MPACT released their 1Q FY24/25 financial results on 30th July 2024. What is Mapletree Pan Asia Commercial Trust (MPACT) share price? What is MPACT current dividend yield? As a unitholder of MPACT, these are the kind of questions in my mind.

Do you know the history of MPACT? Mapletree Pan Asia Commercial Trust (“MPACT”) was formed as a result of the merger between Mapletree Commercial Trust and Mapletree North Asia Commercial Trust. I was a unitholder of Mapletree Commercial Trust. Due to the merger, I became exposed to the underperforming assets in Hong Kong.

As of 30 June 2024, MPACT’s total assets under management was S$16.5 billion. Its portfolio comprised of 18 commercial properties across five key gateway markets of Asia – five in Singapore,

one in Hong Kong, two in China, nine in Japan and one in South Korea. If you are keen to know the location of the exact properties, you can check them out at MPACT’s portfolio.

Let us first take a look of MPACT’s latest financial results.

MPACT 1Q FY24/25 Financial Results

In 1Q FY24/25, MPACT’s gross revenue fell 0.2% year-on-year to S$236.7 million. Net property Income (“NPI”) remained stable and increased slightly by 0.1% year-on-year to S$179.4 million. Both gross revenue and Net Property Income were anchored by the robust performance and contributions from the Singapore properties. This helped to offset overseas market volatilities and the adverse

foreign exchange impact on the contributions from the overseas assets.

One of the eyesores was the net finance costs which increased 9.8% year-on-year. finance costs due to higher interest rates on SGD, HKD and JPY borrowings. As a result, amount available for distribution to Unitholders decreased 3.5% year-on-year.

As expected, MPACT’s Distribution Per Unit (DPU) declined 4.1% year-on-year to 2.09 cents.

