I bought Intel (NASDAQ: INTC) and added it to my stock portfolio. Why? Intel’s share price has staged a dramatic comeback in recent weeks, fuelled by two seismic developments that have reshaped investor sentiment: a $5 billion investment from NVIDIA and early-stage talks with Apple about a potential stake. These moves, coming on the heels of a decade-low slump and mounting competitive pressure, have injected fresh optimism into the chipmaker’s turnaround narrative and sent its stock soaring to levels not seen in years.

I bought Intel (NASDAQ: INTC) and added it to my stock portfolio. Why? Intel’s share price has staged a dramatic comeback in recent weeks, fuelled by two seismic developments that have reshaped investor sentiment: a $5 billion investment from NVIDIA and early-stage talks with Apple about a potential stake. These moves, coming on the heels of a decade-low slump and mounting competitive pressure, have injected fresh optimism into the chipmaker’s turnaround narrative and sent its stock soaring to levels not seen in years.

The rally began in mid-September 2025 when NVIDIA announced it would invest $5 billion in Intel’s common stock at $23.28 per share. The news sent Intel’s shares rocketing nearly 23% in a single session, closing at $30.57 and marking its best trading day since October 1987. The investment is more than a financial lifeline. It represents a strategic collaboration between two of the most influential players in the semiconductor industry. NVIDIA, whose GPUs dominate the AI infrastructure market, will work with Intel to co-develop custom x86 CPUs for data centres and integrate RTX GPU chiplets into Intel’s system-on-chips for PCs. This partnership aims to fuse NVIDIA’s AI and accelerated computing stack with Intel’s vast x86 ecosystem, creating a new generation of computing platforms that could redefine performance benchmarks across enterprise and consumer markets.

The timing of NVIDIA’s investment is critical. Intel has been struggling to regain its footing amid fierce competition from AMD and Arm, delays in its Ohio One factory project, and a foundry business that has yet to attract major clients. Earlier this year, Intel’s stock had plunged to its lowest point in over a decade, reflecting investor concerns about its ability to execute on ambitious manufacturing and product roadmaps. The NVIDIA deal, coupled with $8.9 billion from the U.S. government and $2 billion from SoftBank, gives Intel a substantial war chest to fund its turnaround and signals that key stakeholders see strategic value in its revival.

Just days after the NVIDIA announcement, Intel’s momentum received another boost when Bloomberg reported that the company had approached Apple about a potential investment. While discussions are still in the early stages and may not result in a formal agreement, the market reacted swiftly. Intel’s shares rose another 6.4% to $31.22 on the day the news broke, while Apple’s stock dipped slightly by 1% to $252.31. The mere possibility of Apple backing Intel was enough to stoke investor enthusiasm, given Apple’s reputation for rigorous strategic discipline and its history of transformative supply chain decisions.

Apple’s potential involvement is particularly intriguing given the companies’ complex history. Apple famously parted ways with Intel in 2020, transitioning its Mac lineup to custom-designed M-series chips manufactured by TSMC. That move was seen as a major blow to Intel’s prestige and market share. Now, five years later, Apple is reportedly considering a financial stake in the very company it once abandoned, not to rekindle old supply chains, but to diversify its strategic exposure to domestic chip manufacturing. With geopolitical tensions rising and supply chain vulnerabilities becoming more pronounced, Apple may see value in supporting Intel’s foundry ambitions as a hedge against overreliance on TSMC.

For Intel, Apple’s backing would be a powerful endorsement. It would signal to the market that the company’s turnaround strategy is gaining traction and that its manufacturing capabilities could eventually become viable alternatives to offshore foundries. While Apple is unlikely to return to using Intel chips in its flagship products, a financial partnership could open doors to future collaboration in areas like AI, edge computing, or even custom silicon for enterprise applications.

