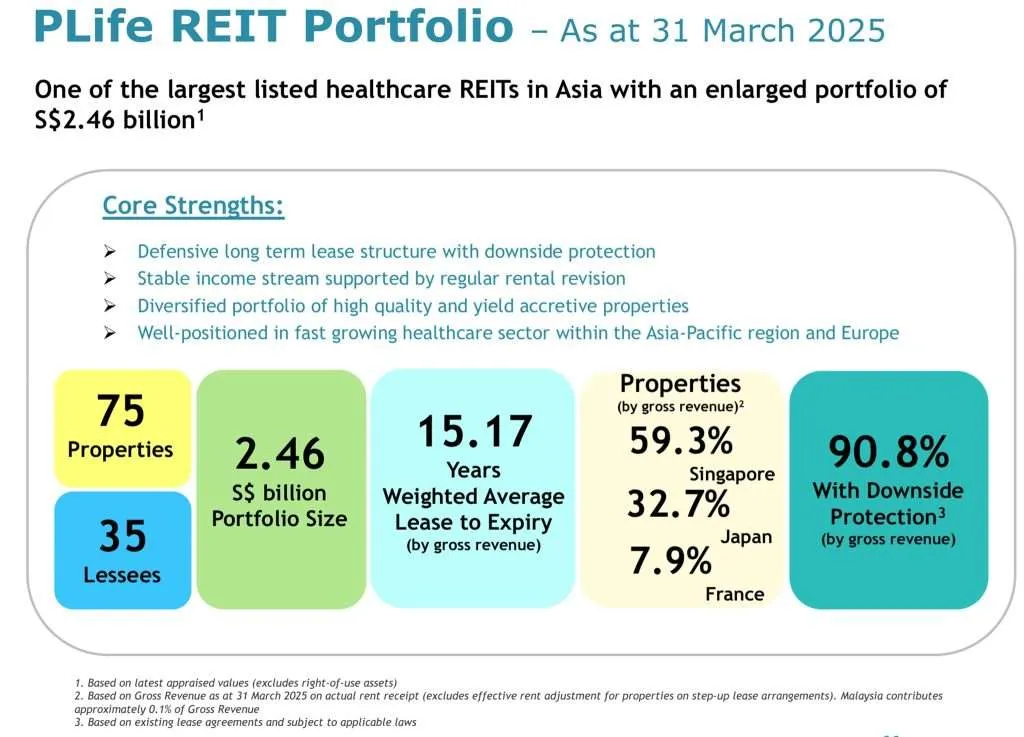

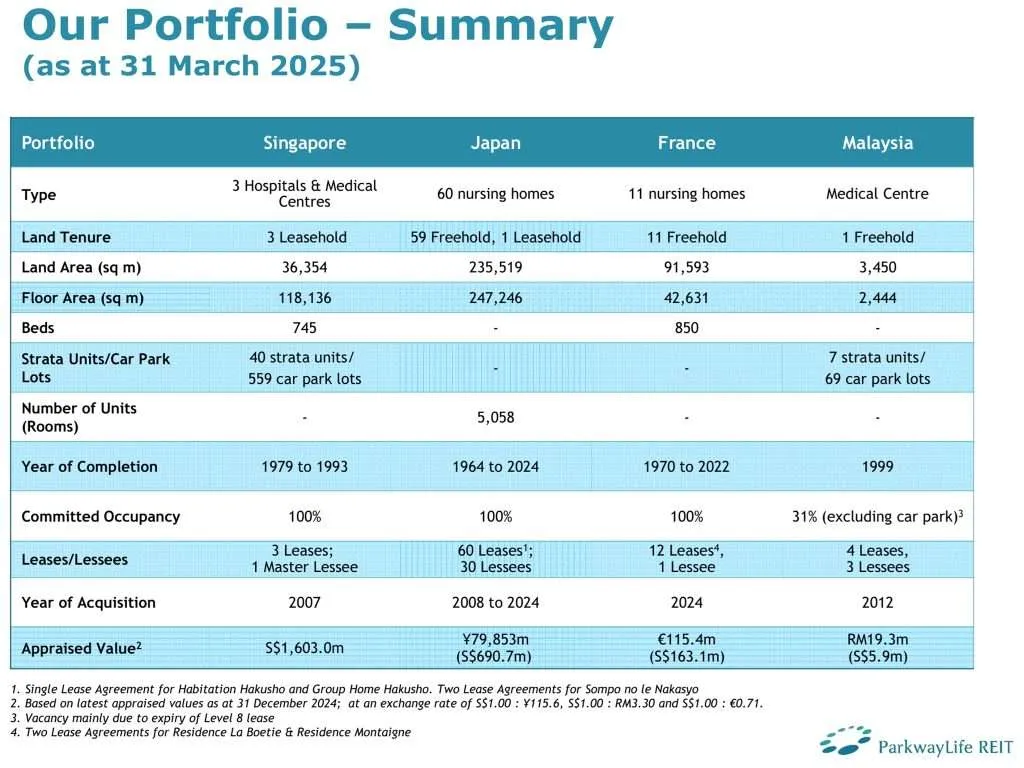

On 22nd April 2025, ParkwayLife REIT announced their 1Q2025 business updates. If you are looking for a REIT in Healthcare, ParkwayLife REIT is one of the largest listed healthcare REITs in Asia with an enlarged portfolio of S$2.24 billion. In Japan, it has 60 high quality nursing home properties worth S$690.7 million. Because of the step-up rent for its nursing home, ParkwayLife REIT is able to grow its Distribution Per Unit (DPU) year-on-year since IPO.

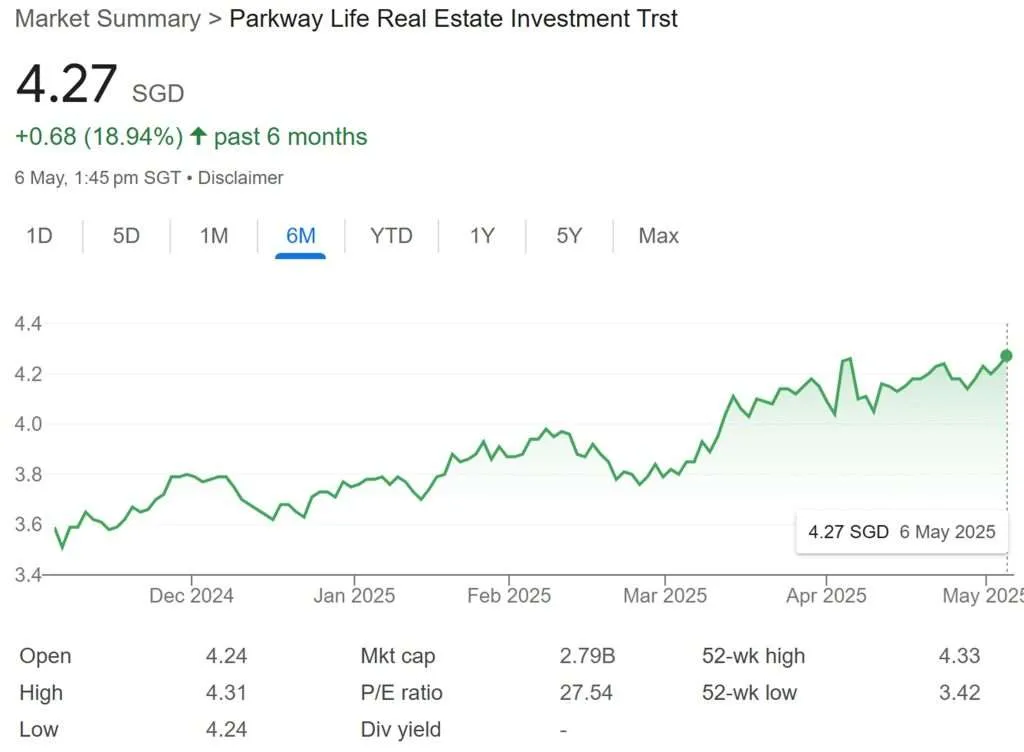

ParkwayLife REIT makes up 5.07% of my stock portfolio in terms of value. Do you know what is ParkwayLife REIT’s current share price and current dividend yield? At the end of this post, I shall take a look at ParkwayLife REIT share price and its dividend yield.

In 1Q2025, ParkwayLife REIT also announced that they will divest the entire Malaysia Portfolio at RM20.09 million (S$6.09 million) which translates to an estimated gain (before tax) of S$0.10 million. This is a related party transaction. The divestment price is at 4.6% above the average of the 2 independent valuations of RM19.2 million as of 31 December 2024.

Now, let us take a look into its latest business updates.

