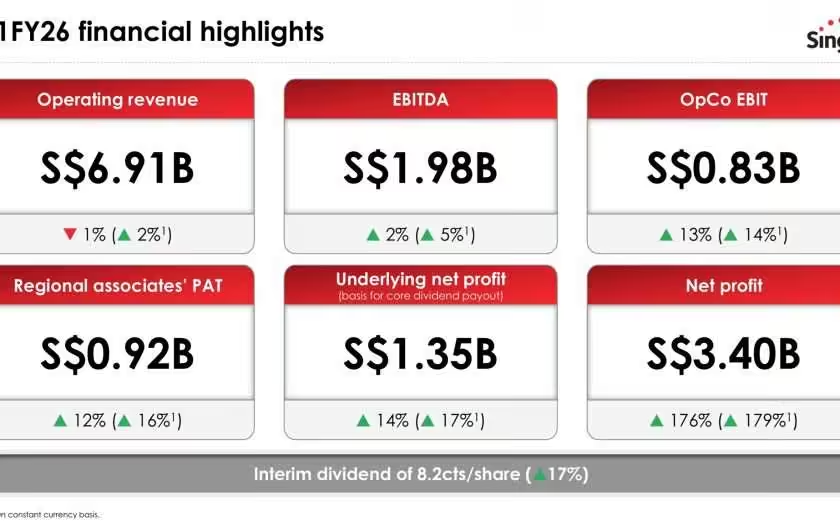

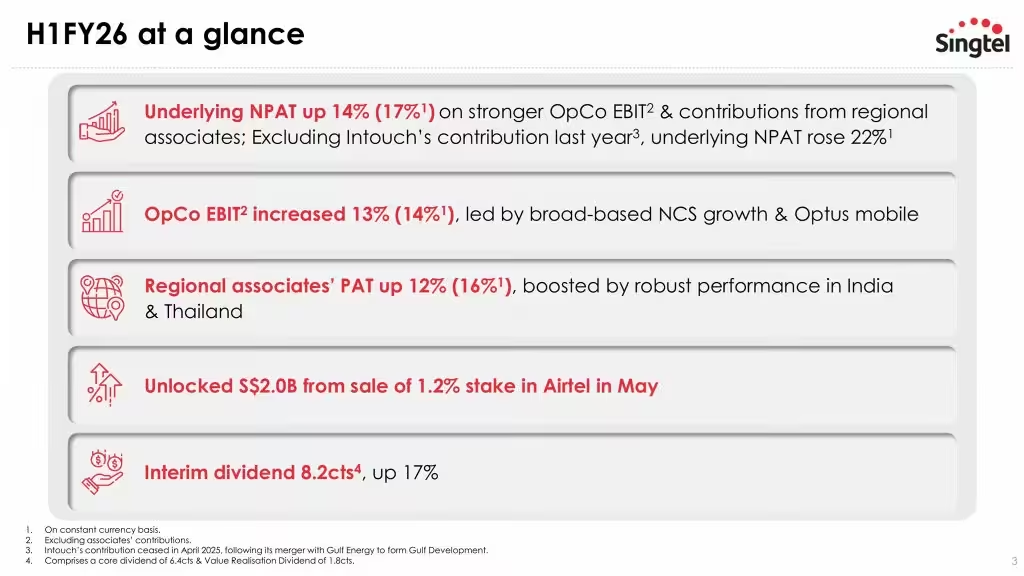

Singtel’s H1FY26 financial results mark a pivotal moment in its transformation journey, showcasing the strength of its diversified portfolio and strategic execution amid macroeconomic headwinds. The Group reported a net profit of S$3.40 billion, a staggering 176% increase year-on-year, largely driven by exceptional gains from strategic divestments. Underlying net profit rose 14% to S$1.35 billion, reflecting solid operational performance across regional associates and core businesses.

A key highlight of the half-year was the S$2.05 billion net exceptional gain, stemming from the partial divestment of Singtel’s stake in Bharti Airtel and the merger of Intouch with Gulf Energy. These moves are part of Singtel’s broader Singtel28 strategy, which aims to unlock value through asset recycling and reinvestment into high-growth areas such as digital infrastructure and enterprise services. With over half of its S$9 billion mid-term asset recycling target already achieved, Singtel has significantly strengthened its balance sheet. Net debt has been reduced to S$8.7 billion, and gearing ratios have improved, supported by prudent financial management. Nearly 90% of the Group’s debt is hedged at fixed rates, and all foreign currency debt is fully hedged, insulating Singtel from FX volatility.

Despite a reported 1.2% decline in operating revenue to S$6.91 billion, the Group’s underlying performance tells a more optimistic story. On a constant currency basis, operating revenue grew 1.9%, EBITDA rose 4.9%, and operating company EBIT surged 14%. These figures underscore the resilience of Singtel’s operating units and the effectiveness of its regional diversification. The interim dividend was raised by 17% to 8.2 cents per share, comprising a core dividend of 6.4 cents and a value realisation dividend of 1.8 cents, reflecting management’s confidence in the Group’s cash flow and capital discipline.