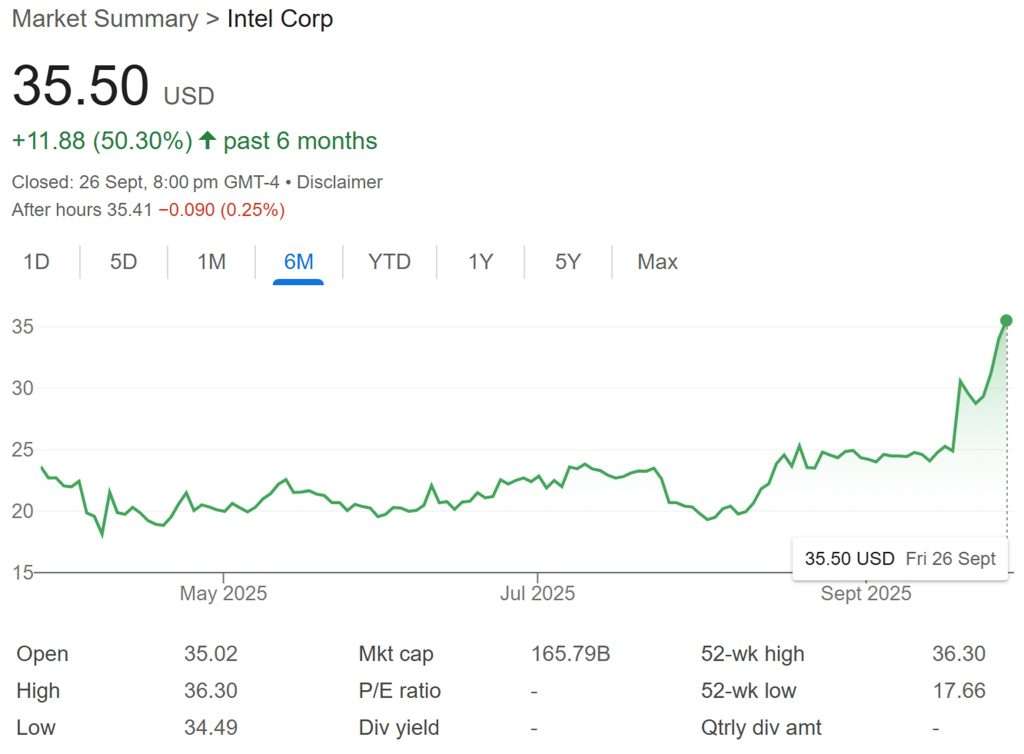

The combined impact of NVIDIA’s confirmed investment and Apple’s potential involvement has transformed Intel’s share price trajectory. From a low of $25.06 earlier in September, the stock surged to an intraday high of $33.41 following the news cycle, reflecting a nearly 30% gain in less than two weeks. Analysts are now revisiting their forecasts, with some suggesting that Intel could outperform the broader semiconductor index if it successfully executes on its new partnerships and product roadmap.

However, scepticism remains. Some industry watchers question whether these investments represent token cooperation or the beginning of a deeper strategic alignment. The absence of a manufacturing commitment from NVIDIA, for instance, leaves Intel’s foundry business still searching for a marquee customer. Similarly, Apple’s interest is speculative at this stage, and without a formal agreement, the market could quickly reverse course if talks fall through. Intel’s leadership, under CEO Lip-Bu Tan, must now deliver on the promise of these partnerships by accelerating product development, securing additional clients, and demonstrating that its manufacturing capabilities can meet the demands of next-generation computing.

In the short term, Intel’s share price performance reflects renewed investor confidence and a belief that the company is no longer on the defensive. With backing from NVIDIA, SoftBank, and potentially Apple, Intel is positioning itself as a national asset and a strategic pillar in the global tech ecosystem. The coming months will be crucial in determining whether this rally marks the beginning of a sustained recovery or a temporary spike driven by market enthusiasm. Either way, Intel’s resurgence has reignited interest in a company that once defined the very core of Silicon Valley and now, with heavyweight allies at its side, may yet do so again.

Last but not least, I want to share that I am using Stocks Cafe to track my stock transactions. Find out why Stocks Cafe is my most favourite Stock Portfolio Management System in the market!