On 25th March 2025, Frasers Centrepoint Trust (FCT) announce their plans to acquire Northpoint City South Wing for S$1.17 billion. The manager will acquire all the units in North Gem Trust (“NG Trust”), a private trust that holds the interests in the Property. Frasers Centrepoint Trust will also acquire a 100.0% interest in the trustee-manager of NG Trust from Frasers Property Limited, the Sponsor of Frasers Centrepoint Trust.

With this acquisition, Frasers Centrepoint Trust will have 100% ownership of both North Wing and South Wing that together form Northpoint City. The Net Property Income (“NPI”) yield based on the Northpoint City’s NPI for the financial year ended 30 September 2024 and the NPI yield based on the agreed property value of S$1,133.0 million is 4.5%

What are the reasons for the acquisition?

Following the acquisition, Frasers Centrepoint Trust’s market share of private suburban shopping centre by net lettable area (“NLA”) will increase from 9.1% to 10.3%. The acquisition will consolidate Frasers Centrepoint Trust’s position as Singapore’s leading prime suburban retail space owner. Frasers Centrepoint Trust owns or jointly owns four of Singapore’s top ten largest prime suburban malls, namely NEX, Northpoint City, Causeway Point and Waterway Point.

Second, with full control of Northpoint City, Frasers Centrepoint Trust will also be able to implement holistic asset enhancement initiatives (“AEIs”) and tenant mix strategies to unlock further value across both wings.

Asset enhancement initiatives refer to strategies and actions taken to improve the value and performance of an asset. These initiatives are typically implemented to increase the overall return on investment and maximize the potential of the asset. There are various ways in which asset enhancement initiatives can be carried out, depending on the type of asset and the specific goals of the investor or owner.

The acquisition is expected to be Distribution per Unit (“DPU”) accretive on a historical pro forma basis.

How will the acquisition of Northpoint City South Wing be funded?

The manager of Frasers Centrepoint Trust intends to finance the total cost of the acquisition via an equity fund raising. The equity fund raising will comprise of a private placement offering to raise gross proceeds of no less than approximately S$200.0 million and a preferential offering to raise gross proceeds of approximately S$200.0 million. The new units via private placement are priced at S$2.09 per unit which represents a discount of 2.9% to the Adjusted VWAP.

The manager may also explore debt financing. Debt financing is a method of raising capital by borrowing funds from external sources, such as banks or financial institutions, rather than issuing shares of stock. It involves taking on debt that must be repaid with interest over a specified period of time. Debt financing can have both advantages and disadvantages. On the one hand, it can provide Frasers Centrepoint Trust with the capital it needs to grow and expand without diluting ownership.

On the other hand, too much debt can lead to financial instability and make it difficult to meet debt obligations. As of 31st December 2024, Frasers Centrepoint Trust’s gearing (aggregate leverage) stood at 39.3%.

The last option is to issue subordinated perpetual securities of no more than approximately S$200.0 million.

Impact to My Stock Portfolio

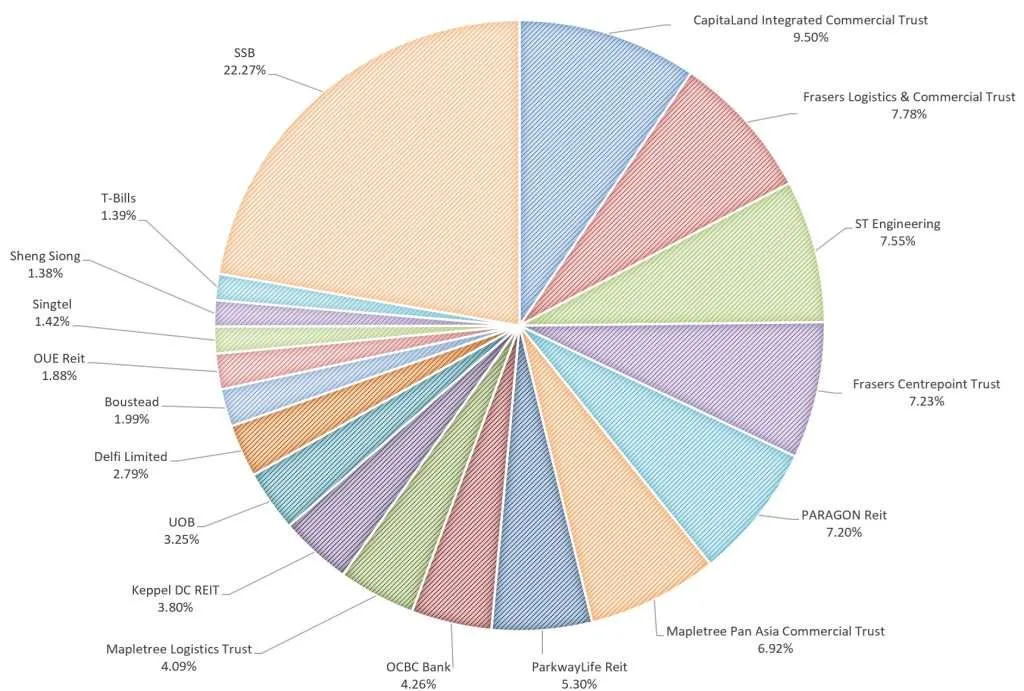

As you can see from the above, Frasers Centrepoint Trust makes up 7.23% of my stock portfolio. Preferential Offering is always a good chance to add more units to my stock portfolio without incurring brokerage charges and also new units are offered at a discount.

Let us wait for the news of the preferential offering!