The cut-off yield for 6-months Singapore Treasury Bills (SGS T Bills) BS25111T is 2.05% per annum. As you can see from the chart above, the cut-off yield for Singapore Treasury Bills is on a downtrend since the beginning of the year. SGS T bills versus SSB versus Fixed Deposits, where will you place your money? I believe this is a common question asked by fellow Singaporeans.

Like you, I am also always finding the best place to park my money. The best place to park your money is one that gives you the highest interest rates or returns. Below, we shall compare the returns from SGS T bills with the best fixed deposit in June, latest issue of Singapore Savings Bonds and a high yield savings account like UOB Stash.

Before that, if you are new to Singapore Treasury Bills, let me give you a brief introduction.

What are Singapore Treasury Bills?

Singapore Treasury Bills are short-term debt instruments issued by the Singapore government to raise funds for its financing needs. These bills are typically sold at a discount from their face value and mature in 3, 6, or 12 months. They are considered a safe investment as they are backed by the Singapore government’s creditworthiness.

Investors can purchase these bills directly from the Singapore government or through designated financial institutions. Treasury Bills are often used by investors as a low-risk, liquid investment option with a fixed return.

The Announcement Date and Auction Date of Singapore Treasury Bills can be found at Monetary Authority of Singapore (MAS) website under Auctions and Issuance Calendar. The issuance calendar 2025 is available below. For convenience, you can also download a copy to keep on your computer’s desktop.

Singapore T-Bills Calendar

For convenience, I am sharing the Singapore Treasury Bills (T-Bills) Auction and Issuance Calendar here. If you need the Treasury Bill results such as the status of each issuance, please refer to Treasury Bills at MAS website – Auctions and Issuance Calendar.

6-Months T-Bills Calendar

1-year T-Bills Calendar

Tracking of Singapore Savings Bonds (SSB) and Treasury Bills (SGS T-Bills) All in One Place