| 1Q FY24/25 (S$’000) |

1Q FY23/24 (S$’000) |

% Change | |

| Gross Revenue | 236,654 | 237,118 | (0.2) |

| Net Property Income | 179,402 | 179,200 | 0.1 |

| Property expenses |

(57,252) | (57,918) | (1.1) |

| Net Finance Costs |

(59,421) | (54,101) | 9.8 |

| Amount Distributable To Unitholders | 110,750 | 114,752 | (3.5) |

| Distribution Per Unit (“DPU”) (cents) | 2.09 | 2.18 | (4.1) |

MPACT 1Q FY24/25 Debt

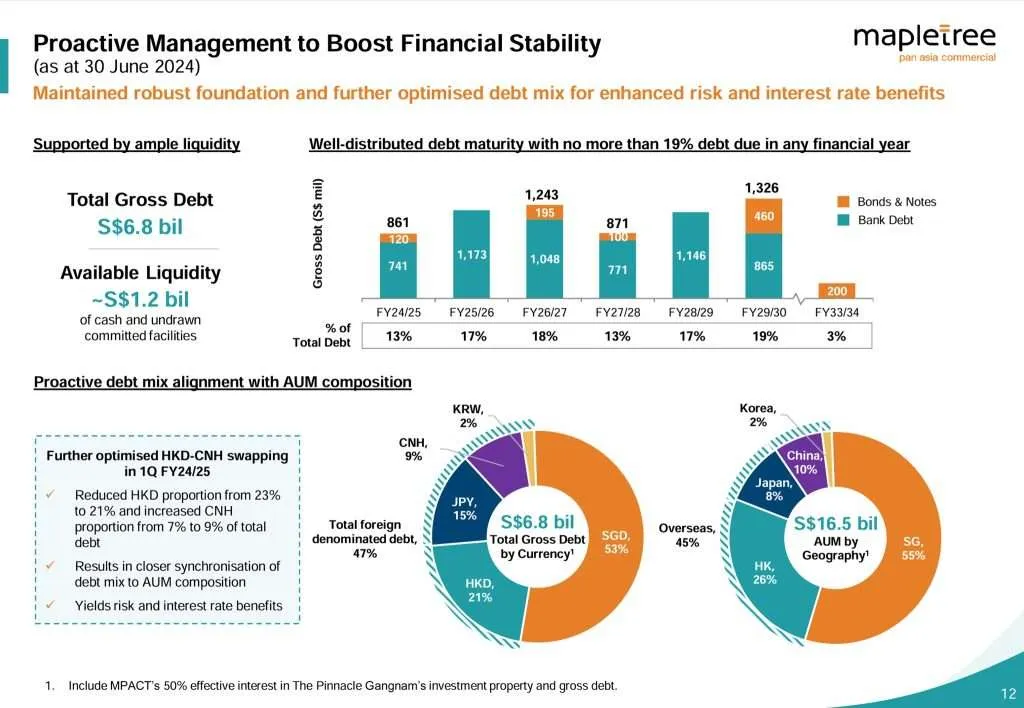

As of 30th June 2024, MPACT’s aggregate leverage ratio was high at 40.5%. The divestment of Mapletree Anson is expected to lower the aggregate leverage as proceeds will be allocated towards debt reduction.

From the presentation slides, you can see that MPACT’s debt maturity profile remained well-distributed, with no single financial year facing more than 19% of debt refinancing.

MPACT’s Average Term to Maturity of Debt was 3.1 years. This metric reflects the average time remaining until MPACT’s outstanding debt matures. A longer average maturities provide REITs with more flexibility to navigate interest rate changes and refinancing needs.

78.9% of the total gross debt of S$6,818.9 million are hedged at fixed rate debts or fixed through interest rate swaps. Additionally, approximately 93% of MPACT’s distributable income (based on rolling four quarters) was derived from or hedged into Singapore dollar. These measures help to mitigate the effects of volatilities in interest and foreign exchange rates.

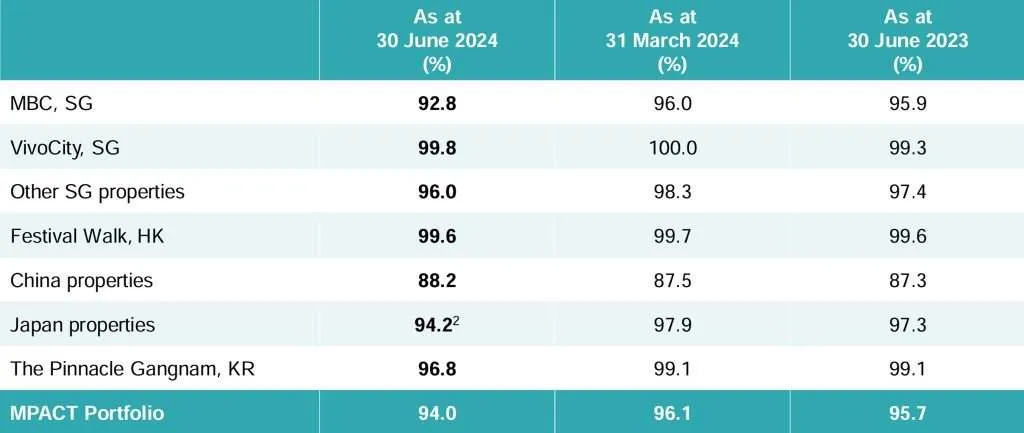

MPACT’s Occupancy

MPACT’s overall portfolio occupancy fell to 94.0% as compared to last quarter. From the comparison, it looks like the lease expiration of Seiko Instrument Inc. at Makuhari Bay Tower at Japan properties was the main contributor of the decline.

MPACT 1Q FY24/25 Lease Expiry

MPACT’s weighted average lease expiry (“WALE”) was 2.3 years for the retail segment and 2.7 years for the office/business park segment, resulting in an overall portfolio WALE of 2.5 years.

A longer WALE indicates a lower risk of vacancy and a more stable income stream, which is generally preferred by investors. Having said that, MPACT’s short WALE allows the manager to renegotiate (escalate) rental rates during renewal and also diversify its tenant mix to adapt to market changes.

