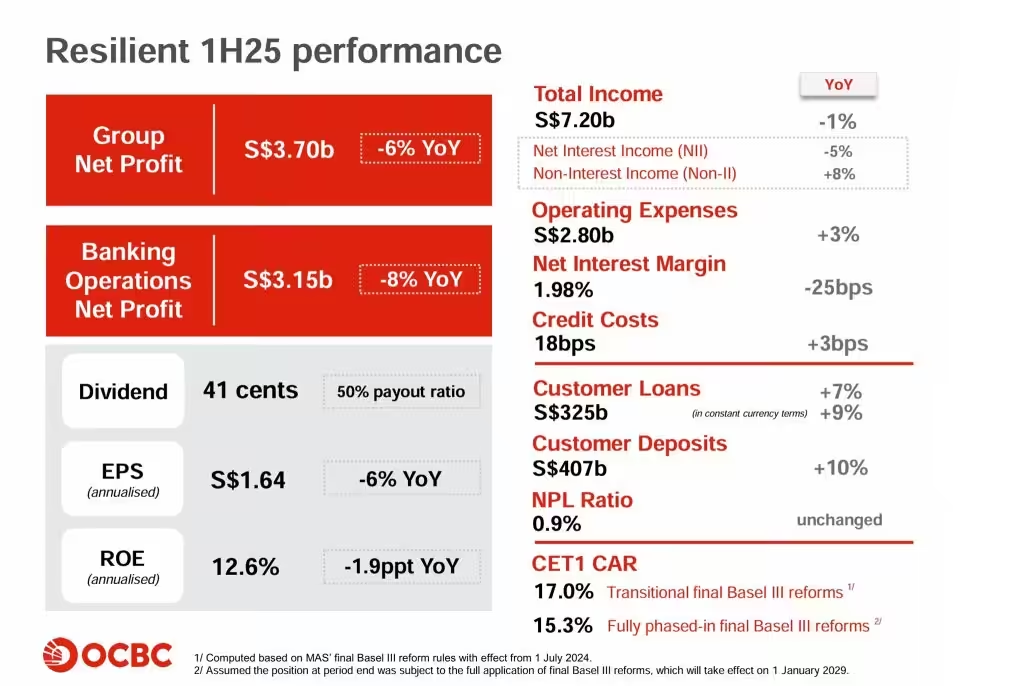

On 1st August 2025, OCBC announced their 1H2025 financial results. The Singapore local bank reported a net profit of S$3.70 billion for the first half of 2025. This is 6% below the record S$3.93 billion achieved in the previous year. Earnings per share fell 6% year on year. OCBC declared an interim ordinary dividend of 41 cents. This represented a payout ratio of 50% of 1H25 Group net profit.

On 1st August 2025, OCBC announced their 1H2025 financial results. The Singapore local bank reported a net profit of S$3.70 billion for the first half of 2025. This is 6% below the record S$3.93 billion achieved in the previous year. Earnings per share fell 6% year on year. OCBC declared an interim ordinary dividend of 41 cents. This represented a payout ratio of 50% of 1H25 Group net profit.

In 1H2025, OCBC’s total income was S$7.20 billion which was 1% lesser as compared to a year ago. Let us take a look at the OCBC’s net interest income performance first. As you can see from the above key highlights, OCBC’s net interest income fell 5% to S$4.63 billion. This is because of the softening interest rate environment. Average asset growth was driven by an increase in loans and other interest-earning high-quality assets which were lower yielding. Net Interest Margin (“NIM”) declined by 25 basis points to 1.98%. The drop in asset yields outpaced the decrease in funding costs.

