On 17th April 2025, Keppel DC REIT announced their 1Q2025 operational updates. As an existing unitholder of Keppel DC REIT, I wonder how has Keppel DC REIT performed after its Rights Issue and Preferential offering in December 2024? Let us take a look below at Keppel DC REIT 1Q2025 operational updates to find out its latest performance and Distribution Per Unit (DPU).

Before that, do you know about Keppel DC REIT? Keppel DC REIT was listed on the Singapore Exchange on 12 December 2014 as the first pure-play data centre REIT in Asia. Keppel DC REIT’s investments comprise a mix of colocation, fully fitted and shell and core assets, as well as debt securities, thereby reinforcing the diversity and resiliency of its portfolio. It has an Assets Under Management (AUM) estimated at S$5 billion.

Now, let at first look at Keppel DC REIT’s latest financial performance.

Keppel DC REIT 1Q2025 Financial Performance

In 1Q2025, Keppel DC REIT’s Net Property Income (NPI) increased 24.1% year on year to S$88.1 million. The increase was attributed to the acquisitions of Keppel DC Singapore 7 & 8 and Tokyo Data Centre 1, higher contributions from contract renewals and escalations in 2024. The increase was partially offset by divestment of Intellicentre Campus, and one-off dispute settlement sum at Keppel DC Singapore 1 received in 2024.

Finance costs were lower due to decrease in interest rates and from interest savings due to loan repayments.

Distribution Per Unit (DPU) increased 14.2% year-on-year to 2.503 cents due to contributions from acquisitions and strong portfolio performance.

| 1Q2025 (S$’000) |

1Q2024 (S$’000) |

Change (%) | |

| Gross Revenue | 102,179 | 83,364 | 22.6 |

| Net Property Income | 88,110 | 71,013 | 24.1 |

| Property Expenses |

(14,069) | (12,351) | 13.9 |

| Finance Costs | (12,457) | (12,992) | (4.1) |

| Distributable Income | 61,839 | 38,791 | 59.4 |

| Distribution Per Unit (“DPU”) (cents) | 2.503 | 2.192 | 14.2 |

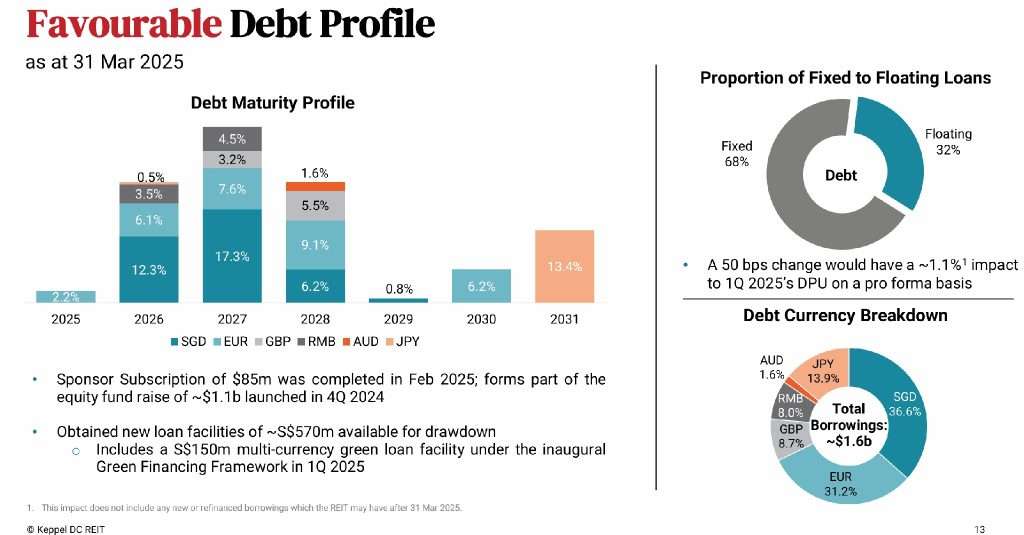

Debt

As of 31st March 2025, Keppel DC REIT’s aggregate leverage stood at a low of 30.2%. This was a decline of -130 bps as compared to December 2024.

Do you know what is aggregate leverage? Aggregate leverage or gearing ratio is a key financial metric used to measure the level of debt used by a Real Estate Investment Trust (REIT) to finance its investments. It is calculated by dividing the total debt of the REIT by the total value of its assets.

