On 31st July 2025, Frasers Logistics and Commercial Trust (FLCT) announced their 3QFY25 business update. As usual, business updates mainly touched on operational performance with minimal updates on financial performance. As of 30th June, Frasers Logistics and Commercial Trust (FLCT) has 114 properties in its portfolio with a total valuation of S$6.9 billion. Are you interested to know if vacant spaces at Alexandra Technopark had been backfilled? What is FLCT share price? What is FLCT dividend yield?

On 31st July 2025, Frasers Logistics and Commercial Trust (FLCT) announced their 3QFY25 business update. As usual, business updates mainly touched on operational performance with minimal updates on financial performance. As of 30th June, Frasers Logistics and Commercial Trust (FLCT) has 114 properties in its portfolio with a total valuation of S$6.9 billion. Are you interested to know if vacant spaces at Alexandra Technopark had been backfilled? What is FLCT share price? What is FLCT dividend yield?

Recently, the manager also announced the divestment of 357 Collins Street because office spaces at Melbourne CBD has been suffering due to remote work culture. The divestment of 357 Collins Street allows Frasers Logistics and Commercial Trust (FLCT) to strategically exit the challenging Melbourne CBD office market. At the same time, proceeds from the sale will also provide Frasers Logistics and Commercial Trust (FLCT) with enhanced financial flexibility to pursue opportunities in the logistics and industrial space.

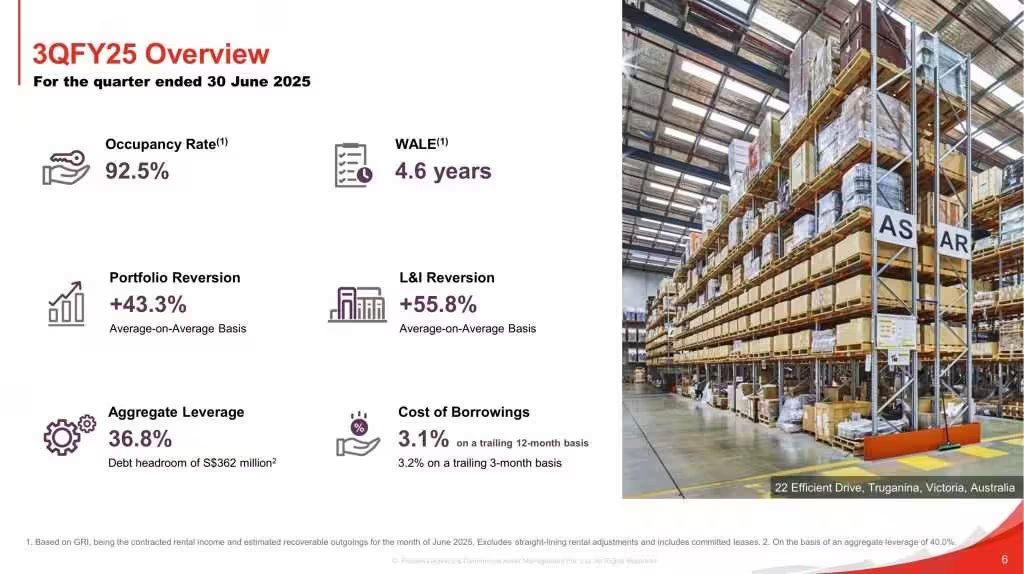

Below, let us find out on the key metrics in Frasers Logistics and Commercial Trust (FLCT)’s 3QFY25 Business Update.

Frasers Logistics and Commercial Trust 3QFY25 Debt

Aggregate leverage, also known as gearing ratio, refers to the ratio of a real estate investment trust’s (REIT) debt to its total assets. As of 30th June 2025, Frasers Logistics and Commercial Trust (FLCT)’s aggregate leverage stood healthy at 36.8%.

Average Weighted Debt Maturity stood at 2.6 years with 67.3% of borrowings hedged at fixed rates. Hedging borrowings at fixed rates help to mitigate against the risk of sudden hike in interest rates.

As you can see from the above slide, Frasers Logistics and Commercial Trust (FLCT) has a well-spread debt maturity profile. What are the benefits of having a well-staggered debt maturity profile? Having a well-staggered debt maturity profile is crucial for REITs to manage their debt obligations effectively. By spreading out debt repayments over different time periods, REITs can avoid liquidity crunches and reduce the risk of default.

Frasers Logistics and Commercial Trust (FLCT) has S$309 million of undrawn facilities available to meet the debt obligations of S$103 million due in 4QFY2025.

Based on Fitch, Frasers Logistics and Commercial Trust (FLCT) has a credit rating of BBB+ or Stable.

