings Bonds Calculator. This tool allows you to project your interest earnings over a 10-year holding period.

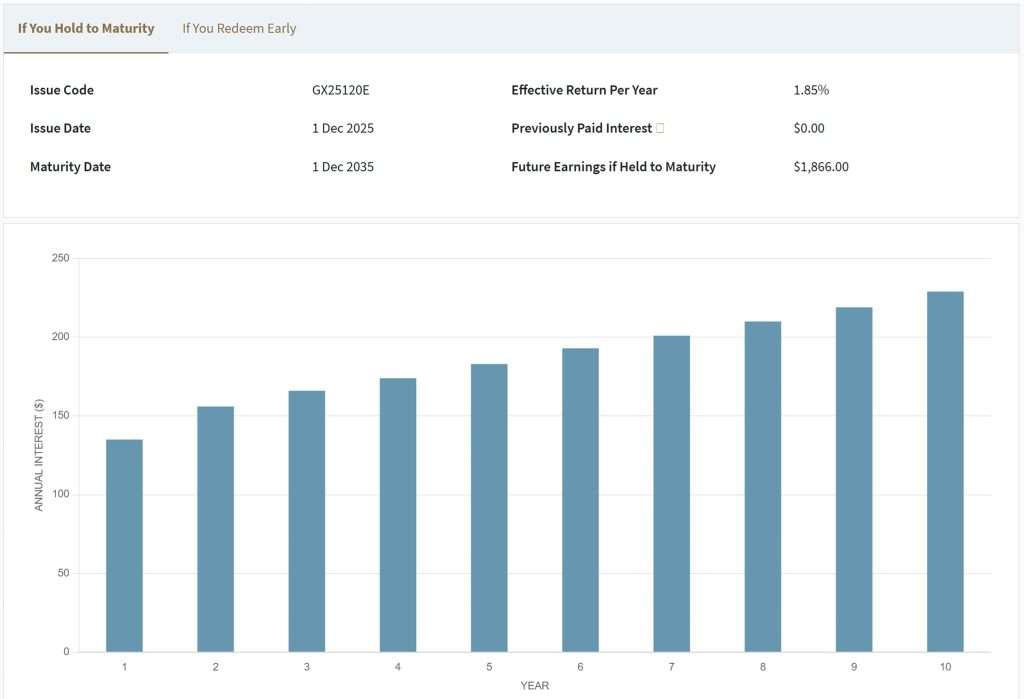

For example, if you invest S$10,000 in the SBDEC25 (GX25120E) tranche and hold it to maturity, your total interest earned would be S$1,866.00.

Here is a breakdown of the annual interest payouts for SBDEC25 (GX25120E) across its 10-year term.

| Year from issue date | Interest % | Average return per year %* |

| 1 | 1.35 | 1.35 |

| 2 | 1.56 | 1.45 |

| 3 | 1.66 | 1.52 |

| 4 | 1.74 | 1.58 |

| 5 | 1.83 | 1.62 |

| 6 | 1.93 | 1.67 |

| 7 | 2.01 | 1.72 |

| 8 | 2.10 | 1.76 |

| 9 | 2.19 | 1.81 |

| 10 | 2.29 | 1.85 |

*At the end of each year, on a compounded basis.

How to Buy Singapore Savings Bonds

To purchase Singapore Savings Bonds, you’ll need an individual CDP account with the Central Depository (CDP). Applications can be made via ATMs, internet banking, or directly through the websites of participating banks such as DBS/POSB, OCBC, and UOB. Just log in and follow the steps to subscribe.

The minimum investment is $500, with a cap of $200,000 per issue. Bonds are issued monthly, and their interest rates are revised annually. Once subscribed, you’ll receive interest payments twice a year, and your principal will be returned at the end of the 10-year bond term.

For more details, refer to How to Buy.

How to Sell Singapore Savings Bonds

You can sell your Singapore Savings Bonds at ATMs operated by participating banks like DBS/POSB, OCBC, and UOB. Just log in to your account at the ATM and follow the on-screen steps to complete the sale.

If your bonds are held under the Supplementary Retirement Scheme (SRS), you may also sell them through your designated SRS operator.

For more details, refer to How to Redeem.

How To Track Singapore Savings Bonds?

You can monitor your Singapore Savings Bonds by visiting the Monetary Authority of Singapore (MAS) website, which offers up-to-date information on bond issuance and performance.

![]() I use Stocks Café to track my SSB Singapore purchases. If you like to know more about Stocks Cafe, please read up my previous review of Stocks Cafe.

I use Stocks Café to track my SSB Singapore purchases. If you like to know more about Stocks Cafe, please read up my previous review of Stocks Cafe.

Should I Consider SBDEC25 GX25120E?

In a declining interest rate environment, banks are steadily adjusting their deposit rates. For instance, the UOB Stash Account is set to lower its interest rate to 1.5% per annum starting 1 December 2025.

If this downward trend continues over the next decade, the Singapore Savings Bonds (SSBs) become a compelling option. The current issue offers an effective return of 1.85% per annum when held for the full 10-year term, providing a relatively stable and predictable yield in contrast to falling bank rates.

All things considered, if no better alternatives emerge, this month’s SSB issue could be a worthwhile place to park my funds for the long haul.