Regional associates continued to be a strong pillar of growth, contributing S$920 million in profit, up 12% year-on-year or 16% in constant currency terms. Excluding Intouch, whose contributions ceased following the merger, the uplift would have been even stronger at 25%. Airtel delivered robust earnings growth in both India and Africa, driven by solid execution and higher mobile tariffs. AIS posted stronger profits on the back of revenue growth and effective cost management. Telkomsel faced challenges due to weaker mobile performance and higher interest expenses, while Globe saw earnings dip amid soft consumer spending. These results highlight Singtel’s strategic advantage in holding stakes across high-growth telecom markets, providing resilience and upside amid domestic challenges.

Among Singtel’s operating companies, NCS continued its strong momentum, delivering broad-based growth and robust bookings. This aligns with Singtel’s pivot toward enterprise digitalisation and government tech transformation. Optus, however, faced uncertainty amid macroeconomic pressures and competitive dynamics in Australia. Despite these challenges, Optus contributed positively to EBIT, aided by higher revenue from a regional network sharing agreement that commenced in January 2025. Looking ahead, Singtel expects operating company EBIT growth in FY2026 to range from high single to low double digits, reflecting cautious optimism amid mixed market conditions.

Nxera, Singtel’s data centre business, is emerging as a transformative growth engine. Management projects more than 20% compound annual EBITDA growth over the next four years, as Nxera scales up its operational capacity across Southeast Asia. This expansion is driven by rising demand for AI workloads, cloud services, and sovereign data hosting—areas where Singtel’s infrastructure and regional footprint offer strategic advantages.

Group CEO Yuen Kuan Moon emphasised the importance of business and geographical diversity in stabilising performance. He noted that Singtel continues to drive growth in connectivity, digital services, and infrastructure, while unlocking value through strategic divestments and partnerships. “The Group’s first half results reflect the positive momentum across our diversified portfolio of businesses across the region,” he said. “We expect our growth engines to change the complexion of the business in the mid-term as they continue to scale.”

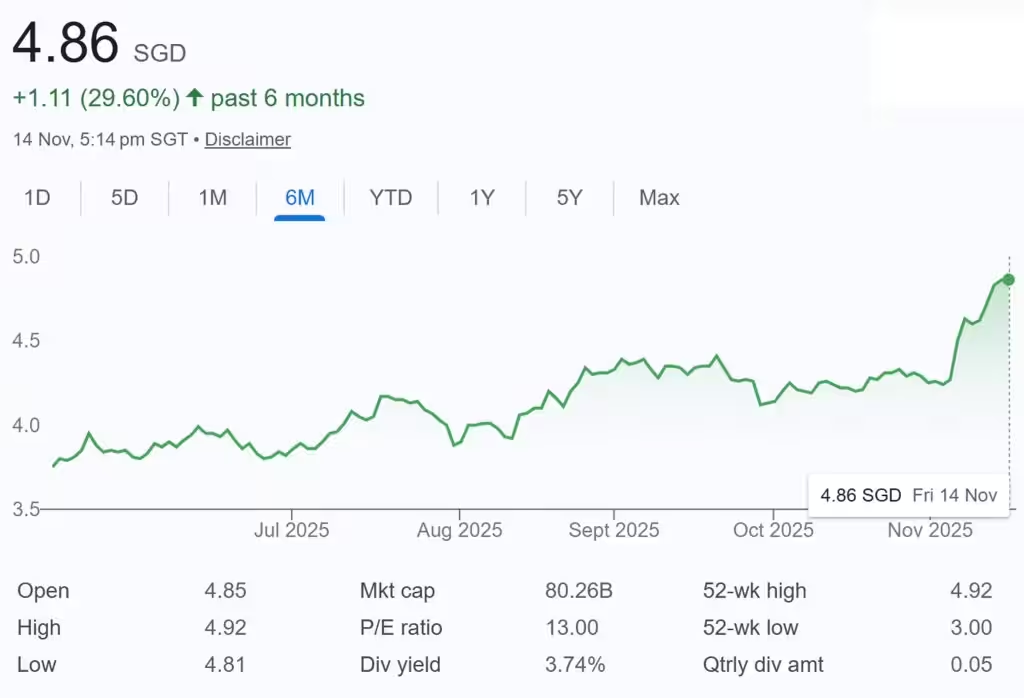

Singtel Share Price and Dividend Yield

Singtel share price closed at S$4.86 on 14th November 2025. Based on Singtel share price of S$4.86 and FY25 full year distribution of 17 cents, this translates to a current dividend yield of 3.50%.

While Singtel faces headwinds from FX volatility, consumer softness, and competitive pressures in Australia, its diversified model, spanning regional associates, enterprise services, and digital infrastructure offers resilience and upside. The Group’s Singtel28 strategy remains a central pillar, balancing value realisation with growth reinvestment. With Nxera, NCS, and Airtel leading the charge, Singtel is well-positioned to evolve into a next-generation digital infrastructure and services powerhouse.