ParkwayLife REIT 1Q2025 Financial Performance

In 1Q2025, ParkwayLife REIT’s Gross Revenue rose 7.3% year-on-year to S$39.0 million. The increase was attributed to the contribution of one nursing home acquired in Japan and eleven nursing homes acquired in France in 2H 2024. The gains were partially offset by the depreciation of the Japanese Yen.

Finance costs have increased by 26% mainly due to funding of Capex and Japan acquisition in 2024, as well as higher interest costs from Japanese Yen debts partially offset by depreciation of JPY.

Distributable Income rose 9.1% year-on-year to S$25.0 million. The higher distributable income was attributed to the acquisitions in 2024 and Singapore hospitals on step-up lease arrangement.

Distribution Per Unit for 1Q 2025 grew by 1.3% to 3.84 cents.

| 1Q2025 (S$’000) |

1Q2024 (S$’000) |

% Change | |

| Gross Revenue | 38,980 | 36,322 | 7.3 |

| Net Property Income | 36,833 | 34,276 | 7.5 |

| Net Finance Costs |

(3,296) | (2,616) | 26.0 |

| Amount Distributable to Unitholders | 25,034 | 22,949 | 9.1 |

| Distribution Per Unit (“DPU”) (cents) | 3.84 | 3.79 | 1.3 |

Debt

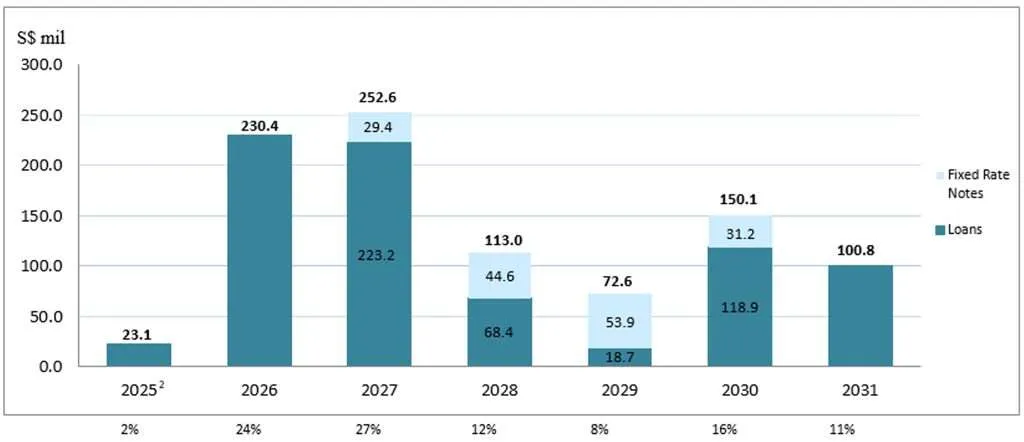

Aggregate leverage, also known as gearing ratio, refers to the ratio of a real estate investment trust’s (REIT) debt to its total assets. As of 31st March 2025, ParkwayLife REIT’s gearing ratio stood healthy at 36.1%. It has ample debt headroom of S$424.1 million and S$727.8 million before reaching 45% and 50% gearing respectively.

ParkwayLife REIT’s current weighted average debt term to maturity stood at 3.3 years. The weighted average term to maturity refers to the average time remaining until the principal amount of the REIT’s debt obligations are due. It is a measure of the REIT’s debt structure and gives an idea of how long the REIT has to manage its debt repayments.

As per the above chart, the debt maturity also looks well spread.

Occupancy

ParkwayLife REIT’s overall portfolio occupancy remained strong at 99.7%.

ParkwayLife REIT’s Current Dividend Yield

At this point of writing, ParkwayLife REIT share price is S$4.27 per share. Based on FY2024 full year distribution of 14.92 cents, this translates to a current dividend yield of 3.49%.

Summary of ParkwayLife REIT 1Q2025 Business Updates

Based on ParkwayLife REIT 1Q2025 business updates, let me summarize the pros and cons below.

The pros are:

- ParkwayLife REIT’s Gross Revenue rose 7.3% year-on-year to S$39.0 million.

- Distribution Per Unit for 1Q 2025 grew by 1.3% to 3.84 cents.

- Gearing ratio stood healthy at 36.1%.

- Overall portfolio occupancy remained strong at 99.7%.

The cons are:

- Finance costs have increased by 26% mainly due to funding of Capex and Japan acquisition.

- Based on S$4.27 per share, low current dividend yield of 3.49%.