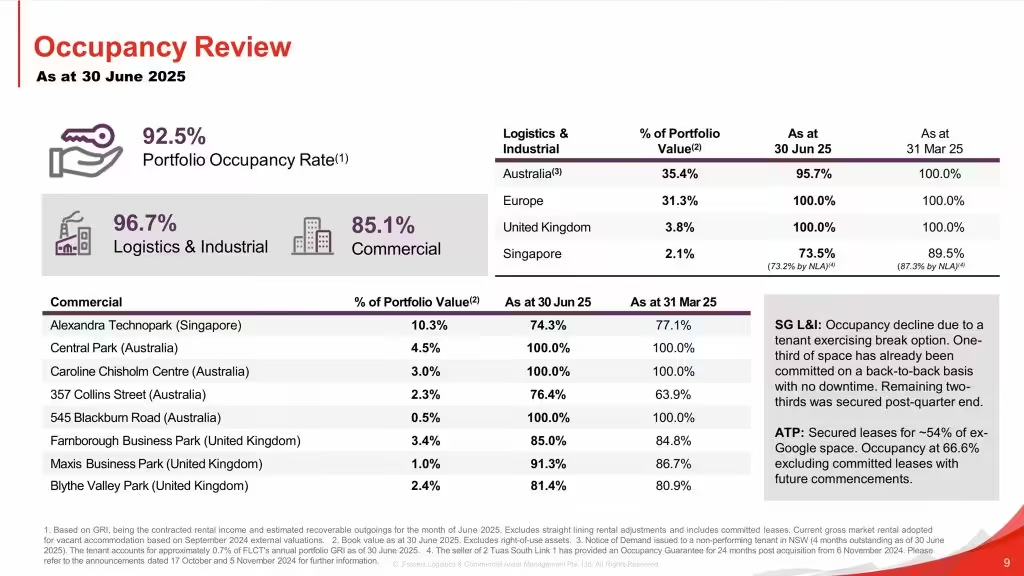

Occupancy

Frasers Logistics and Commercial Trust’s overall portfolio occupancy continue to stand healthy at 92.5% despite falling slightly from 94.3% as compared to 1HFY25. The occupancy for its logistics & industrial segment fell to 96.7%, mainly dragged down by Singapore. Singapore’s logistics & industrial occupancy declined due to a tenant exercising break option. One third of space has already been committed on a back-to-back basis with no downtime. Remaining two thirds was secured post-quarter end.

The occupancy for its commercial segment stood at 85.1%. At Alexandra Technopark, the manager had secured leases for estimated 54% of space vacated by Google. Based on the above, Alexandra Technopark and 357 Collins Street occupancies are the two lowest in its commercial segment.

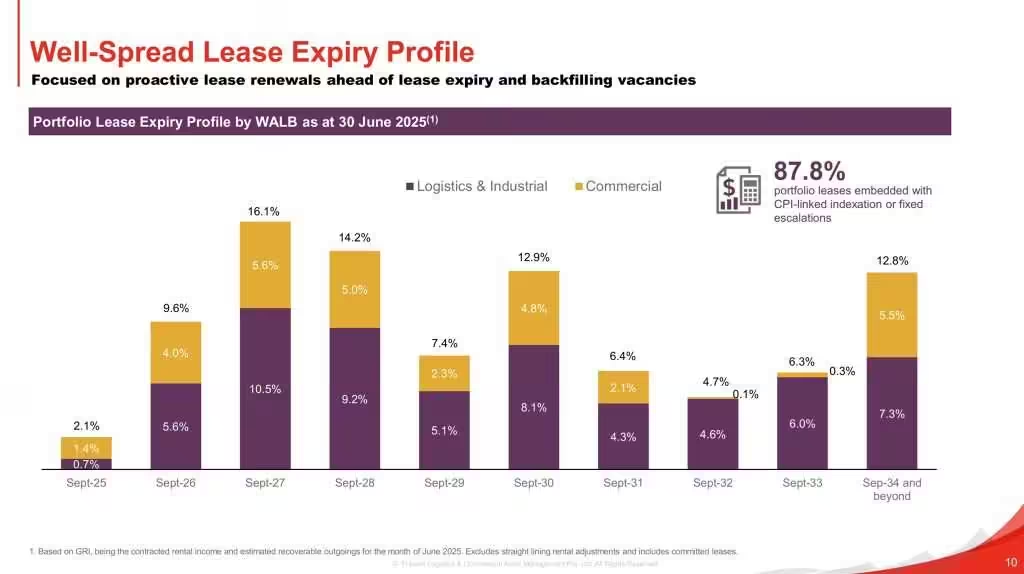

Lease Expiry

As you can see from the above, lease expiry remains well-spread. The manager shared that they would focus on proactive lease renewals ahead of lease expiry and backfilling vacancies. 87.8% of Frasers Logistics and Commercial Trust (FLCT) portfolio leases are embedded with CPI-linked indexation or fixed escalations. The fixed escalations helped FLCT maintained its positive rental reversions. Frasers Logistics and Commercial Trust (FLCT) portfolio rental reversions is positive +43.3% on average-on-average basis.