A high leverage ratio indicates that the REIT is relying heavily on debt to fund its operations, which can increase financial risk. On the other hand, a low leverage ratio suggests that the REIT has a conservative capital structure with less debt.

Investors and analysts use the leverage ratio to assess the financial health and risk profile of a REIT. A well-managed REIT will typically maintain a balanced leverage ratio that allows for growth while also ensuring financial stability.

As you can see from the above, Keppel DC REIT has a well-spread debt maturity profile. 68% of its debt are hedged at fixed rates to mitigate against sudden interest rate hikes.

Keppel DC REIT has an estimated debt headroom of S$886 million before it reaches the gearing limit of 40%.

Occupancy

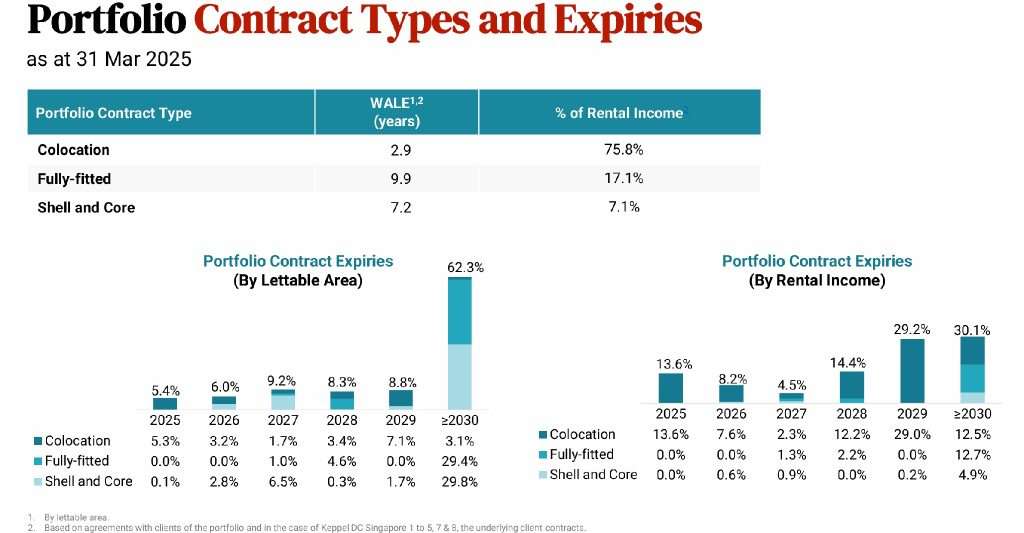

Keppel DC REIT’s portfolio occupancy stood high at 96.5%. Weight Average Lease Expiry is healthy at 7.1 years.

The Weight Average Lease Expiry is a metric used in the real estate industry to calculate the average length of time until all leases in a property expire, weighted by the size of each lease. This metric is helpful for property owners and investors to gauge the stability and predictability of their rental income.

A higher Weight Average Lease Expiry indicates longer lease terms and less turnover of tenants, which can be seen as a positive sign of a property’s financial health. On the other hand, a lower Weight Average Lease Expiry may suggest higher tenant turnover and potentially more risks for the property’s income stream. By analysing this metric, property owners can make more informed decisions about their investments and property management strategies.

In terms of contract expiries, we can see that 13.6% of it by rental income expires in 2025. The bulk of it expires in 2029 and beyond 2030. We should continue monitoring the expiries for the subsequent quarters.

Keppel DC REIT Share Price and Dividend Yield

Based on Keppel DC REIT share price of S$2.05 and FY2024 full year distribution of 9.451 cents, this translates to a current dividend yield of 4.61%. In my opinion, Keppel DC REIT’s current dividend yield is unattractive as it is less than my personal threshold of 5%.

Summary of Keppel DC REIT 1Q2025 Operational Updates

As usual, let me summarize the pros and cons of Keppel DC REIT based on its 1Q2025 operational updates.

The pros are:

- Net Property Income (NPI) increased 24.1% year on year to S$88.1 million.

- Distribution Per Unit (DPU) in 1Q2025 increased 14.2% year-on-year to 2.503 cents.

- Aggregate leverage stood at a low of 30.2%.

- Overall portfolio occupancy stood high at 96.5%.

The cons are:

- Low current dividend yield of 4.61% based on S$2.05 per unit.