Earn 2.90% per annum with Standard Chartered Bank eSaver Savings Account Bonus Interest Promotion! From 1st February 2025 to 31st March 2025, you can earn up to 2.90% per annum interest on eligible deposit balance of up to S$2 million with no lock-in period when you bring in incremental fresh funds.

If you look at the Best Fixed Deposit Rates in February, CIMB Bank is only giving you 2.70% per annum for a 3-month fixed deposit placement. For a longer placement of 6 months, MayBank2u Singapore offered the highest fixed deposit interest rate at 2.90% per annum. As there is no-lock in period for this eSaver Savings Account promotion, it can be a better choice than fixed deposits.

What about comparing this promotion with our favourite Singapore T Bills? The cut off yield for BS25103S 6-Month T-bill is also 2.90% per annum. Given that there is no-lock in period, this Standard Chartered Bank eSaver Savings Account Bonus Interest Promotion may not be that bad after all! How does this work? Find out next.

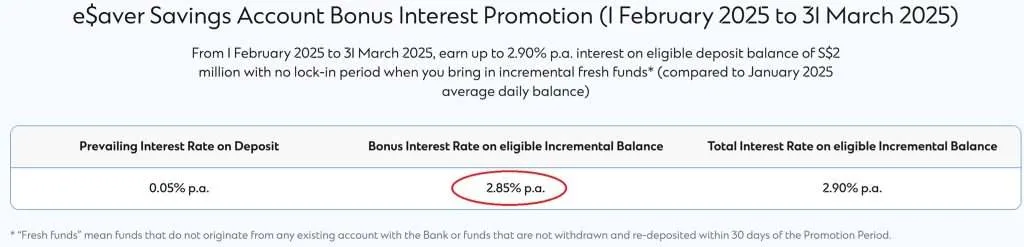

As you can see from the above, you will earn the Bonus interest rate of 2.85% per annum on eligible incremental balance. Together with the prevailing interest rate of 0.05% per annum, you will earn a total interest rate of 2.90% per annum.

After the promotion period, it is important to know that you will cease to earn any Bonus interest rate but will continue to earn the Prevailing interest rate of only 0.05% per annum.

In summary, you will earn 2.90% per annum but only for 2 months (1st February to 31st March 2025).

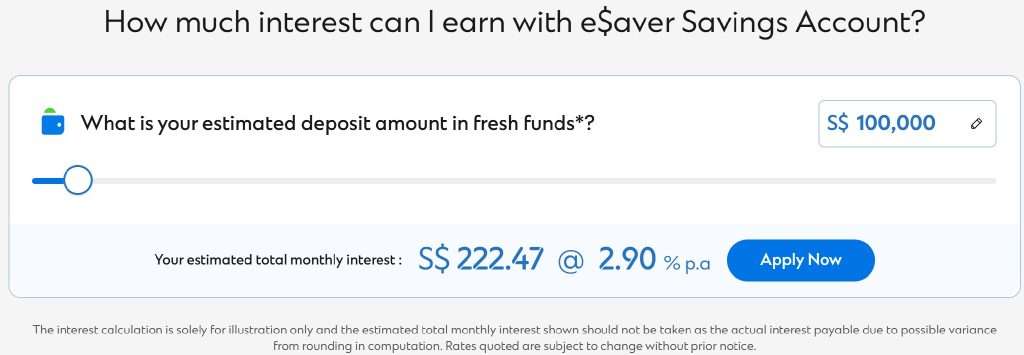

If I have 100K, how much interests will I receive if I put my 100K into Standard Chartered eSaver Savings Account right now?

Based on the calculator that is available on Standard Chartered Bank’s website, I will receive S$222.47 per month. For 2 months, I will receive a total interest of S$444.94 based on 2.90% per annum.

As there is no lock in period, I think it is an easy way to earn extra cash simply by putting in fresh funds into your eSaver account for just 2 months. After that, it is advisable to withdraw your money and put it elsewhere given the petite interest rate of only 0.05% per annum.

This is not a sponsored post and solely based on my own research and opinion. With falling interest rates, I believe everyone like me is looking for the best place to park your money to earn extra cash. If you like this post, do check out Standard Chartered Bank’s eSaver Account Bonus Interest Promotion: e$aver Savings Account: No Lock-in Period with 2.90% p.a. interest – Standard Chartered Singapore