SRS account interest rate is only 0.05% per annum. What is SRS? Why am I contributing to SRS account despite the low interest rate? In this post, I will share the reasons why I am topping up my SRS account to the maximum allowed each year. The SRS contribution limit for each year is S$15,300. I will also share some SRS account investment opportunities so that you can earn higher returns using the money in your SRS account.

What is SRS? The Supplementary Retirement Scheme (SRS) is a voluntary savings scheme in Singapore that complements the Central Provident Fund (CPF) for retirement planning. It was introduced by the government in 2001 to encourage individuals to save more for their retirement and reduce the reliance on government assistance in old age.

How does the SRS Account work?

I have an SRS account with OCBC. Any individual who is a Singaporean citizen, Permanent Resident, or foreigner with a valid employment pass can open an SRS account with one of the three local banks (DBS, UOB, OCBC) in Singapore. SRS account opening with DBS, UOB or OCBC is easy. You can open an account using Digital Banking.

Contributions made to the SRS account are eligible for tax relief, making it an attractive option for individuals looking to reduce their taxable income. The funds in the SRS account can also be invested in a wide range of financial products such as stocks, bonds, unit trusts, and insurance products. For example, you can use your funds in the SRS account to purchase Singapore Treasury Bills, Singapore Savings Bonds and even some Endowment plans.

When you make your first contribution to the SRS account, the retirement age where you can start withdrawal will be locked down. Any subsequent change in the statutory retirement age (e.g. up to age 65) will not affect you. For example, I can start making penalty-free withdrawals from my SRS account at the age of 62.

Only 50% of the withdrawals are taxable at retirement, and the remaining 50% can be tax-free. Withdrawals from SRS accounts are subject to tax in the Year of Assessment following the year of withdrawal.

Benefits of Topping Up Your SRS Account

Tax savings

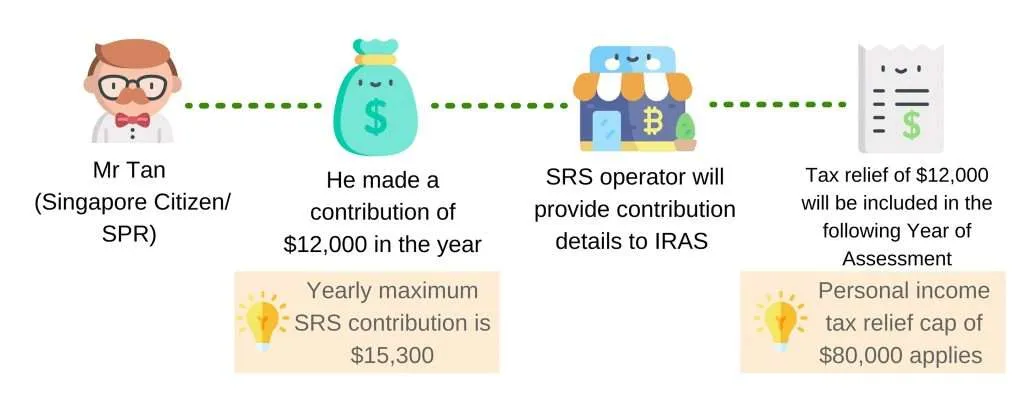

Image source from: IRAS | SRS contributions and tax relief

Are you frustrated having to pay high taxes every year? Contributions to the SRS account can help individuals reduce their taxable income and potentially lower their tax bills. For myself, I always top up my SRS account to the maximum allowed each year to reduce the amount of taxes I have to pay each year. The yearly maximum SRS contribution allowed is S$15,300.

Retirement planning

The SRS account provides a supplementary source of income during retirement, in addition to CPF savings and other investments. As shared earlier in this post, the voluntary Supplementary Retirement Scheme (SRS) was introduced by the Singapore government in the year 2001 with the purpose of helping Singaporeans in retirement planning.

You may make penalty-free withdrawals from your SRS account over 10 years starting from the date of your first penalty-free withdrawal. When you make your first contribution to the SRS account, the retirement age where you can start withdrawal will be locked down. Any subsequent change in the statutory retirement age (e.g. up to age 65) will not affect you. For example, I can start making penalty-free withdrawals from my SRS account at the age of 62.

In my opinion, S$400,000 is the optimal amount of money you should accumulate in your SRS account for retirement as you will be able to withdraw S$40,000 each year for 10 years. During the 10-year window where you start withdrawing the money, only 50% of your withdrawals are taxable. This means that only $20,000 is subject to tax.

SRS Account Investment Opportunities

SRS account interest rate is only 0.05% per annum. However, the SRS account allows individuals to invest in a wide range of financial products to potentially grow their retirement savings. As shared above, you can use your funds in the SRS account to purchase Singapore Treasury Bills, Singapore Savings Bonds and even some Endowment plans to give you higher returns.

Personally, I used the money in my SRS account to purchase Singapore Savings Bonds and SGS T Bills which gives me higher returns.

How are you beating the SRS Account Interest Rate?

The Supplementary Retirement Scheme (SRS) account is a valuable tool for retirement planning in Singapore, offering tax benefits, investment opportunities, and flexibility for individuals looking to save more for their golden years. By taking advantage of the SRS account, individuals can enhance their retirement savings and enjoy a more financially secure future.

Half of the year 2025 had already passed. Do you have an SRS account, and have you start topping up your SRS account?