This is your last chance to max your SRS (Supplementary Retirement Account) contribution. Most banks in Singapore require processing time for Supplementary Retirement Scheme (SRS) contributions, so avoid waiting until the very last day. To ensure your contribution is successfully credited and eligible for tax relief, plan ahead and make your SRS deposit early.

The SRS account interest rate may only be 0.05% per annum, but that hasn’t stopped me from contributing to it consistently. In fact, I make it a point to top up my Supplementary Retirement Scheme (SRS) account to the maximum limit of S$15,300 every year. The reason is simple: while the base interest rate is low, the real value of SRS lies in its tax benefits and the wide range of investment opportunities it unlocks. By channelling funds into SRS, I can invest in assets that generate far higher returns than the nominal interest, turning this scheme into a powerful tool for long‑term wealth building.

The SRS was introduced in Singapore in 2001 as a voluntary savings scheme designed to complement the Central Provident Fund (CPF). Its purpose is to encourage individuals to save more for retirement and reduce reliance on government support in old age. Beyond the immediate tax relief, the scheme allows contributors to invest their balances in options such as REITs, bonds, unit trusts, and equities, creating opportunities to grow wealth meaningfully over time.

In this post, I will share why I continue to maximize my SRS contributions each year despite the low account interest rate and explore the investment strategies available within SRS that can help you achieve higher returns and build a sustainable retirement plan.

How does the SRS Account work?

I maintain my SRS account with OCBC, but anyone who is a Singaporean citizen, Permanent Resident, or foreigner holding a valid employment pass can open an SRS account with one of the three local banks – DBS, UOB, or OCBC. Opening an account is straightforward and can be done conveniently through digital banking platforms.

Contributions made to an SRS account qualify for tax relief, which makes the scheme particularly attractive for individuals seeking to lower their taxable income while planning for retirement. Beyond the basic savings function, the funds in an SRS account can be invested in a wide range of financial products, including stocks, bonds, unit trusts, and insurance solutions. Investors can also use their SRS balances to purchase Singapore Treasury Bills, Singapore Savings Bonds, or selected endowment plans, creating opportunities to grow wealth beyond the nominal account interest.

One important feature of the scheme is that the retirement age for penalty‑free withdrawals is fixed at the time of your first contribution. This means that even if the statutory retirement age is raised later, your withdrawal age remains unchanged. For instance, I will be able to start making penalty‑free withdrawals from my SRS account at age 62, regardless of future adjustments to the national retirement age.

At retirement, only 50 percent of the withdrawals from an SRS account are subject to tax, while the remaining half can be tax‑free. These withdrawals are taxed in the Year of Assessment following the year they are made, offering a significant advantage for individuals who plan their retirement income strategically.

Benefits of Topping Up Your SRS Account

Tax savings

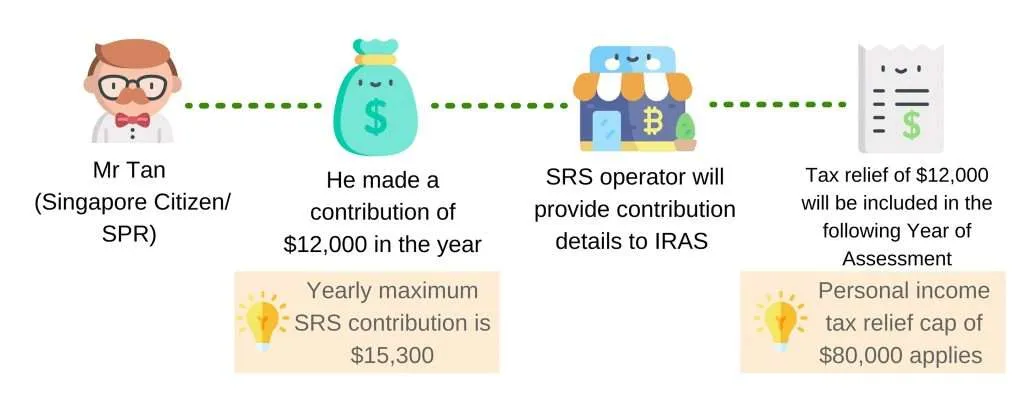

Image source from: IRAS | SRS contributions and tax relief

Are you tired of seeing a large portion of your income go toward taxes each year? One effective way to ease that burden is by contributing to a Supplementary Retirement Scheme (SRS) account. SRS contributions not only help reduce taxable income but can also significantly lower annual tax bills. Personally, I make it a point to top up my SRS account to the maximum limit every year, ensuring I take full advantage of the tax relief available. The current yearly maximum contribution allowed is S$15,300, and by consistently reaching this limit, I’ve been able to manage my taxes more efficiently while building a stronger foundation for retirement.

Retirement planning

The SRS account provides a supplementary source of income during retirement, in addition to CPF savings and other investments. As shared earlier in this post, the voluntary Supplementary Retirement Scheme (SRS) was introduced by the Singapore government in the year 2001 with the purpose of helping Singaporeans in retirement planning.

You may make penalty-free withdrawals from your SRS account over 10 years starting from the date of your first penalty-free withdrawal. When you make your first contribution to the SRS account, the retirement age where you can start withdrawal will be locked down. Any subsequent change in the statutory retirement age (e.g. up to age 65) will not affect you. For example, I can start making penalty-free withdrawals from my SRS account at the age of 62.

In my opinion, S$400,000 is the optimal amount of money you should accumulate in your SRS account for retirement as you will be able to withdraw S$40,000 each year for 10 years. During the 10-year window where you start withdrawing the money, only 50% of your withdrawals are taxable. This means that only $20,000 is subject to tax.

SRS Account Investment Opportunities

SRS account interest rate is only 0.05% per annum. However, the SRS account allows individuals to invest in a wide range of financial products to potentially grow their retirement savings. As shared above, you can use your funds in the SRS account to purchase Singapore Treasury Bills, Singapore Savings Bonds and even some Endowment plans to give you higher returns.

Personally, I used the money in my SRS account to purchase Singapore Savings Bonds and SGS T Bills which gives me higher returns.

How are you beating the SRS Account Interest Rate?

The Supplementary Retirement Scheme (SRS) account is a valuable tool for retirement planning in Singapore, offering tax benefits, investment opportunities, and flexibility for individuals looking to save more for their golden years. By taking advantage of the SRS account, individuals can enhance their retirement savings and enjoy a more financially secure future.

We are in the last month of this year 2025. Do you have an SRS account, and have you start topping up your SRS account?