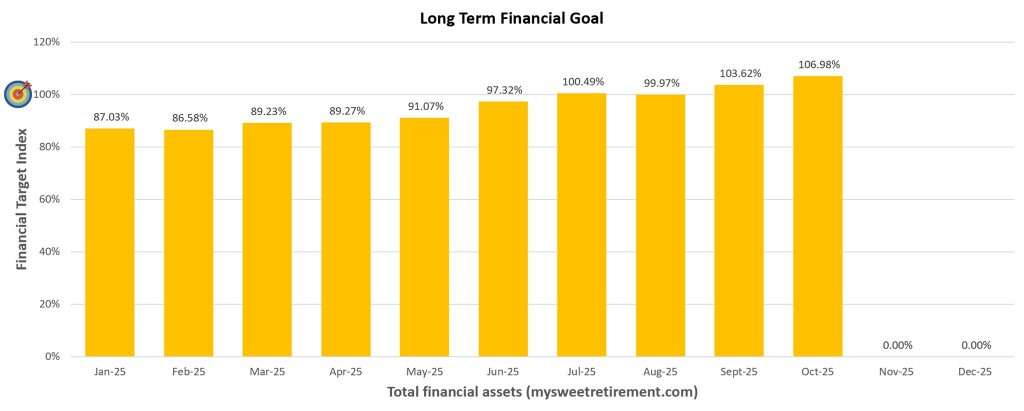

I am going to update on my Financial Goals Progress for October 2025. In July, I achieved the financial goal that I have set for myself 5 years ago. This month, the total value of my assets reached another new high at 106.98%. I exceed my financial goal by 6.98%. The increase in total value of my assets was attributed to my stock investments. The share price of Centurion Accommodation REIT which I added to my stock portfolio last month held up well. Similarly, the share price of Keppel DC REIT held up well after the preferential offering.

What does the above chart mean? The above chart is the total value of my financial assets represented in percentage against my financial goal (target). They comprised of my insurance savings, savings accounts, fixed deposits, Singapore Savings Bonds, Singapore Treasury Bills, current value of my stocks, and funds in Supplementary Retirement Scheme account.

Have you defined your financial goals yet? These goals are the specific targets you set to guide how you manage your money whether for short-term needs or long-term aspirations. Establishing financial goals gives you clarity, purpose, and motivation to make smarter financial choices. With clear objectives in place, you can monitor your progress, make informed decisions, and steadily build toward lasting financial stability and security. My long-term financial goal is to stash sufficient money (target) which can help me to retire early in Singapore.

How did I achieve my financial goals?

To achieve my financial goal in 5 years, you need a lot of discipline. Below are the actions I did.

Save 20 Percent of My Salary

I have made it a habit to set aside 20% of my salary into the savings pocket on GSX Digital Bank. Every month, as soon as my paycheck comes in, I transfer that portion straight into the pocket. It is a simple routine that steadily builds my cash reserves giving me a financial cushion I can tap into whenever I need it in the future.

Contribute to SRS

It goes without saying, most working adults understand the value of contributing to their Supplementary Retirement Scheme (SRS) account, especially for the tax relief it offers. To stay disciplined, I set up a dedicated savings pocket under GSX Digital Bank, where I have been transferring funds monthly into my SRS Saving Pocket. Next month, I plan to close this pocket and move the accumulated amount into my actual SRS account to maximize this year’s tax benefits.

Reinvest Dividends Collected

If you are familiar with investing, you have likely heard of the power of compounding. It is the process where earnings from an asset such as dividends or interest are reinvested to generate even more earnings. In simple terms, compounding allows your money to earn money, and then those earnings earn even more.

Over time, this snowball effect can lead to exponential growth. As reinvested returns increase your investment base, each cycle produces larger gains than the last. That is why compounding is often called the “eighth wonder of the world”, a quiet but powerful engine for long-term wealth.

The secret to unlocking compounding’s full potential? Start early and stay consistent. Even modest, regular contributions can grow substantially if given enough time. Patience is key. The longer you let your investments compound, the greater the payoff.

Personally, I have been practicing this since 2012. Whenever I receive dividends from the stocks and REITs in my portfolio, I do not spend them. I accumulate and reinvest them into more dividend-yielding assets. This disciplined approach has steadily increased my passive income year after year.

Side Hustle

What is a side hustle? A side hustle is a way to make extra money outside of your full-time job. It is typically a passion project or small business that you work on during your free time to bring in additional income. Side hustles can range from freelance work, selling products online, offering services, or even renting out property. Many people start side hustles to pursue their interests, build new skills, or save up for a specific goal.

In April, I decided to take the plunge and started a new side hustle. If you notice, I started selling stock investments and personal finance related books on my blog. Reading stock investment and personal finance books offers a range of powerful, long-term benefits, especially if you’re serious about building wealth and making informed decisions.

Reading books on stock investment and personal finance significantly enhances your financial literacy, helping you understand key concepts like budgeting, saving, investing, and risk management. These books cultivate an investor mindset, teaching discipline and long-term thinking while improving your decision-making and helping you avoid common financial mistakes.

They encourage wealth-building habits and provide diverse strategies from seasoned investors, allowing you to find approaches that align with your goals. Ultimately, they empower you to take control of your money, build financial independence, and make informed choices that support lasting financial well-being.

