Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest pure-play foundry, has once again underscored its critical role in the global tech ecosystem with a blockbuster Q3 2025 earnings report. As the backbone of the AI revolution and the go-to partner for the world’s most advanced chip designers, TSMC’s latest results reflect not just cyclical recovery but structural ascendancy.

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest pure-play foundry, has once again underscored its critical role in the global tech ecosystem with a blockbuster Q3 2025 earnings report. As the backbone of the AI revolution and the go-to partner for the world’s most advanced chip designers, TSMC’s latest results reflect not just cyclical recovery but structural ascendancy.

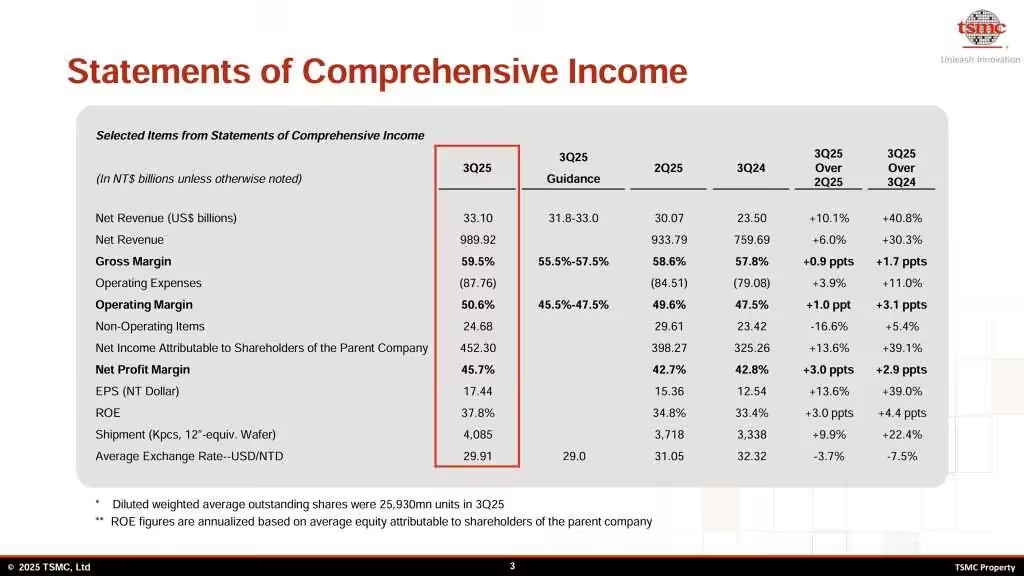

In the third quarter of 2025, TSMC reported revenue of US$33.1 billion, marking a 10.1% increase from the previous quarter and a 30.3% surge year-over-year. This performance exceeded both internal guidance and market expectations, driven by insatiable demand for high-performance computing (HPC) chips and a surprising rebound in smartphone silicon orders. Net income reached NT$452.3 billion, up 39.1% from the same period last year, while earnings per share came in at NT$17.44. Gross margin expanded to 59.5%, up 0.9 percentage points sequentially, and operating margin held firm at 50.6%, reflecting TSMC’s ability to maintain pricing power even amid rising input costs.

The company’s return on equity (ROE) climbed to 37.8%, a testament to its capital efficiency and disciplined execution. These metrics not only highlight TSMC’s financial strength but also reinforce its strategic importance in a world increasingly reliant on advanced semiconductors.

A closer look at the revenue mix reveals the growing dominance of advanced process technologies. The 3nm and 5nm nodes together accounted for 60% of wafer revenue, while nodes 7nm and below made up 74% of total wafer sales. This concentration reflects the industry’s shift toward more power-efficient, performance-optimized chips, particularly for AI inference and training workloads, which demand cutting-edge silicon.

