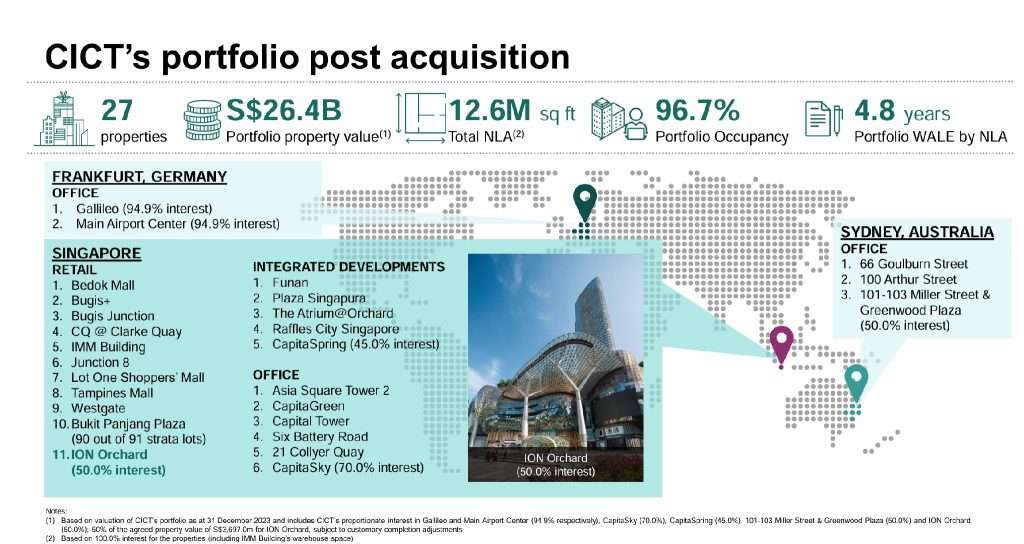

On 3rd September 2024, CICT (CapitaLand Integrated Commercial Trust) entered into an agreement with its sponsor, CapitaLand Investment Limited (CLI) to acquire a 50.0% interest in ION Orchard at S$1,848.5 million. The other 50 per cent will continue to be held by Hong Kong developer Sun Hung Kai Properties. As shared by CICT, the acquisition is expected to be Distribution Per Unit (DPU) accretive and I shall share more details below.

With every acquisition, the manager will always share the benefits. Below is the rationale shared by CICT for the acquisition of ION Orchard.

- Transformative acquisition of Singapore’s iconic destination mall with universal appeal.

- Consolidates CICT’s retail presence in the tightly held downtown precinct.

- Reinforces CICT’s proposition as the proxy for high quality Singapore commercial real estate.

- Immediate DPU accretion and well positioned for growth.

As a dividend investor for passive income, I will be most interested in the last bullet point.

But first, who is Sun Hung Kai?

If you also invest in Hong Kong stock market, the name Sun Hung Kai should not be alien to you. Sun Hung Kai Properties is one of the largest property developers in Hong Kong, with a strong presence in both residential and commercial developments. The company has a history of delivering high-quality projects and has gained a reputation for its innovative designs and sustainable practices. Sun Hung Kai Properties has also expanded its operations internationally, with projects in mainland China, Singapore, and the United Kingdom. With a focus on customer satisfaction and long-term value creation, Sun Hung Kai Properties continues to be a prominent player in the real estate industry.

Proforma DPU Accretion

On a pro forma basis, assuming CICT had held and operated ION Orchard from 1 January to 30 June 2024, the distribution per unit (DPU) accretion is expected to be 0.9%.

On a pro forma basis, assuming CICT had held and operated ION Orchard for the financial year ended 31st December 2023, the DPU accretion is expected to be approximately 1.2%.

Pro forma refers to a financial statement that provides a projection or estimate of a company’s future financial performance. These statements are typically used to show investors and stakeholders the potential outcomes of certain events, such as a merger or acquisition, or changes in the business operations. Pro forma statements are not based on actual results, but rather on assumptions and hypothetical scenarios. They are used to give insight into how a company’s financials could be impacted by various factors, helping decision-makers make informed choices about the company’s future direction.

Method of Financing and Use of Proceeds

At this point of writing, CICT has completed the financing via equity fund raising via private placement and the preferential offering. I shall not touch on the unit price here. If you are interested, please refer to the announcement.

I am usually interested in how the manager will use the proceeds from the funding raising. As shared by the manager of CICT, they intended to use the gross proceeds of approximately S$1.1 billion from the Equity Fund Raising in the following manner:

- approximately S$1,082.6 million (which is equivalent to approximately 97.8% of the gross proceeds of the Equity Fund Raising) to finance the Proposed Acquisition and the associated costs.

- approximately S$5.0 million (which is equivalent to approximately 0.4% of the gross proceeds of the Equity Fund Raising) to be used for the repayment and refinancing of debt and/or capital expenditure and asset enhancement initiatives; and

- approximately S$19.9 million (which is equivalent to approximately 1.8% of the gross proceeds of the Equity Fund Raising) to pay the estimated fees and expenses, including professional fees and expenses, incurred or to be incurred by CICT in connection with the Equity Fund Raising, with the balance of the gross proceeds of the Equity Fund Raising, if any, to be used for general corporate and/or working capital purposes.

My Thoughts on CICT ION Orchard Acquisition

While I love ION Orchard for its prime location, the acquisition came as a surprise. This is because CICT current aggregate leverage stood at 39.8% which I think is on the higher end as compared to other retail and office REITs.

Long term investors of CICT have known CICT for its investment strategy in sub urban retail malls. With this recent move, it seems to have shifted its strategy to start having a mix of sub urban malls and shopping malls in urban prime locations.

With this acquisition, I do hope CICT can look into its strategy to grow its current dividend yield nearer to 6% as compared to the flat 5% throughout these years.