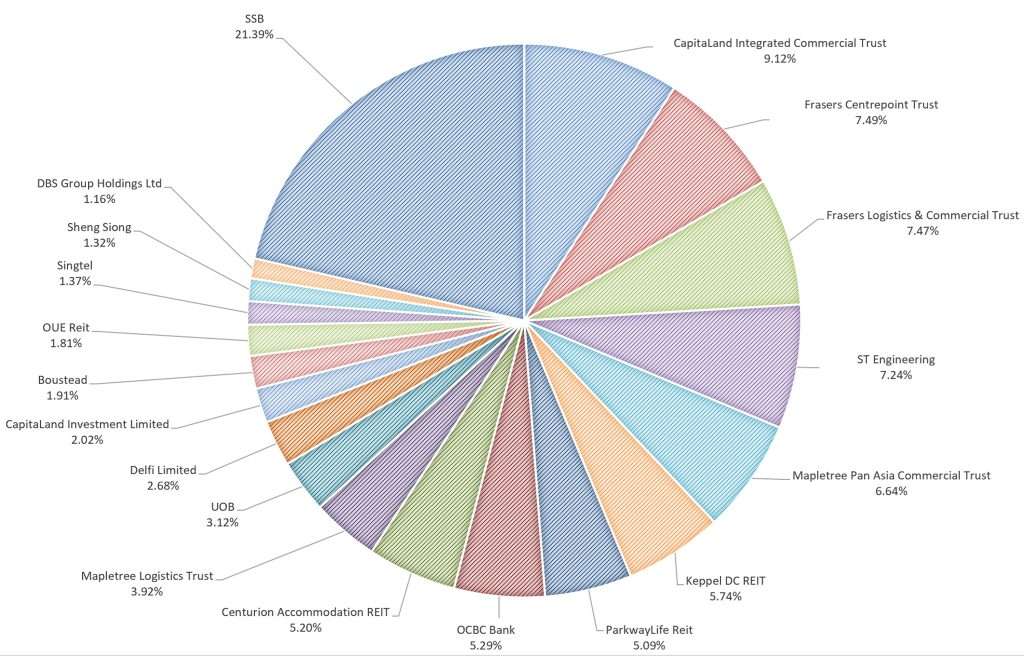

Updates to My Stock Portfolio

As you can see from the above, my allocation in Keppel DC REIT increased after the results of the preferential offering. I was fully allocated the units that I applied for. One of the actions that I applaud was that Keppel DC REIT allocated me the excess units so that I will not end up with odd lots. Other REIT managers who are going to launch preferential offering should practice this.

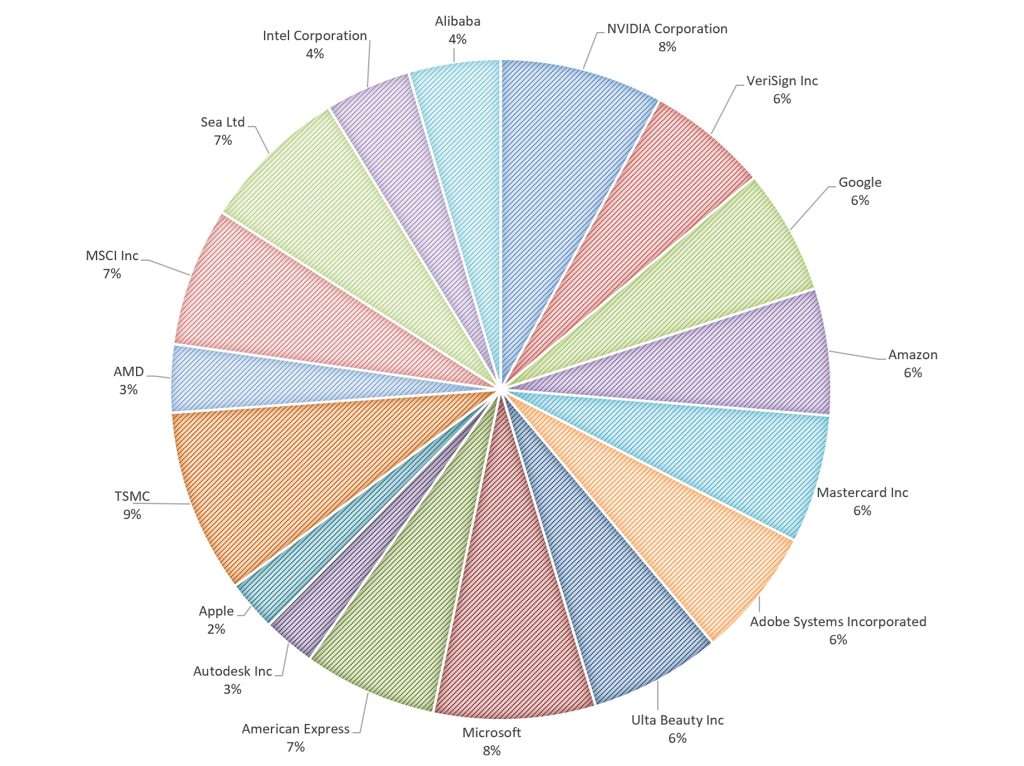

The US stock market continue to rally. Most of the technology stocks held up well. The share price of Alibaba, Intel, AMD and TSMC which I added this year continue its uptrend. On the other hand, Sea Limited share price declined in October. I took opportunity and averaged down on Sea Limited. I remain positive on its Sea Money (Monee) and gaming segment.

Financial Goals Progress for October 2025

Artificial Intelligence continues to fuel a bull run across the tech sector, and I see immense potential in companies embracing AI-driven transformation. Even Data Centre REITs like Keppel DC REIT have benefited from this surge, riding the momentum of increased demand for digital infrastructure.

On the personal front, my Singapore stock portfolio keeps delivering steady dividends, while my US holdings continue to appreciate in value. With just two months left in 2025, I am focused on staying disciplined and keeping my financial assets above target.

That said, the festive season is approaching and with it, the usual uptick in spending. Between social gatherings, gift exchanges, and prepping for Christmas dinner, I am bracing for a slight increase in expenses. Time to be prudent without missing the joy.

So, are you ready to wrap up 2025 with impact and intention?