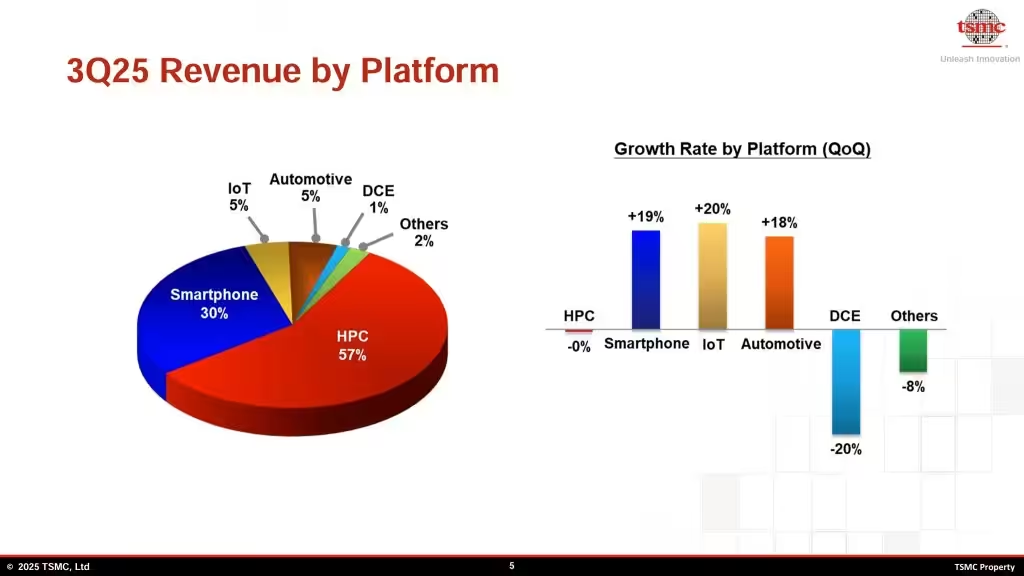

High-performance computing remained TSMC’s largest end-market, contributing 57% of total revenue. This segment includes chips for data centres, AI accelerators, and custom silicon for hyperscalers. While HPC revenue was flat quarter-over-quarter, it remains the company’s most strategic growth engine. AI-related demand, in particular, is “stronger than expected,” according to CEO C.C. Wei, who noted that TSMC is working closely with customers to support their aggressive roadmaps.

Smartphones, long considered a mature and cyclical segment, surprised to the upside. The segment contributed 30% of revenue, up 19% sequentially, driven by new flagship launches and restocking by OEMs ahead of the holiday season. This rebound suggests that the post-pandemic inventory correction may be bottoming out, and that premium-tier devices, many of which rely on TSMC’s 3nm and 4nm nodes are regaining momentum.

The Internet of Things (IoT) and automotive segments each contributed 5% of revenue, both growing around 20% quarter-over-quarter. While still relatively small in absolute terms, these segments are strategically important for TSMC’s diversification. The automotive sector, in particular, is undergoing a transformation as electric vehicles and autonomous systems demand more advanced chips. TSMC’s investment in automotive-grade process technologies positions it well to capture this long-term opportunity.

Digital consumer electronics (DCE), on the other hand, declined to just 1% of revenue, down 20% from the previous quarter. This reflects ongoing weakness in legacy consumer devices and a shift in focus toward higher-margin, higher-complexity applications.

Geographically, North America continued to dominate, accounting for 76% of total revenue. This concentration reflects the deepening partnerships between TSMC and U.S.-based tech giants, particularly in AI and cloud computing. It also underscores the strategic rationale behind TSMC’s aggressive U.S. expansion.

The company is currently building six advanced fabs in Arizona, with the fourth fab set to feature N2 and A16 process technologies. The fifth and sixth fabs will push even further into next-generation nodes, reinforcing TSMC’s commitment to maintaining its technology leadership. In April, the company secured US$6.6 billion in CHIPS Act funding from the U.S. government to support its Phoenix buildout. This funding is part of a broader US$165 billion investment roadmap that includes capacity expansion, R&D, and workforce development.

TSMC’s U.S. strategy is not just about capacity. It is about resilience. By localizing production of its most advanced nodes, the company is helping its customers de-risk their supply chains while aligning with geopolitical imperatives. At the same time, TSMC continues to invest in its home base in Taiwan, where it maintains its most advanced R&D and production capabilities.

