On 23rd January 2025, MPACT (Mapletree Pan Asia Commercial Trust) released their 3QFY24/25 financial results. Existing investors of MPACT knows that the REIT is undergoing headwinds due to its underperforming assets in China and high finance costs due to higher interest rates on SGD, HKD and JPY borrowings. Mapletree Pan Asia Commercial Trust (MPACT) currently makes up 6.92% of my stock portfolio.

As a unitholder of MPACT, I am wondering what is Mapletree Pan Asia Commercial Trust (MPACT) share price? What is MPACT current dividend yield? Have the financials improved? Let us take a look below at its latest financial results.

MPACT 3QFY24/25 Financial Results

In 3Q FY24/25, MPACT’s Gross Revenue was 7.4% lower year-on-year due to reduced contribution from Singapore properties due to divestment of Mapletree Anson and lower overseas contributions which was further dampened by a stronger SGD against JPY, HKD and RMB.

Property expenses and net finance costs improved by 4.0% and 9.7% year-on-year respectively. This was due to the divestment of Mapletree Anson and thus lower utility expenses. Proceeds from the divestment of Mapletree Anson were also used to reduce borrowings which reduced finance costs.

Distribution Per Unit (DPU) was 9.1% lower at 2.00 cents as a result of lower overseas contributions and further dampened by adverse forex movements.

| 3QFY24/25 (S$’000) |

3QFY23/24 (S$’000) |

% Change | |

| Gross Revenue | 223,674 | 241,586 | (7.4) |

| Net Property Income | 166,916 | 182,436 | (8.5) |

| Property expenses |

(56,758) | (59,150) | 4.0 |

| Net Finance Costs |

(51,803) | (57,394) | 9.7 |

| Amount Distributable to Unitholders | 104,656 | 115,260 | (9.2) |

| Distribution Per Unit (“DPU”) (cents) | 2.00 | 2.20 | (9.1) |

MPACT 3Q FY24/25 Debt

As of 31st December 2024, MPACT’s gearing stood at 38.2%. Gearing, also known as aggregate leverage, refers to the ratio of a real estate investment trust’s (REIT) debt to its total assets. Average Term to Maturity of Debt stood at 3.1 years.

Moody’s gave MPACT a Baa1 (negative). The Baa1 rating is considered to be a negative rating in the credit rating system. This rating indicates that the credit quality of the investment is medium-grade and may possess certain speculative characteristics. Investors should exercise caution when considering investments with a Baa1 rating, as there may be some level of risk involved.

As you can see from the above slide, MPACT has a well-distributed debt maturity profile with no more than 23% debt due in any financial year. Approximately 81.5% of the total gross debt was either in fixed-rate debts or fixed through interest rate swaps, while approximately 91% of MPACT’s distributable income (based on rolling four quarters) was either generated in or hedged into Singapore dollar.

MPACT’s Occupancy

Overall occupancy fell further from 90.3% as of 30th September 2024 to 90% on 31st December 2024. When is MPACT divesting its underperforming China properties?

Next, let us take a look at the rental reversion. Do you know what is rental reversion? Rental reversion refers to the change in rental rates when leases are renewed. A positive rental reversion means the new rental rate is higher than the previous rate. A negative rental reversion happens when the new rental rate is lower than the previous rate. Whether the rental reversion is positive or negative depends on the market demand and supply.

The Singapore portfolio demonstrated notable strength, with rental reversions ranging from 2.0% at Mapletree Business City to 16.9% at VivoCity.

MPACT 3QFY24/25 Lease Expiry

Lease expiry remained well-staggered. The weighted average lease expiry (WALE) was 2.1 years for the retail segment and 2.3 years for the office/business park segment, resulting in an overall portfolio WALE of 2.2 years.

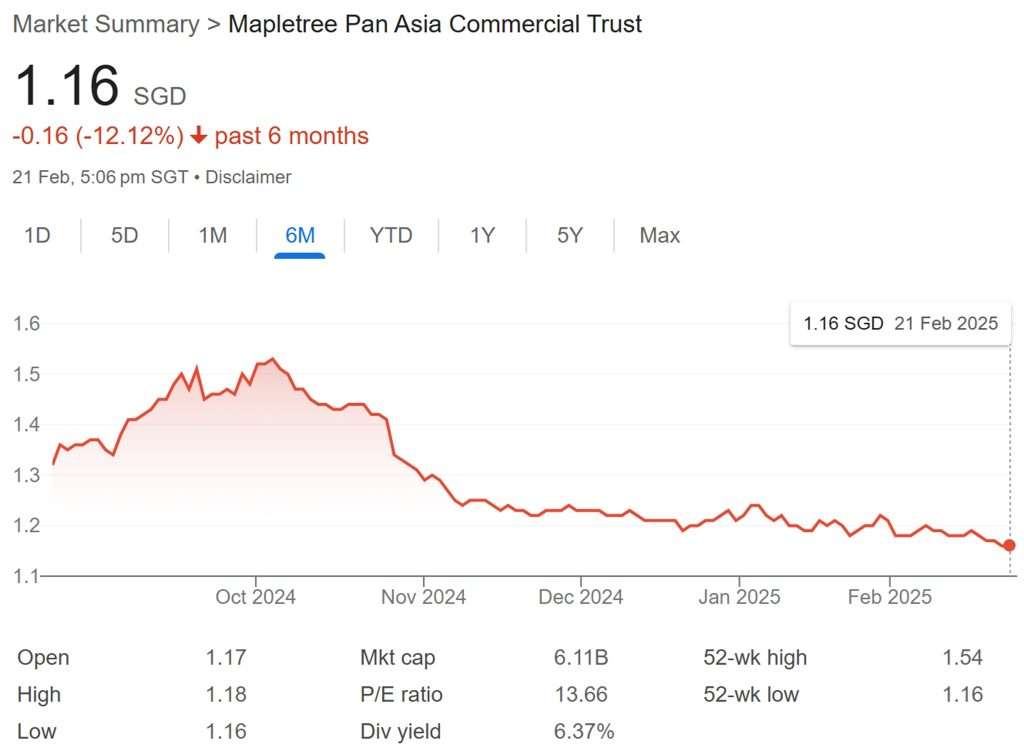

MPACT Share Price and Dividend Yield

MPACT share price closed at S$1.16 on Friday, 21st February 2025. Based on MPACT’s FY23/24 full year distribution of 8.91 cents and current share price of S$1.16, this translates to a high current dividend yield of 7.68%.

Despite the high current dividend yield, it is expected that the full year dividend yield may be much lower due to lower DPU for each quarter as MPACT is facing headwinds.

Summary of MPACT 3QFY24/25 Financial Results

The above information may be overwhelming for you. As usual, let me summarize the pros and cons.

The pros are:

- Property expenses and net finance costs improved by 4.0% and 9.7% year-on-year respectively attributed to the divestment of Mapletree Anson.

- Gearing remained healthy at 38.2% even though I hope it can be lower.

- Positive rental reversion of 4.6%.

- Lease expiry remained well-staggered.

- Estimated high current dividend yield of 7.68%.

The cons are:

- Gross revenue was 7.4% lower year-on-year.

- Lower overseas contributions which were further dampened by a stronger SGD against JPY, HKD and RMB.

- DPU fell 9.1% year-on-year to 2.00 cents.

- Occupancy fell to 90%.

- China properties continue to be drag to overall portfolio occupancy and rental reversions.

In conclusion, MPACT continue to face headwinds due to its underperforming oversea assets.