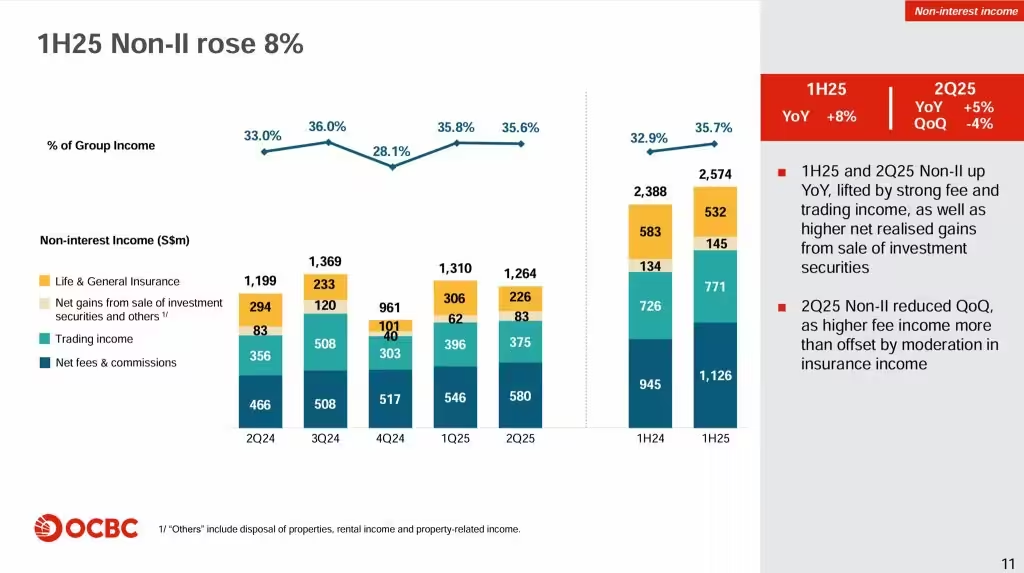

OCBC Non-interest Income

OCBC’s non-interest income comes from fees and commissions, trading income and Income from life and general insurance. In 1H2025, OCBC’s non-interest income grew 8% to S$2.57 billion. The growth in OCBC’s non-interest income was driven by the robust rise in fees and trading income.

OCBC’s net fee income of S$1.13 billion was 19% higher from broad-based growth. Wealth management fees which made up nearly half of net fee income, surged by 25%, with growth across all wealth product channels.

Net trading income was S$771 million which was 6% above the previous year. This was driven by 10% rise in customer flow income. Customer flow income refers to revenue generated from treasury activities that arise directly from servicing customer needs. To help you understand better, below are examples of customer flow income:

- Foreign exchange transactions: When customers exchange currencies for trade, travel, or investment.

- Interest rate hedging: Helping corporate clients manage interest rate risks through swaps or other derivatives.

- Structured products: Offering tailored investment solutions to wealth clients.

- Commodities and other financial instruments: Facilitating trades or hedges for clients in sectors like energy or agriculture.

Insurance income from Great Eastern Holdings (“GEH”) declined by 9% to S$532 million. The decrease was attributable to the mark-to-market impact of decline in interest rates on the valuation of insurance contract liabilities, as well as lower valuation of private equity holdings, from its insurance funds.

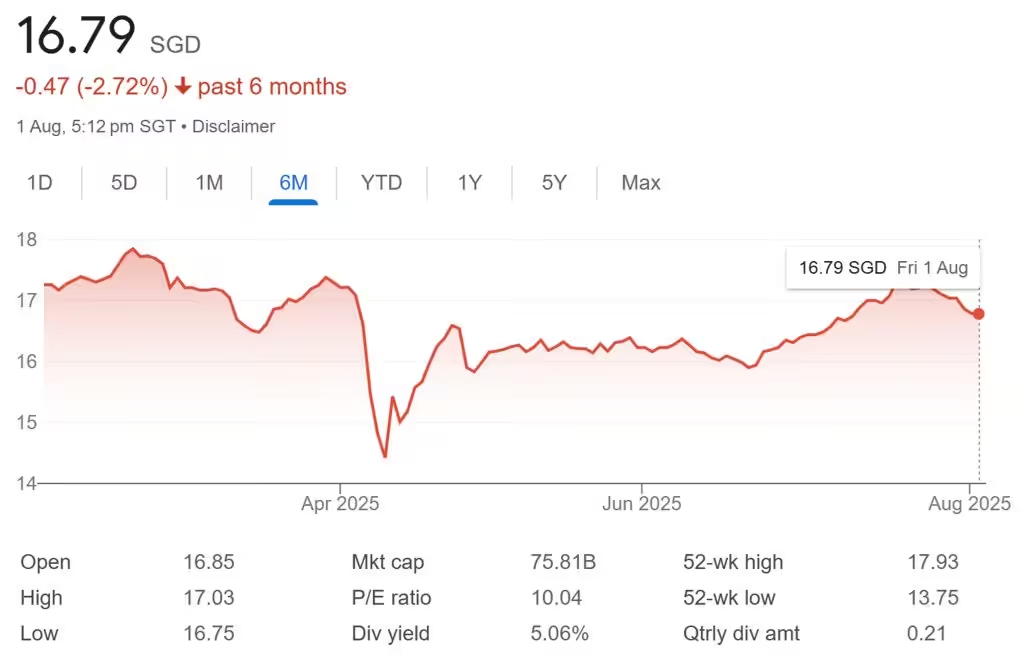

OCBC Shares Price

As you can see from the above 6-months OCBC bank shares price chart, OCBC bank shares price has been hovering between S$15 to S$18. The share price is on an uptrend in July but came down slightly in August. Should I buy OCBC shares now? In the next section, let us take a look at OCBC dividend yield and see what OCBC bank shares price makes a good entry point.

