The effective interest rate for Singapore Savings Bonds (SSB) December 2024 (SBDEC24 GX24120F) is 2.81% if you held it for 10 years. Singapore Savings Bonds interest rate had been on a downtrend since the US Federal Reserve announced a 50-bps rate cut in September 2024. This month, the Singapore Savings Bonds interest rate had recovered from 2.56% in October to 2.81%.

What are Singapore Savings Bonds?

Singapore Savings Bonds are a type of government bond issued by the Monetary Authority of Singapore that offers individuals a safe and flexible way to save money. These bonds have a low minimum investment amount, starting at just $500, and offer a higher interest rate than traditional savings accounts.

Investors can purchase Singapore Savings Bonds directly from the government and hold them for up to 10 years, earning regular interest payments along the way. These bonds are considered a low-risk investment option, making them popular among risk-averse investors looking to grow their savings over time.

Why Buy Singapore Savings Bonds Over Other Type of Investments?

One benefit of Singapore Savings Bonds over other types of investments is their low-risk nature. Singapore Savings Bonds are backed by the Singapore government, making them a very safe investment option.

Additionally, they offer a higher interest rate compared to traditional savings accounts, making them a more attractive option for those looking for a low-risk investment with better returns.

Another advantage is that Singapore Savings Bonds are flexible, allowing investors to redeem them at any time without any penalties. This makes them a convenient choice for those who may need access to their funds in the short term.

Singapore Savings Bonds Calculator

Monetary Authority of Singapore (MAS) had come up with a Singapore Savings Bonds calculator which you can use to calculate how much interest you would earn if you held Singapore Savings Bonds Dec 2024 for 10 years.

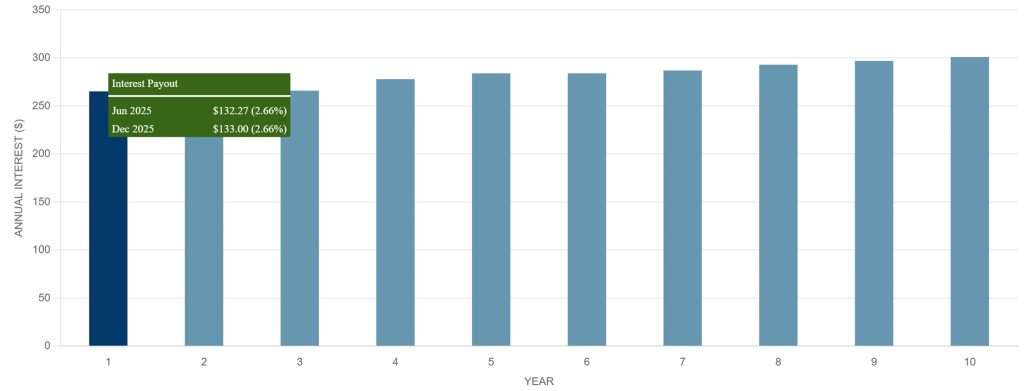

Let us use an investment of S$10,000 as an example. If you purchase Singapore Savings Bonds SBDEC24 GX24120F and held it for 10 years, you will receive a total earning of S$2,821.27. You will receive an estimate of S$265 per year until maturity in December 2034 depending on the interest rate for that year.

Below is the interest per year for Singapore Savings Bonds December 2024.

| Year from issue date | Interest % | Average return per year %* |

| 1 | 2.66 | 2.66 |

| 2 | 2.66 | 2.66 |

| 3 | 2.66 | 2.66 |

| 4 | 2.78 | 2.69 |

| 5 | 2.84 | 2.72 |

| 6 | 2.84 | 2.74 |

| 7 | 2.87 | 2.75 |

| 8 | 2.93 | 2.77 |

| 9 | 2.91 | 2.79 |

| 10 | 3.01 | 2.81 |

*At the end of each year, on a compounded basis.

How to Buy Singapore Savings Bonds

To buy Singapore Savings Bonds, you first need to have an individual CDP account with the Central Depository (CDP). You can apply for the bonds through ATMs of participating banks, internet banking services, or through the DBS/POSB, OCBC, or UOB websites. Simply log in to your bank account and follow the instructions to subscribe to the bonds.

The minimum amount you can invest in Singapore Savings Bonds is $500, and you can apply for up to $200,000 worth of bonds in each issue. The bonds are issued monthly, and the interest rates are adjusted every year. Once you have successfully subscribed to the bonds, you will receive your interest payments twice a year, with the principal amount being repaid at the end of the bond’s 10-year tenure.

For more details, refer to How to Buy.

How to Sell Singapore Savings Bonds

To sell Singapore Savings Bonds, you can do so through the ATMs of participating banks, such as DBS/POSB, OCBC, and UOB. Simply log in to your bank account through the ATM and follow the instructions to sell your bonds.

You can also sell your Singapore Savings Bonds through SRS Operator if you hold them under the Supplementary Retirement Scheme.

For more details, refer to How to Redeem.

How To Track Singapore Savings Bonds?

To track your Singapore Savings Bonds, you can visit the official website of the Monetary Authority of Singapore (MAS) where they provide regular updates on the issuance and performance of the bonds.

![]() I use Stocks Café to track my Singapore Savings Bonds purchases. If you like to know more about Stocks Cafe, please read up my previous review of Stocks Cafe.

I use Stocks Café to track my Singapore Savings Bonds purchases. If you like to know more about Stocks Cafe, please read up my previous review of Stocks Cafe.