Rental reversion refers to the change in rental rates when leases are renewed. A positive rental reversion means the new rental rate is higher than the previous rate. A negative rental reversion happens when the new rental rate is lower than the previous rate. Whether the rental reversion is positive or negative depends on the market demand and supply.

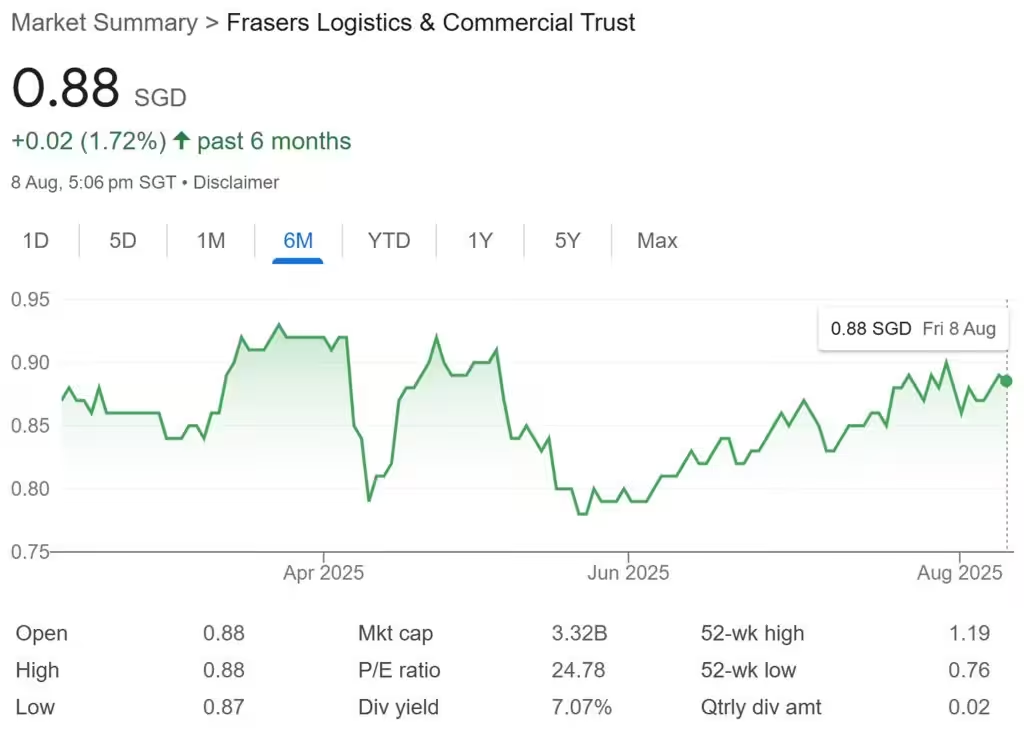

What is Frasers Logistics and Commercial Trust Share Price and Dividend Yield?

Frasers Logistics & Commercial Trust share price is on a 6-months uptrend. FLCT share price closed at S$0.88 on Friday. Based on FLCT share price of S$0.88 and FY24 full year distribution of 6.80 cents, Frasers Logistics & Commercial Trust dividend yield work out to be 7.73%.

Summary of Frasers Logistics and Commercial Trust 3QFY25 Business Update

Let me summarize the pros and cons based on Frasers Logistics and Commercial Trust 1QFY25 business updates.

The pros are:

- Aggregate leverage stood healthy at 36.8%.

- 67.3% of borrowings hedged at fixed rates to mitigate against sudden interest rate hikes.

- Well-staggered debt maturity profile.

- Healthy portfolio occupancy at 92.5%.

- Well-spread lease expiry profile.

- Portfolio leases are embedded with CPI-linked indexation or fixed escalations.

- Portfolio rental reversions is positive +43.3% on average-on-average basis.

- Attractive current dividend yield of 7.73% at S$0.88 per share.

The cons are:

- Occupancy for its logistics & industrial segment fell to 96.7%, mainly dragged down by Singapore.

- Occupancy for its commercial segment stood at 85.1%, dragged down by vacancies at Alexandra Technopark.