OCBC Dividend Yield

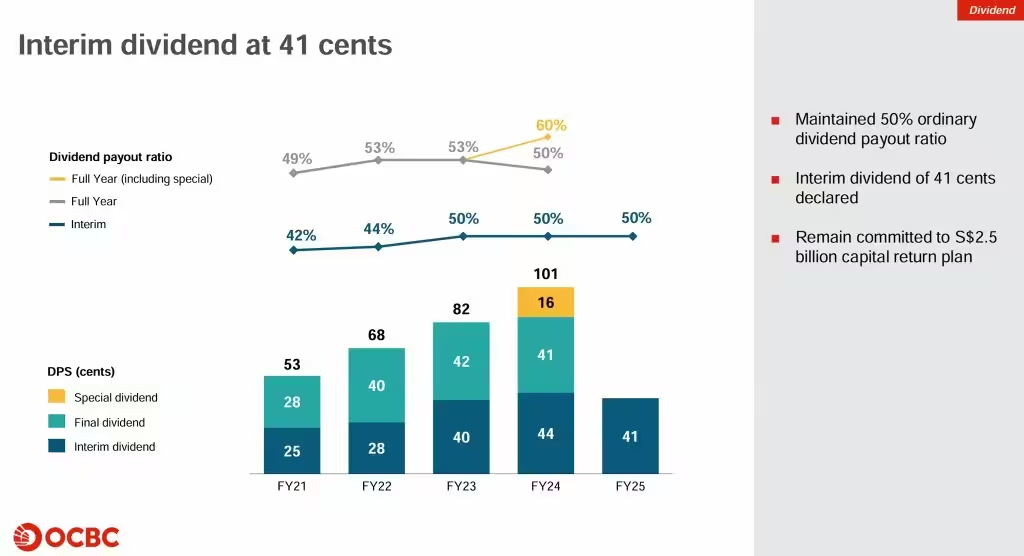

As highlighted earlier, OCBC had declared an interim ordinary dividend of 41 cents. This represented a payout ratio of 50% of 1H25 Group net profit. OCBC ex-dividend date is 8th August 2025. OCBC dividend payout date is 21st August 2025. OCBC dividend payout date can be found at the OCBC investor information page.

OCBC had previously announced S$2.5 billion capital return which includes a special dividend amounting to 10% of OCBC’s FY25 Group net profit. OCBC will also perform share buybacks over two years, to be completed in 2026. Together with OCBC’s target 50% ordinary dividend payout ratio, the dividend payout represented a total dividend payout ratio of 60% for FY25.

Just for reference, below are OCBC dividends paid over the last 5 years.

Financial Year: 2024

OCBC Dividend 2024: 1.01 SGD per share (Interim: 44 cents, Final: 41 cents, Special: 16 cents)

Financial Year: 2023

OCBC Dividend 2023: 0.82 SGD per share (Interim: 40 cents, Final: 42 cents)

Financial Year: 2022

OCBC Dividend 2022: 0.68 SGD per share (Interim: 28 cents, Final: 40 cents)

Financial Year: 2021

OCBC Dividend 2021: 0.53 SGD per share (Interim: 25 cents, Final: 28 cents)

Financial Year: 2020

OCBC Dividend 2020: 0.318 SGD per share (Interim: 15.9 cents, Final: 15.9 cents)

Based on FY2024 full year dividend payout of S$1.01 per share, OCBC current dividend yield is 6.02%. Excluding the special dividend paid out in FY2024, OCBC current dividend yield is 5.06%.

Assuming OCBC pays out a special dividend in FY2025, S$16 to S$16.8 makes a good entry point given that the current dividend yield is estimated to be 6%.

If we want to be more conservative, then S$14.10 makes a good entry point for a decent 6% dividend yield.

Summary of OCBC 1H2025 Financial Results

Unlike REITs, it is hard to analyse a bank’s business and financial results. Nevertheless, let me summarize the pros and cons I captured based on OCBC financial results.

The pros are

- Non-interest income grew 8% to S$2.57 billion year-on-year. This was driven by robust rise in fees and trading income, offset by lower insurance income from Great Eastern Holdings.

- OCBC current dividend yield is 6.02% (include special dividends).

- OCBC current dividend yield is 5.06% (exclude special dividends).

- OCBC will also perform share buybacks over two years, to be completed in 2026. Earnings Per Share (EPS) may increase due to share buybacks.

The cons are

- Net profit of S$3.70 billion was 6% lower year-on-year.

- Earnings per share fell 6% year on year.

- Net interest income fell 5% to S$4.63 billion due to softening interest rates environment.

At this point of writing, OCBC makes up 5.62% of my stock portfolio. OCBC dividend payout date is 21st August 2025 which I am looking forward to receiving the dividends. If I have extra cash on hand, I will accumulate OCBC when opportunity arises to build up my passive income.