Singapore Stock screening is the process of filtering a large number of stocks based on specific criteria to identify potential investment opportunities. Investors use stock screening tools to narrow down the universe of stocks to those that meet their individual investment goals and risk tolerance.

Common criteria for screening include market capitalization, industry sector, price-to-earnings ratio, dividend yield, and growth projections. By utilizing stock screening, investors can efficiently identify stocks that align with their investment strategy and make informed decisions on where to allocate their capital.

What are some the Benefits of Stock Screening?

Stock screening can be a valuable tool for investors looking to make informed decisions about which stocks to buy. By using specific criteria, such as industry sector, market capitalization, or financial ratios, investors can quickly narrow down their options and focus on companies that meet their investment objectives. This can help save time and effort in the research process, as well as potentially uncovering hidden gems or undervalued stocks that may have been overlooked.

Stock screening can also assist in identifying trends or patterns in the market, allowing investors to stay ahead of the curve and make strategic investment decisions.

Overall, utilizing stock screening can lead to a more efficient and effective investment strategy, ultimately increasing the likelihood of achieving financial success in the stock market.

What are some Popular Stock Screening Tools?

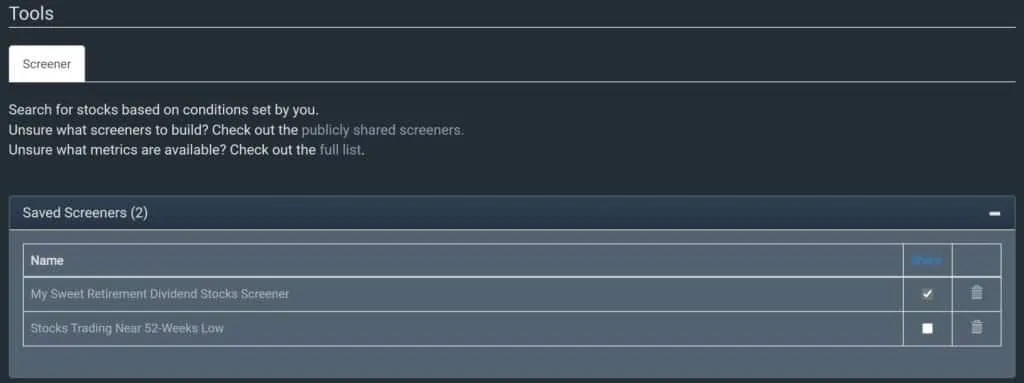

Stock Cafe, a popular platform that allows users to filter stocks based on various criteria such as market capitalization, sector, and financial ratios. This is my preferred tool when it comes to screening for stocks. I shall share the criteria I used below to screen for Singapore REITs.

Shareinvestor, a popular investment platform offers a comprehensive stock screener with options to search for stocks using fundamental analysis metrics. If you are into fundamental analysis, this tool is right for you.

SGX Stock Facts, an official tool provided by the Singapore Exchange that allows users to screen stocks based on financial performance and company information.

There are many more tools out there. The above tools can be useful for investors looking to narrow down their options and make informed decisions when investing in the Singapore stock market.

How do I screen for REITs that pay the highest dividends?

There are many stock screening tools out there. As such, it is not difficult to obtain a shorter list of good REITs and their current dividend yield for further analyse and decision making. Stock Screening tools allow you to screen REITs based on specific factors like P/E ratio, dividend yield, and other financial metrics.

As shared above, I use Stocks Café Stock Screener to screen for a list of REITs that meet my predefined criteria so that I have a shorter list of REITs to analyse. Below are the criteria that I used to screen for dividend stocks. You can adjust them to fit your risk appetite.

- Market Capitalization >= 1B

- Current Yield (%) >= 5 and <= 10

- Price / Book <= 3

Reminder: It is important for you to know that you should not buy the stock solely based on the current dividend yield. The screening results quickly gives you a glimpse of the current dividend yields of the REITs that meet the above screen criteria.

After you have a list of REITs, read up their latest financial results or annual reports. There are 6 terms to know as a REIT investor and they should give you an indicator whether the REIT is performing or underperforming.

Happy Singapore Stock Screening!