DBS, OCBC and UOB share price crashed earlier this week as Trump announced the implementation of tariffs on various countries. Just a few days later, Trump announced a 90-days tariff pause except for China. The positive news resulted in the bounce back of the share prices of stocks including DBS (SGX:D05), OCBC (SGX:U11) and UOB (SGX:O39).

Before the Singapore stock market open on Monday, are you wondering what is the closing price of DBS, OCBC and UOB on Friday? What is DBS, OCBC and UOB current dividend yield? Bank stocks are attractive for their comparable dividend yield with REITs. Thus, it makes sense why DBS, OCBC and UOB are the hottest traded bank stocks when Singapore stock market crashed.

First, let us take a look at DBS, OCBC and UOB historical dividend payout. After that, let us take a look at what are the bank’s closing price to calculate their current dividend yield.

DBS Dividend

Financial Year: 2024

Dividend Payout: 2.22 SGD per share (Interim: 162 cents, Final: 60 cents)

Financial Year: 2023

Dividend Payout: 1.75 SGD per share (Interim: 126 cents, Final: 49 cents)

Financial Year: 2022

Dividend Payout: 1.82 SGD per share (Interim: 99 cents, Final: 38 cents, Special: 45 cents)

Financial Year: 2021

Dividend Payout: 1.09 SGD per share (Interim: 76 cents, Final: 33 cents)

Financial Year: 2020

Dividend Payout: 0.78 SGD per share (Interim: 62 cents, Final: 16 cents)

OCBC Dividend

Financial Year: 2024

Total Dividend Payout: 1.01 SGD per share (Interim: 44 cents, Final: 41 cents, Special: 16 cents)

Financial Year: 2023

Dividend Payout: 0.82 SGD per share (Interim: 40 cents, Final: 42 cents)

Financial Year: 2022

Dividend Payout: 0.68 SGD per share (Interim: 28 cents, Final: 40 cents)

Financial Year: 2021

Dividend Payout: 0.53 SGD per share (Interim: 25 cents, Final: 28 cents)

Financial Year: 2020

Dividend Payout: 0.318 SGD per share (Interim: 15.9 cents, Final: 15.9 cents)

UOB Dividend

Financial Year: 2024

Total Dividend Payout: 2.30 SGD per share (Interim: 88 cents, Final: 92 cents, Special: 50 cents)

Financial Year: 2023

Total Dividend Payout: 1.70 SGD per share (Interim: 85 cents, Final: 85 cents)

Financial Year: 2022

Total Dividend Payout: 1.30 SGD per share (Interim: 60 cents, Final: 70 cents)

Financial Year: 2021

Total Dividend Payout: 1.20 SGD per share (Interim: 60 cents, Final: 60 cents)

Financial Year: 2021

Total Dividend Payout: 0.78 SGD per share (Interim: 39 cents, Final: 39 cents)

DBS Current Dividend Yield

What is DBS Bank’s current dividend yield? Based on the current share price and 2024 full year dividend payout of 2.22 SGD per share, this translates to a current dividend yield of 5.82%.

OCBC Current Dividend Yield

What is OCBC Bank’s current dividend yield? Based on the current share price and 2024 full year dividend payout of 1.01 SGD per share, this translates to a current dividend yield of 6.72%.

Excluding the special dividend, OCBC Bank’s current dividend yield is 5.66%.

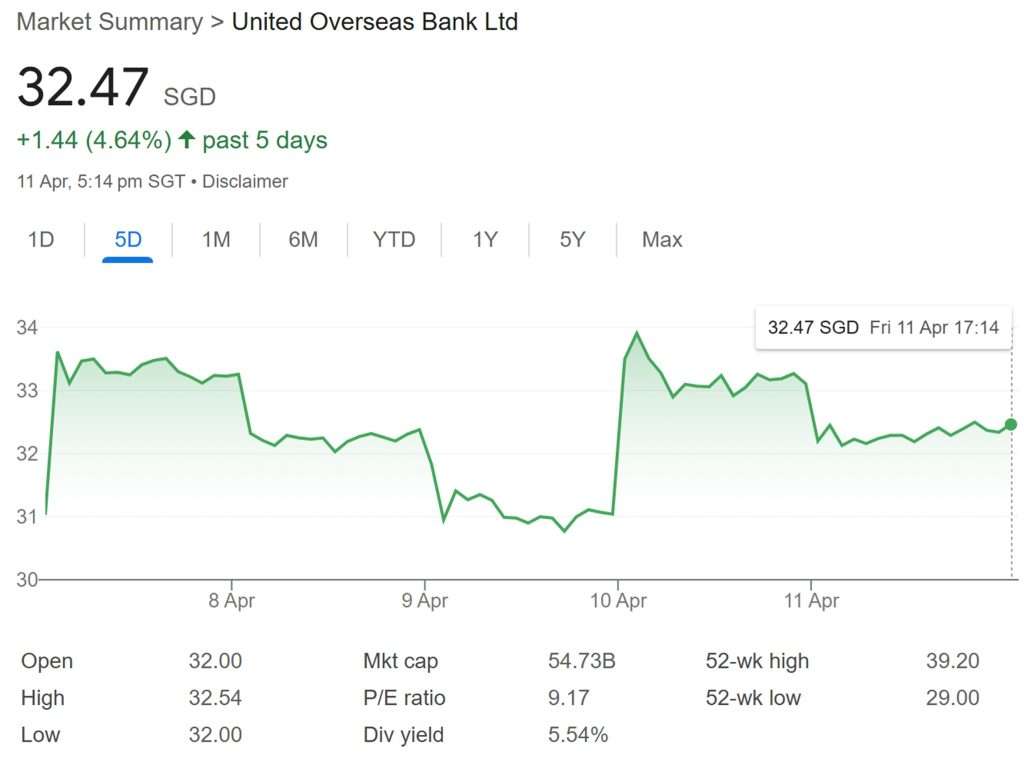

UOB Current Dividend Yield

What is UOB Bank’s current dividend yield? Based on the current share price and 2024 full year dividend payout of 2.30 SGD per share, this translates to a current dividend yield of 7.08%.

Excluding the special dividend, UOB’s current dividend yield is 5.54%.

Summary of DBS, OCBC and UOB Share Price

Based on the closing prices of the 3 banks DBS, OCBC and UOB, the current dividend yield of Singapore Bank stocks is between 5 to 6% (exclude special dividend).

I have bought DBS and OCBC last week when prices dipped. If the share prices of DBS, OCBC and UOB continue to crash, I will continue to add them to my stock portfolio.

What about you?