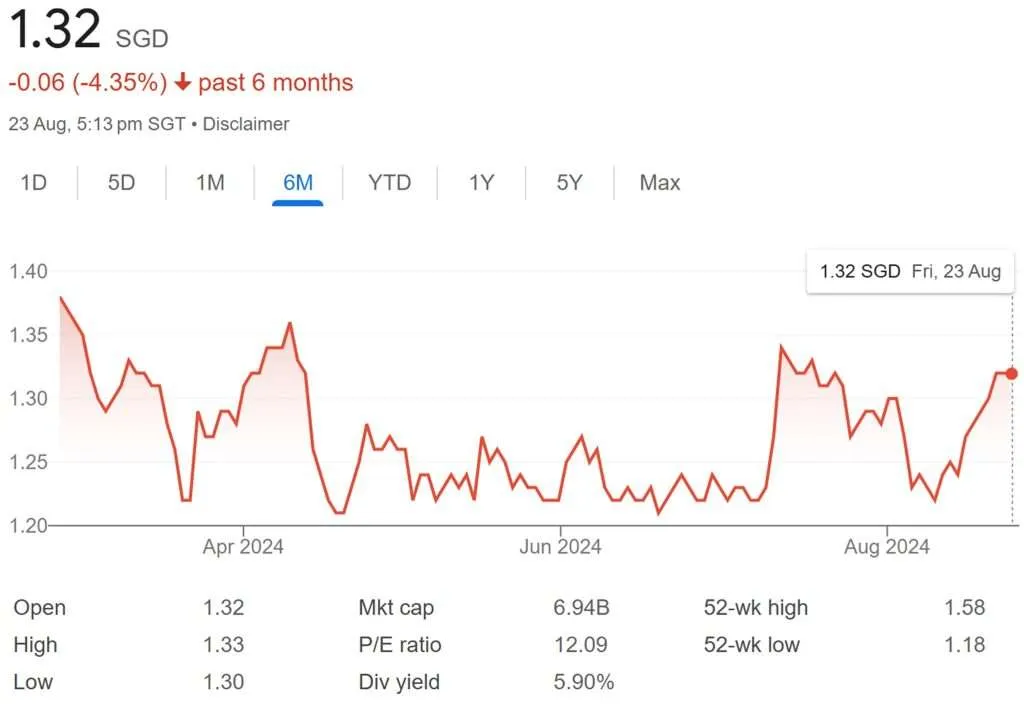

MPACT Share Price and Dividend Yield

MPACT share price closed at S$1.32 on Friday, 23rd August 2024. Based on MPACT’s FY23/24 full year distribution of 8.91 cents and share price of S$1.32, this translates to a high current dividend yield of 6.75%.

Summary of MPACT 1Q FY24/25 Financial Results

Based on the financial results, we had sensed that MPACT is facing headwinds. In fact, the financial results are all in a sea of red.

Let me summarize the pros and cons. The pros are:

- Net property Income (“NPI”) remained stable and increased slightly by 0.1% year-on-year to S$179.4 million.

- Debt maturity profile remained well-distributed. 78.9% of the total gross debt of S$6,818.9 million are hedged at fixed rate debts or fixed through interest rate swaps.

- Overall portfolio short WALE of 2.5 years which allows the manager to renegotiate (escalate) rental rates during renewal and also diversify its tenant mix to adapt to market changes

- High current dividend yield of 6.75%. However, be prepared FY24/25 full year estimated dividends maybe lower as MPACT is facing headwinds.

The cons are:

- MPACT’s gross revenue fell 0.2% year-on-year to S$236.7 million.

- Net finance costs which increased 9.8% year-on-year.

- Distribution Per Unit (DPU) declined 4.1% year-on-year to 2.09 cents.

- High aggregate leverage ratio at 40.5%.

- Overall portfolio occupancy fell to 94.0%.

As an existing unitholder, I seriously hope MPACT consider divesting more of those non-performing assets. No amount of uplifting its flagship assets Festival Walk and VivoCity can mitigate the underperformance of its other oversea assets!