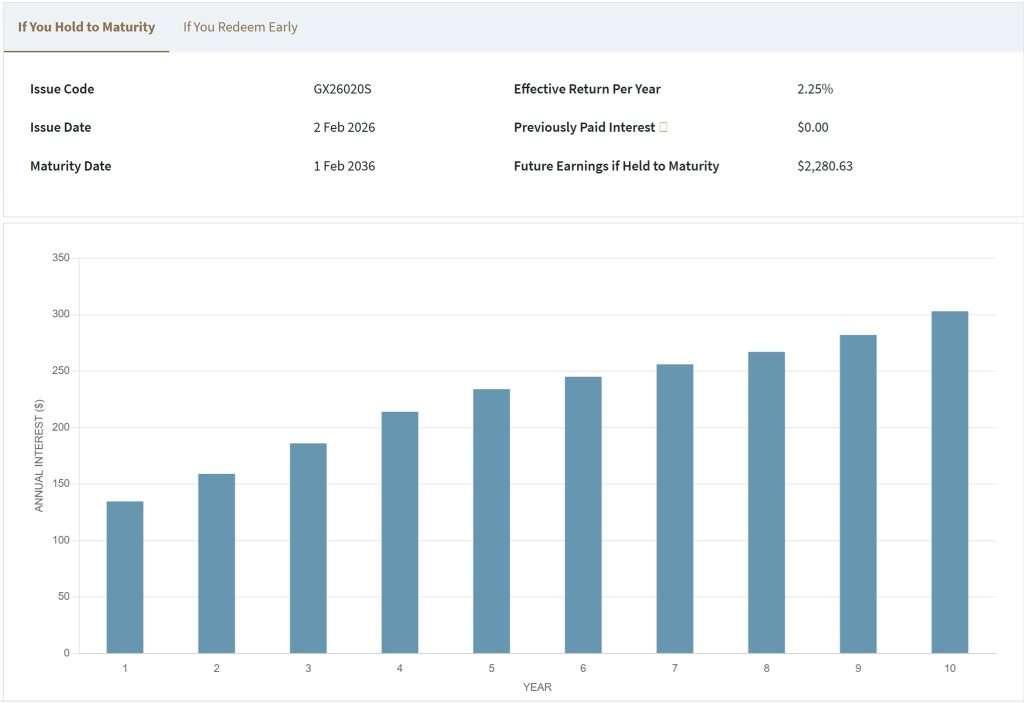

The effective interest rate for the Singapore Savings Bond interest rate SBFEB26 GX26020S is 2.25% if I hold it to maturity over 10 years. If I sell SBFEB26 after one year, Singapore Savings Bond interest rate is 1.35% per annum. As you can see from the above chart, the effective interest rate of Singapore Savings Bond took a reversal from its downtrend and started to rise since November (SBDEC25).

Based on the best fixed deposit rates in December 2025, there are no banks offering a better rate than SBFEB26 at 1.35% per annum for a one-year holding period. For example, OCBC is offering only 1.15% per annum for a fixed deposit placement of 12-months via online banking. DBS is offering only 1.00% per annum for a 12-months fixed deposit placement. Investing in this month’s issue of Singapore Savings Bond SBFEB26 is a better choice over fixed deposits given the higher interest rate and no lock in period.

Are Singapore Savings Bonds Suitable for Retirement Savings?

As shared last month, investing in Singapore Savings Bond is unlike chasing promotional bank rates that change every few months. Singapore Savings Bond offers predictability. I know exactly what I will get if I hold it, and the “step‑up” feature means my returns grow the longer I stay invested. It is almost like being rewarded for patience, a trait that aligns perfectly with how I have approached retirement planning.

With just $500 as the entry point, it feels accessible. And for me, it is not just about the numbers. It is about building a disciplined savings journey, one step at a time. Adding SBJAN26 to my portfolio is not just another investment decision, it is a way of reinforcing the long‑term plan my wife and I have been nurturing for years: steady growth, predictable income, and the peace of mind that comes with knowing our retirement savings are on track.

What are the Benefits of Investing in Singapore Savings Bonds?

Despite relatively modest yields, SSBs are low-risk investments, perfect for conservative investors seeking steady growth. The longer you hold them, the higher your effective return. Each individual can invest up to S$200,000, inclusive of both cash and SRS contributions.

In the next section, we will walk through how to calculate your potential returns using the MAS SSB Calculator.

How to Buy Singapore Savings Bonds Online?

To purchase Singapore Savings Bonds, you’ll need an individual CDP account with the Central Depository (CDP). Applications can be made via ATMs, internet banking, or directly through the websites of participating banks such as DBS/POSB, OCBC, and UOB. Just log in and follow the steps to subscribe.

The minimum investment is $500, with a cap of $200,000 per issue. Bonds are issued monthly, and their interest rates are revised annually. Once subscribed, you’ll receive interest payments twice a year, and your principal will be returned at the end of the 10-year bond term.

For more details, refer to How to Buy.

Where Can I Check the Latest Interest Rates for Singapore Savings Bonds?

You can check out the latest issue of Singapore Savings Bond at Monetary Authority of Singapore (MAS) Singapore Savings Bond Portal where the interest rates of the latest issue of the bond are published. To help investors easily estimate their returns, the Monetary Authority of Singapore (MAS) also offers a Singapore Savings Bonds Calculator. This tool allows you to project your interest earnings over a 10-year holding period.

For example, if you invest S$10,000 in the SBFEB26 (GX26020S) tranche and hold it to maturity, your total interest earned would be S$2,280.63. Here is a breakdown of the annual interest payouts for SBFEB26 (GX26020S) across its 10-year term.

| Year from issue date | Interest % | Average return per year %* |

| 1 | 1.35 | 1.35 |

| 2 | 1.59 | 1.47 |

| 3 | 1.86 | 1.60 |

| 4 | 2.14 | 1.73 |

| 5 | 2.34 | 1.85 |

| 6 | 2.45 | 1.94 |

| 7 | 2.56 | 2.02 |

| 8 | 2.67 | 2.10 |

| 9 | 2.82 | 2.17 |

| 10 | 3.03 | 2.25 |

*At the end of each year, on a compounded basis.

How To Track Singapore Savings Bonds?

You can monitor your Singapore Savings Bonds by visiting the Monetary Authority of Singapore (MAS) website, which offers up-to-date information on bond issuance and performance.

![]() I use Stocks Café to track my SSB Singapore purchases. If you like to know more about Stocks Cafe, please read up my previous review of Stocks Cafe.

I use Stocks Café to track my SSB Singapore purchases. If you like to know more about Stocks Cafe, please read up my previous review of Stocks Cafe.

Should I Consider SBFEB26 GX26020S?

This latest Singapore Savings Bond (SSB) issue stands out against fixed deposits and savings accounts. It provides an effective return of 2.25% per annum if held to maturity over 10 years, and 1.35% per annum in the shorter term. While not sky‑high, these returns are relatively stable and predictable qualities that are increasingly valuable as bank rates continue to slide.

With some extra cash available, I will consider adding SBFEB26 (GX26020S) to my retirement savings portfolio. It is a disciplined way to lock in steady returns while complementing my long‑term investment strategy.