Looking ahead, TSMC provided upbeat guidance for Q4 2025. The company expects revenue between US$32.2 billion and US$33.4 billion, representing a 22% year-over-year increase at the midpoint. Full-year revenue growth is projected in the mid-30% range, driven by AI momentum and a mild recovery in non-AI segments. Capex for the year remains unchanged at US$32 billion, with a continued focus on leading-edge capacity and overseas expansion.

CEO C.C. Wei emphasized that the company is seeing “stronger-than-expected” demand for AI-related chips and is “working closely with customers to support their growth.” This suggests that the AI boom is not a short-term spike but a multi-year structural trend that will continue to drive TSMC’s growth.

TSMC’s Q3 results are more than just a financial beat. They are a strategic affirmation. In a world where compute is the new oil, TSMC is the refinery. Its ability to scale advanced nodes, maintain profitability, and align with geopolitical shifts makes it an indispensable player in the global tech stack.

For investors, the message is clear: TSMC is not just riding the AI wave. It is building the infrastructure beneath it. For customers, it remains the foundry of choice for the most demanding workloads. And for the broader industry, TSMC’s performance is a barometer of where the future of silicon is headed.

As we move into 2026, all eyes will be on how TSMC executes on its ambitious roadmap, navigates geopolitical complexities, and continues to define the frontier of semiconductor innovation. But if Q3 is any indication, the company is not just keeping pace. It is setting it.

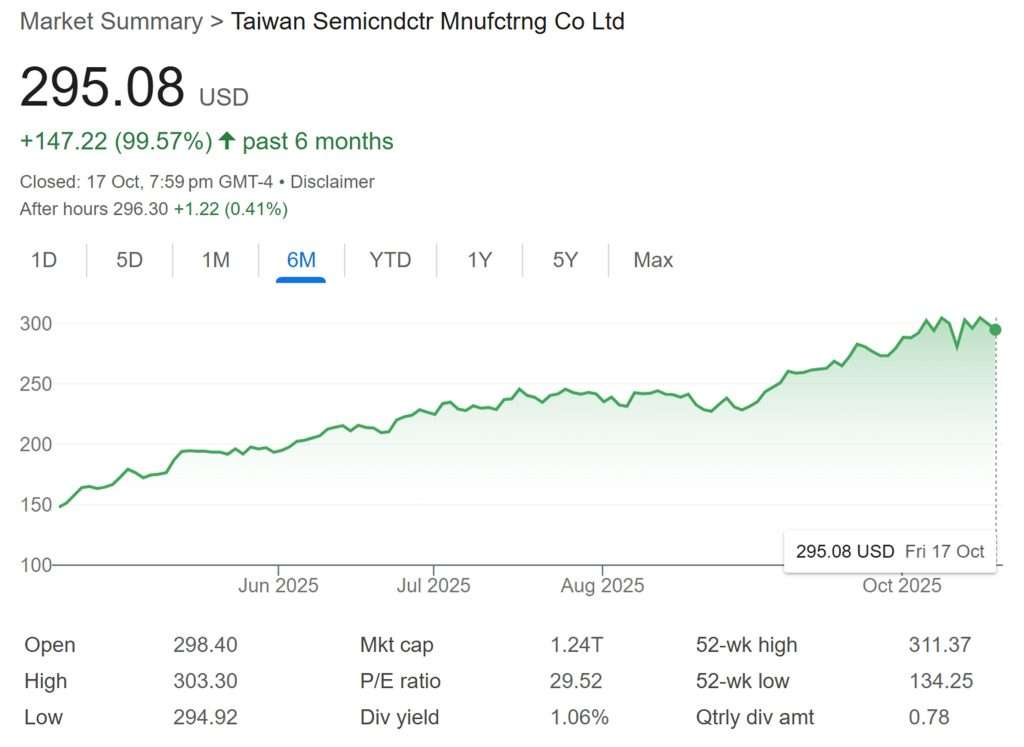

At this point of writing, TSMC makes up 9% of my stock portfolio. As you can see from the above TSMC 6-months share price chart, TSMC share price had jumped by 99.57%. On 17th October 2025, TSMC share price closed at US$295.08. Will the share price of AI technology chip makers continue to rally and reach a new high?