GREAT SP endowment plan is a short-term single premium non-participating endowment plan that provides a guaranteed returns of 2.00% per annum at the end of 2 years. The plan is offered by Great Eastern. Similar to previous tranches, the benefits of the GREAT SP endowment plan are the guaranteed return of 2.00% upon maturity in 2 years, 100% capital guaranteed upon maturity and added protection against Death and Total and Permanent Disability with no medical assessment needed.

What are Endowment Plans?

If you are not familiar with Endowment plans, they are life insurance saving plans offered by insurance companies. The aim is to help policyholders save towards specific financial goals. Policy holders can contribute a regular amount for a designated period of time or pay a lump sum upfront at the start of the policy.

Endowment plans usually provides financial protection against death and total and permanent disability until the end of the policy term. Upon maturity of the policy, you will be given a lump sum payout with the guaranteed return. It is best to study the plan carefully as certain endowment plans offers non-guaranteed returns.

The objective of endowment plan is to provide stable returns together with insurance protection.

In this case, GREAT SP offers you 2.00% p.a. guaranteed return upon maturity in 2 years.

GREAT SP Guaranteed Payout Options

GREAT SP pays a guaranteed survival benefit at the end of the 12th policy month and the 24th policy month.

Taking a single premium of S$10,000 as an example, if you decide to accumulate the 1st year payout, the total payout you will receive after 2 years is S$10,403.

If you decide to withdraw the survival benefit in year 1, the total payout you will receive after 2 years is S$10,400.

Great SP Death Benefit

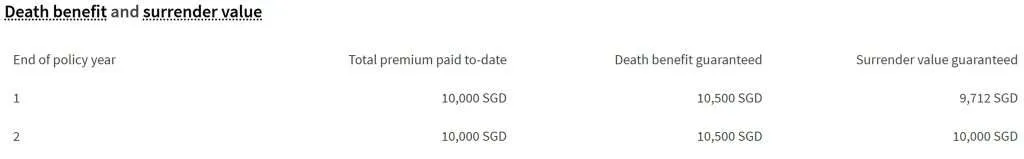

I submitted for a quotation based on a single premium of S$10,000. As you can see from the above, the death benefit guaranteed is S$10,500.

Comparing Great SP with Singapore Savings Bonds

Singapore Savings Bonds are a type of government bond issued by the Monetary Authority of Singapore that offers individuals a safe and flexible way to save money. Below is the interest per year for the latest issue of Singapore Savings Bond (SBAPR25 GX25040F).

| Year from issue date | Interest % | Average return per year %* |

| 1 | 2.73 | 2.73 |

| 2 | 2.73 | 2.73 |

The returns from Singapore Savings Bond are clearly higher than the 2.00% per annum offered by GREAT SP endowment plan.

Comparing Great SP with GSX Digital Bank

GXS Bank is a digital bank, and it holds a banking licence issued by the Monetary Authority of Singapore. GSX Digital Bank is backed by a consortium consisting of Grab Holdings Inc. – Southeast Asia’s leading super app, and Singtel – Asia’s leading communications technology group.

GSX Digital Bank pays you 2.08% per annum for money in the main account. For the savings pockets, the interest rate is 2.38% per annum. If I have a lump sum of money, I will put it in the boost pocket to earn 2.88% per annum.

The returns from GSX bank are also higher than the 2.00% per annum offered by GREAT SP endowment plan.

My Thoughts on Great SP Endowment Plan

The past tranches of Great SP endowment plan had been fantastic as the returns beat other financial products such as Singapore Savings Bond and even fixed deposits.

I am surprised that the return from this issue of GREAT SP endowment plan is extremely low at 2.00% per annum. As you can see from the above, the return from low-risk products such as Singapore Savings Bond and a digital savings account can easily beat this endowment plan.

If you wanted an investment product that have death and total and permanent disability benefit, then GREAT SP can be a viable option that you can consider. I already shared earlier above the guaranteed death benefit.

If you are still keen in GREAT SP, you can either buy it directly from Great Eastern Life’s website or via OCBC Bank’s website.

Disclaimer: This is Not a sponsored post, and the opinions are solely based on My Sweet Retirement’s opinion.