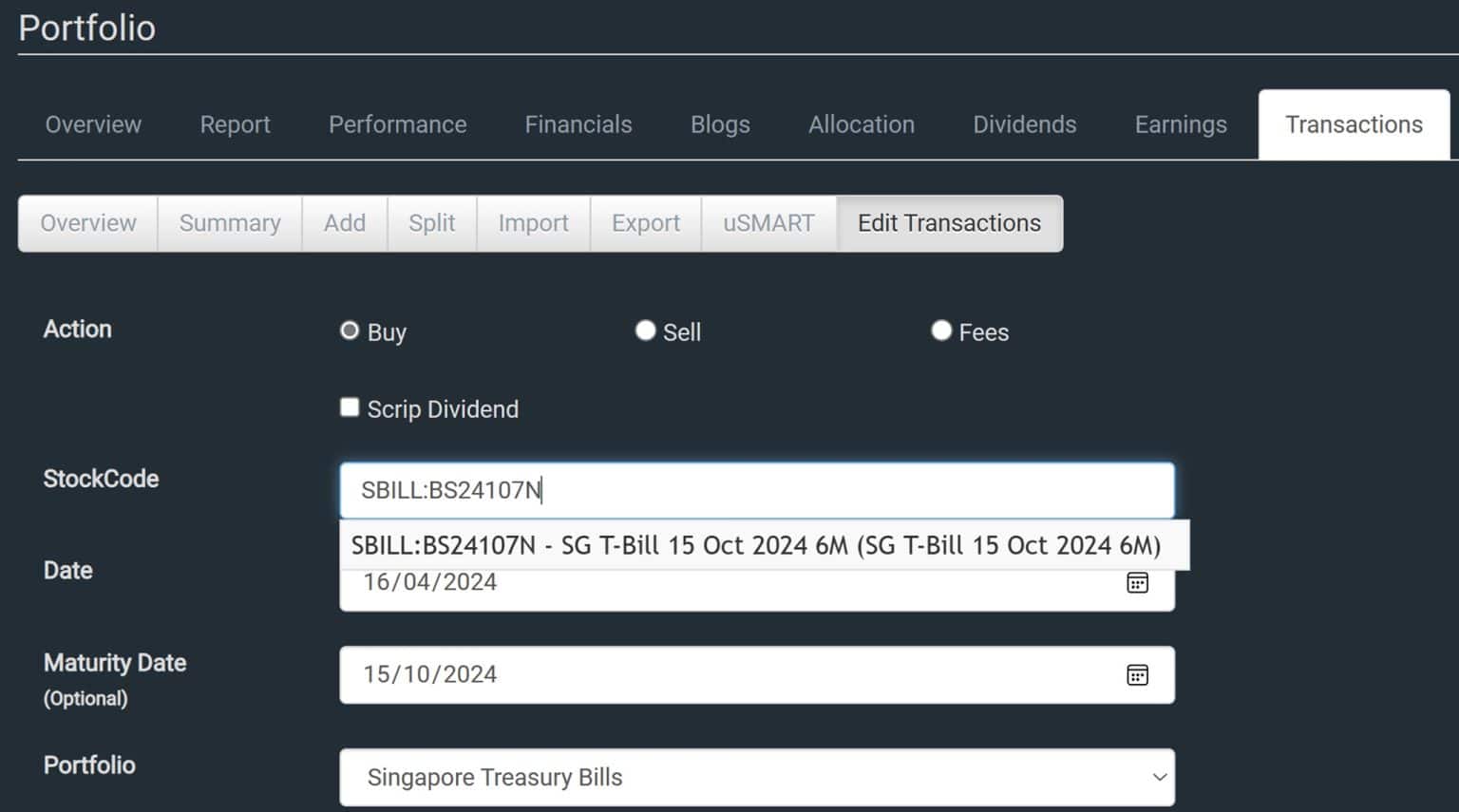

Stocks Café is probably the only software that I know which allows you to track your purchased Singapore Savings Bonds and Treasury Bills (T-Bills) all in one place together with your stock investments. This makes it easy to track your total net investments.

Stocks Café allows you to create portfolios. You can use portfolio to different your investments. For example, I created three portfolios in Stocks Café, namely Stocks, Singapore Savings Bonds and Treasury Bills. This allow me to categorize how much I allocate for each investment.

Should you invest in SGS T Bills or Fixed Deposits right now?

The best fixed deposit in June comes from DBS Bank. DBS Bank is offering the highest fixed deposit interest rate at 2.45% per annum for a 12-months tenure. If you wish to opt for a shorter tenure period of 6-months, DBS Bank is offering 2.15% per annum for a 6-months fixed deposit placement.

The fixed deposit promotion from DBS Bank is the clear winner against SGS T Bills.

Buy SGS T Bills or put your money in High Yield Savings Account UOB Stash Account?

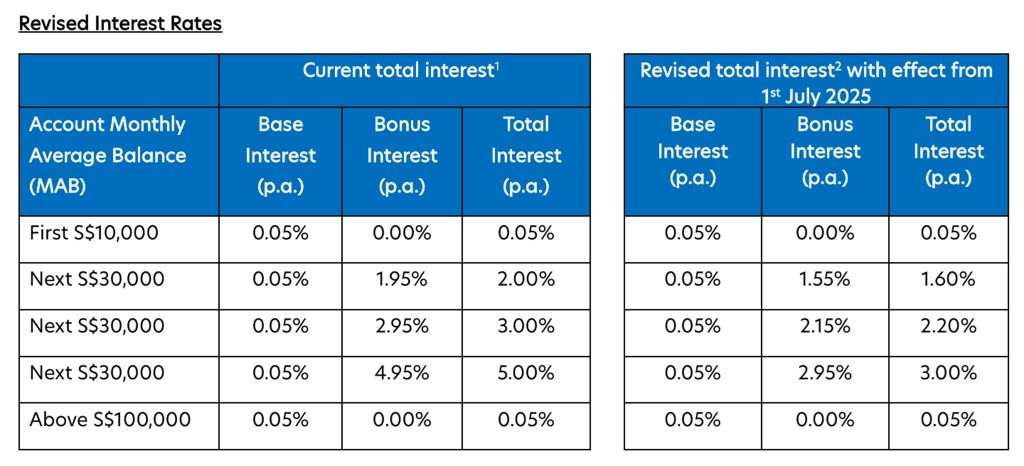

Above are the revised tiered interest rates offered by UOB Stash Account effective from 1st July 2025. With the revised interest rates, you can earn up to S$2,040 interest a year with a deposit balance of S$100,000 in your UOB Stash Account by simply maintaining or increasing your Monthly Average Balance (MAB) each month.

Based on the revised rates, UOB Stash Account interest rates work out to be estimated 2.04% per annum.

As the difference in interest rates between SGS T Bills and UOB Stash Account is not significant, I would rather stash my money in UOB Stash Account.

Comparing SGS T Bill with SSB

The cut off yield of the latest issue of SGS T Bill (BS25111T 6-Month T-bill) sunk to 2.05% per annum. The difference in return offered by SBJUL25 and BS25111T 6-month T-bill is not significant.

As such, I would rather park my money with SBJUL25 given the 1-year return is 0.01% higher than BS25111T 6-month T-bill.

My Thoughts on SGS T Bills Singapore BS25111T

It is very disappointing that the cut-off yield from SGS T bills continue to decline with every new issue. With falling interest rates, I would place my money in DBS Bank 12-month fixed deposit to earn 2.45% per annum.

If you cannot afford to lock your money for 12 months, then put your money into either Singapore Savings Bond or a high interest rate yielding account such as UOB Stash Account.

I will skip SGS T Bills as the cut-off yield is poor.