How is your Retirement Planning? Retirement planning is a crucial aspect of financial management that involves setting aside funds and creating a strategy to ensure financial security during retirement years. It is important to start planning for retirement early in order to build up savings and investments that will provide income in later years.

Factors to consider when planning for retirement include setting retirement goals, estimating expenses, saving through retirement accounts such as your CPF, and considering other sources of income such as passive income. It is essential to regularly review and adjust retirement plans as needed to account for changing circumstances and to ensure a comfortable retirement.

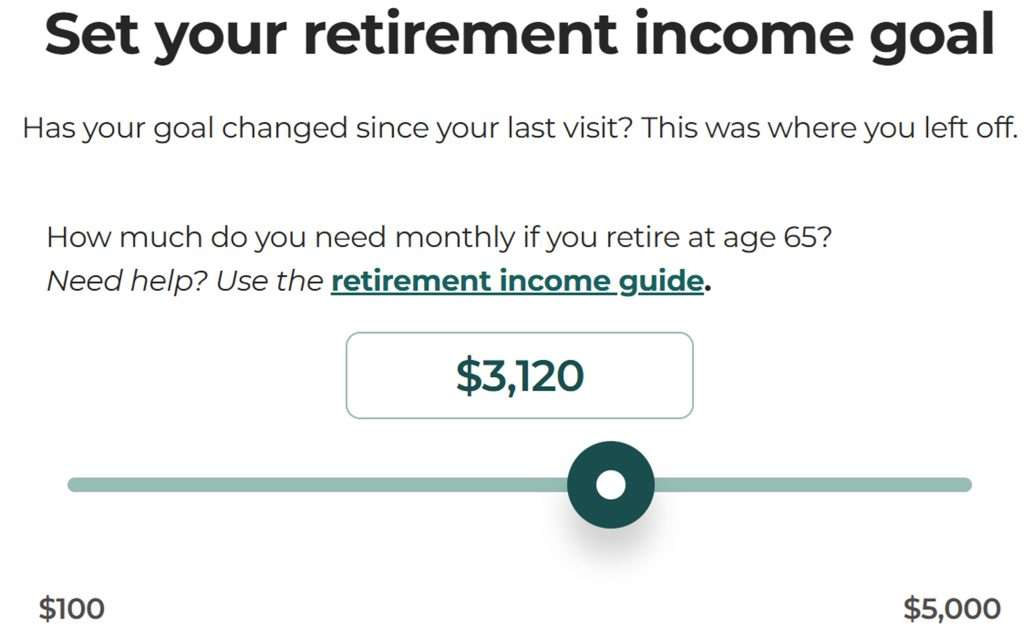

With rising prices, do you know how much are your monthly expenses after you retire? Do you know how much savings you should start setting aside now so that there is enough to cope with your monthly expenses after retirement? What is your retirement income goal?

Today, I am going to share with you a retirement planning tool that I have found recently, and it is available to all Singaporeans. With retirement age in Singapore raised to 64 years from 1 July 2026, it becomes even more important to focus on retirement planning.

CPF Retirement Planning

CPF have developed a fantastic tool for Singaporeans to estimate our expenses after retirement. The purpose is for you to start planning early and start saving to meet your retirement lifestyle.

Do you know how much you need monthly if you retire? CPF retirement income guide helps you with your planning. Based on your selection, the retirement income guide will estimate how much you need when you retire.

My selections are:

- For general household expenses, I am usually prudent but will spend more occasionally.

- My healthcare and medical needs will mostly be addressed through visits to General practitioners and a mix of Government and private hospitals.

- I will mostly dine at Food courts and hawker centres and occasionally visit restaurants.

- For leisure, I am likely to take an annual trip to regional countries. E.g. East Asia (or several trips to neighbouring countries)

- I will mostly commute via public transport, with occasional taxi or private hire rides.

Based on my selections, I will need a retirement income of S$3120 per month to meet my retirement lifestyle.

CPF Retirement Plans

Next, you can select your retirement lifestyle. There are currently three CPF retirement plans. For myself, I have chosen the CPF LIFE Standard Plan as I can lower my lifestyle to buy less with steady monthly payouts when prices rise in the future.

Next, the tool will estimate the payout I need at my Singapore retirement age. As you can see below, my payout goal at 65 with inflation of 2% factored in is S$4,830. I will need a retirement savings goal of S$926,000. This is the savings I need at age 65 to start receiving my target monthly payout of S$4,830 for life.

The link to the tool can be found here. CPFB | Retirement payout planning

On top of relying on your CPF savings, find out more how I am building my passive income through other means to Retire Early.