On 11th February 2025, the manager of Paragon REIT and Cuscaden Peak jointly announced the privatization of Paragon REIT. If you are wondering what is Cuscaden Peak, Cuscaden Peak Investments Private Limited is the sponsor of PARAGON REIT.

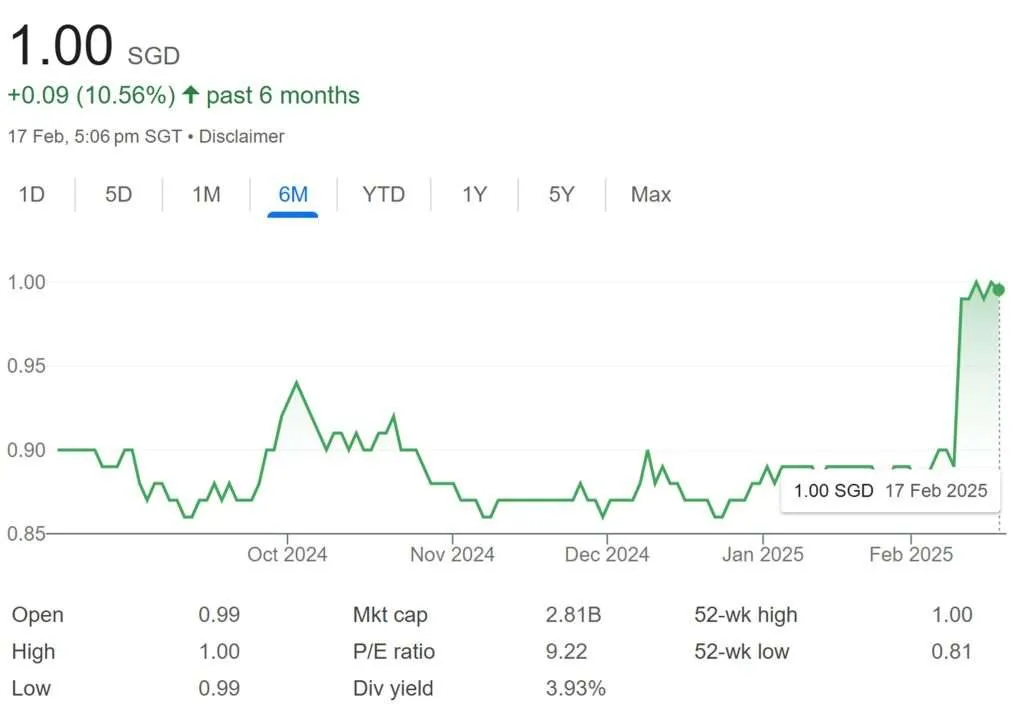

How much is the manager offering to delist Paragon REIT and take it private? The scheme consideration of S$0.9800 in cash per unit represents a 7.1% premium to adjusted NAV (Net Asset Value) which translates to a Price / Adjusted NAV multiple of 1.07x. It also represents premiums of 10.9% and 12.8% to the 1-month and 12-month volume-weighted average price, respectively. The cash consideration of S$0.98 also exceeded the highest ever traded price over the last 2 years.

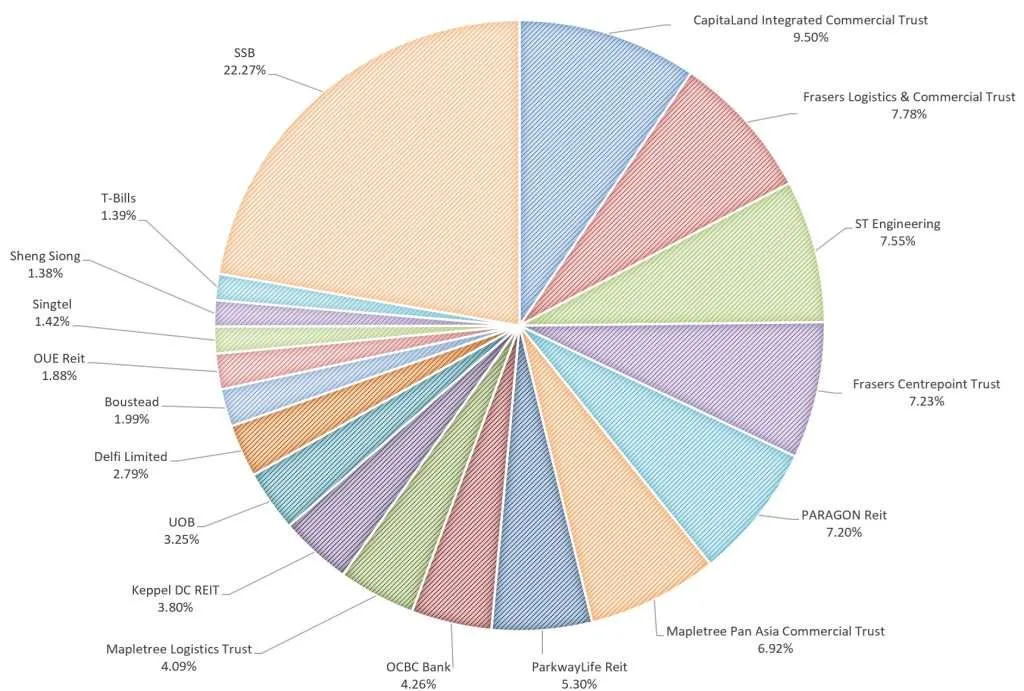

Currently, Paragon REIT makes up 7.20% of my stock portfolio.

Rationale for taking Paragon REIT Private

You can find the rationale via Paragon REIT’s website, but I thought I shared them here as well.

PARAGON REIT is constrained in its potential for sustained growth as it has faced low free float and trading liquidity, as well as limited analyst coverage and institutional investor flows, which restrict its ability to access capital markets and expand its portfolio, as compared to other retail S-REIT peers.

One of the rationales for taking Paragon REIT private is that PARAGON REIT’s portfolio relied heavily on Paragon. Paragon is an upscale mall that is more than 30 years old and that accounts for 72% of the REIT’s appraised value.

The mall’s premier upscale status is being challenged by malls undergoing major upgrades and upcoming redevelopments in the surrounding catchment. For example, Ming Arcade, Tanglin Shopping Centre, Forum The Shopping Mall, voco Orchard Singapore, and HPL House. These upcoming developments are expected to significantly ramp up competition once completed.

The Offeror believes that a potential significant asset enhancement initiative (“Potential AEI”) for Paragon is necessary to maintain its long-term competitiveness as a leading upscale retail mall in Singapore and intends to collaborate closely with PARAGON REIT to facilitate the implementation of such a Potential AEI.

Expected Timeline for Delisting of Paragon REIT

If you are an existing investor of Paragon REIT like me, do take note of the following estimated timelines.

| Expected date of EGM and Scheme Meeting | April 2025 |

| Expected Effective Date of the Scheme | May 2025 |

| Expected payment of Scheme Consideration | May 2025 |

| Expected delisting of PARAGON REIT | End May 2025 |

At this point of writing, Paragon REIT closed at S$1.00 on 17-Feb-25. Should I sell it instead of waiting for the delisting?