The effective interest rate for SSB SBSEP25 GX25090A is 2.11% if you held it for 10 years. The interest rates for this month’s issue of the SSB Singapore Savings Bond continue to decline further by 0.18% from 2.29% offered by SBAUG25. What is the SSB yield if you sell off after one year? If you decided to sell off it after holding it for 1 year, the return per year is 1.71%. Is this month’s issue of Singapore Savings Bond worth buying? In this post, I shall compare this month’s issue of Singapore Savings Bond with latest issue of T Bills and some of the popular high interest savings account that I owned.

The effective interest rate for SSB SBSEP25 GX25090A is 2.11% if you held it for 10 years. The interest rates for this month’s issue of the SSB Singapore Savings Bond continue to decline further by 0.18% from 2.29% offered by SBAUG25. What is the SSB yield if you sell off after one year? If you decided to sell off it after holding it for 1 year, the return per year is 1.71%. Is this month’s issue of Singapore Savings Bond worth buying? In this post, I shall compare this month’s issue of Singapore Savings Bond with latest issue of T Bills and some of the popular high interest savings account that I owned.

Before that, do you know what are Singapore Savings Bonds? Singapore Savings Bonds are a type of government bond issued by the Monetary Authority of Singapore that offers individuals a safe and flexible way to save money. The “step up” feature of the SSB facilitates long term investment which means the return increases the longer you hold them for.

These bonds have a low minimum investment amount, starting at just $500, and offer a higher interest rate than traditional savings accounts. Investors can purchase Singapore Savings Bonds directly from the government and hold them for up to 10 years, earning regular interest payments along the way.

Why should you buy Singapore Savings Bonds? Singapore Savings Bonds are low risk investments, thus making them a popular investment option among risk-averse investors looking to grow their savings over time. The return increases as you hold them longer. The limit an individual can purchase is S$200,000 inclusive of both cash and SRS.

Singapore Savings Bonds SSB Calculator

Monetary Authority of Singapore (MAS) had come up with a Singapore Savings Bonds Calculator which you can use to calculate how much interest you would earn if you held Singapore Savings Bonds for 10 years.

Let us use an investment of S$10,000 as an example. If you purchase SSB Singapore (SSB SBSEP25 GX25090A) and held it for 10 years, you will receive a total earning of S$2,134.00.

Below is the interest per year for SSB SBSEP25 GX25090A.

| Year from issue date | Interest % | Average return per year %* |

| 1 | 1.71 | 1.71 |

| 2 | 1.71 | 1.71 |

| 3 | 1.71 | 1.71 |

| 4 | 1.79 | 1.73 |

| 5 | 1.92 | 1.77 |

| 6 | 2.09 | 1.82 |

| 7 | 2.31 | 1.88 |

| 8 | 2.53 | 1.96 |

| 9 | 2.72 | 2.04 |

| 10 | 2.85 | 2.11 |

*At the end of each year, on a compounded basis.

How to Buy Singapore Savings Bonds

To buy Singapore Savings Bonds, you first need to have an individual CDP account with the Central Depository (CDP). You can apply for the bonds through ATMs of participating banks, internet banking services, or through the DBS/POSB, OCBC, or UOB websites. Simply log in to your bank account and follow the instructions to subscribe to the bonds.

The minimum amount you can invest in Singapore Savings Bonds is $500, and you can apply for up to $200,000 worth of bonds in each issue. The bonds are issued monthly, and the interest rates are adjusted every year. Once you have successfully subscribed to the bonds, you will receive your interest payments twice a year, with the principal amount being repaid at the end of the bond’s 10-year tenure.

For more details, refer to How to Buy.

How to Sell Singapore Savings Bonds

To sell Singapore Savings Bonds, you can do so through the ATMs of participating banks, such as DBS/POSB, OCBC, and UOB. Simply log in to your bank account through the ATM and follow the instructions to sell your bonds.

You can also sell your Singapore Savings Bonds through SRS Operator if you hold them under the Supplementary Retirement Scheme.

For more details, refer to How to Redeem.

How To Track Singapore Savings Bonds?

To track your Singapore Savings Bonds, you can visit the official website of the Monetary Authority of Singapore (MAS) where they provide regular updates on the issuance and performance of the bonds.

![]() I use Stocks Café to track my SSB Singapore purchases. If you like to know more about Stocks Cafe, please read up my previous review of Stocks Cafe.

I use Stocks Café to track my SSB Singapore purchases. If you like to know more about Stocks Cafe, please read up my previous review of Stocks Cafe.

Comparing SSB Singapore with SGS T Bill

The cut off yield of the latest issue of SGS T Bill (BS25115V 6-Month T-bill) sunk to 1.77% per annum. The returns for SGS T Bill are slightly higher at 1.77% per annum as compared to SSB yield at 1.71% return for the 1st year.

Comparing SSB Singapore with GXS Savings Account

With effect from 8th August 2025, GXS reduced their GXS Savings Account interest rates again. The interest rate for Main Account will be adjusted from 1.68% p.a. to 1.08% per annum. The interest rate for Saving Pockets will be adjusted from 1.98% p.a. to 1.38% per annum.

The return from SSB Singapore first year return is higher at 1.71%.

Comparing SSB Singapore with UOB Stash Savings Account

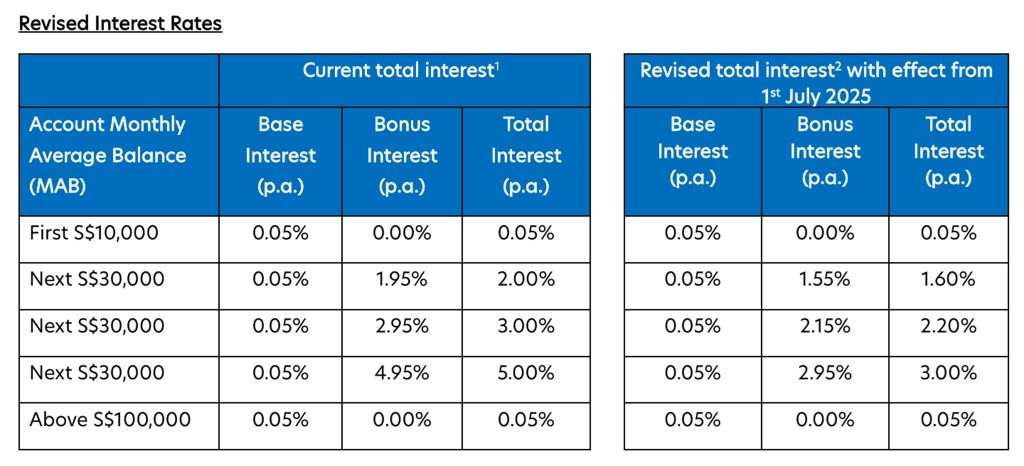

Effective from 1st July 2025, UOB Stash had revised their interest rates. With the revised interest rates, you can earn up to S$2,040 interest a year with a deposit balance of S$100,000 in your UOB Stash Account by simply maintaining or increasing your Monthly Average Balance (MAB) each month.

Based on the revised rates, UOB Stash Account interest rates work out to be estimated 2.04% per annum. The returns from UOB Stash Account are better than this month’s issue of SSB Singapore.

Will I Buy SBSEP25 GX25090A?

Based on the above comparisons against other financial instruments, this month’s issue of Singapore Savings Bond (SBSEP25 GX25090A) is not worth investing if you are looking at short term investments as the return for the first 3 years is only a mere 1.71% per annum which is worse than last month’s issue of Singapore Savings Bond.

There are better places to park your money such as UOB Stash and other high interest savings accounts.

Always look for the best place to park your money!