I bought Sea Limited. Sea Limited (NYSE: SE), Southeast Asia’s leading tech company, has staged a dramatic comeback. In August 2025, Sea stock price surged over 20%, marking one of the most significant rallies in the region’s tech sector this year. The Singapore-based conglomerate best known for its e-commerce platform Shopee, gaming division Garena, and fintech arm SeaMoney has reignited investor confidence after a turbulent period of overexpansion and strategic missteps.

I bought Sea Limited. Sea Limited (NYSE: SE), Southeast Asia’s leading tech company, has staged a dramatic comeback. In August 2025, Sea stock price surged over 20%, marking one of the most significant rallies in the region’s tech sector this year. The Singapore-based conglomerate best known for its e-commerce platform Shopee, gaming division Garena, and fintech arm SeaMoney has reignited investor confidence after a turbulent period of overexpansion and strategic missteps.

This recent Sea Limited stock surge was triggered by a strong Q2 2025 earnings report, released on August 12. The company posted over $16 billion in revenue, exceeding analyst expectations and signaling renewed operational strength. Shopee continued to dominate Southeast Asia’s e-commerce market, while SeaMoney expanded its digital lending and mobile payment services across Indonesia, Vietnam, and the Philippines. These core markets are now central to Sea’s growth strategy, following its exit from less profitable regions like Latin America and Europe.

Sea Limited Q2 2025 Financial Results

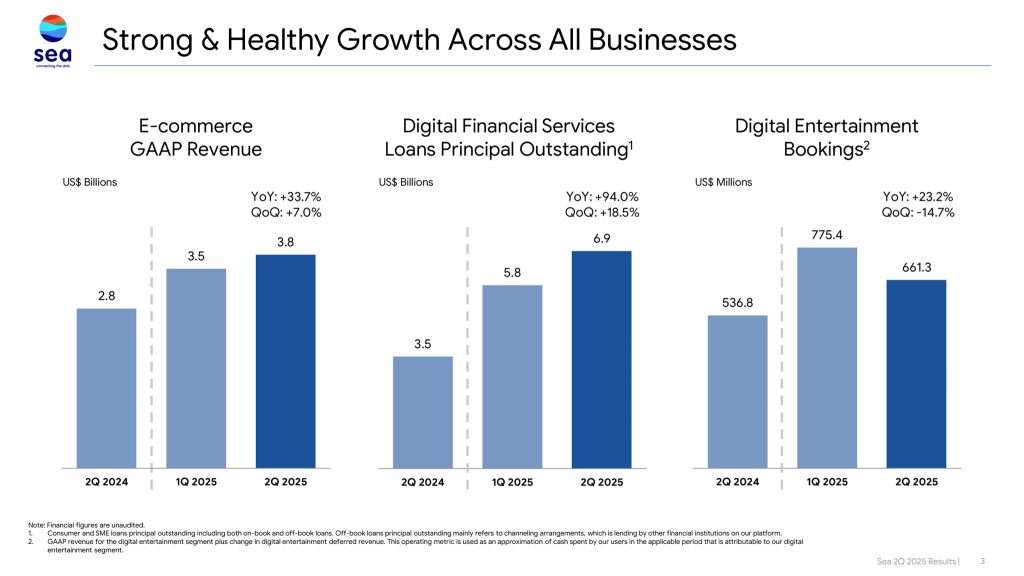

Sea Limited delivered a robust set of financial results for Q2 2025, signalling a strong rebound across its core business segments. Total revenue rose 38.2% year-over-year to $5.3 billion, driven primarily by Shopee’s continued dominance in Southeast Asia’s e-commerce market, which generated $3.77 billion in revenue and achieved a 27.9% increase in gross merchandise volume. SeaMoney, the company’s digital financial services arm, posted a 70% year-over-year revenue jump to $883 million, fuelled by a rapidly expanding loan book that reached $6.9 billion and surpassed 30 million active borrowers.

Garena, Sea’s gaming division, also showed signs of recovery with a 23% increase in bookings, anchored by Free Fire’s sustained engagement and new content rollouts. The company’s adjusted EBITDA nearly doubled to $829 million, while net income surged to $440 million, reflecting improved operating margins and disciplined cost management. Despite missing EPS estimates slightly, Sea’s performance underscored its ability to scale efficiently and capitalize on digital growth across Southeast Asia and Brazil.

Investors responded swiftly. Sea’s American Depositary Receipts (ADRs) jumped 16.16% in a single trading session, reflecting bullish sentiment across Asian tech stocks. The rally also coincided with broader optimism in emerging markets, where digital transformation and mobile-first consumer behaviour continue to drive growth.

Despite the excitement, Sea Limited’s valuation remains complex. The company’s price-to-earnings (PE) ratio is nearing 200, indicating high investor expectations. Its pretax profit margin remains negative at -19%, underscoring ongoing cost pressures. However, Sea’s balance sheet offers stability, with $22 billion in assets and $14 billion in liabilities a healthy financial position that supports continued investment in its core businesses.

Analysts are cautiously optimistic about Sea Limited’s stock forecast. Price targets for September 2025 hover around $192.53, with projections holding steady through year-end. While the upside may appear modest, the rally reflects growing confidence in Sea’s strategic pivot and its ability to execute in high-growth Southeast Asian markets.

Sea Limited’s resurgence is more than a market event. It is a narrative of recalibration and regional dominance. Shopee is no longer just an online marketplace. It is a cultural and commercial force across Southeast Asia. SeaMoney is evolving into a critical fintech platform, offering digital banking and financial inclusion to millions of underbanked consumers. Garena, while facing headwinds in gaming, remains a key asset in Sea’s digital ecosystem.

For investors tracking Southeast Asia tech stocks, Sea Limited’s performance offers a compelling case study. The company’s ability to learn from past mistakes, refocus on profitable markets, and deliver strong financial results positions it as a foundational player in the region’s digital economy. As global investors increasingly look to Southeast Asia for growth, Sea Limited stands out as a stock to watch.

Looking ahead, Sea faces challenges from intense competition in e-commerce and fintech to evolving regulatory landscapes. But its August rally suggests that the company is no longer reacting to market forces. It is shaping them. Whether this momentum leads to sustained profitability remains to be seen, but Sea Limited’s strategic clarity and regional focus make it one of the most compelling tech stocks in Southeast Asia today.

Why I Bought Sea Limited?

Despite Sea Limited stock price shooting up 20%, I still bought it because of its digital entertainment segment. Sea Limited are raising their full-year guidance for Garena and expect bookings to grow more than 30% Year-on-Year in 2025. If you play games, you probably have heard of multiple key titles such as Free Fire, Arena of Valor, EA Sports FC Online, and Call of Duty: Mobile. These game titles had delivered double-digit Year-on-Year growth in the second quarter.

Investors investing in Sea Limited should look at holding Sea stock at a longer term. In upcoming quarters, let us see if Sea Limited stock price can sustain its rally and growth.