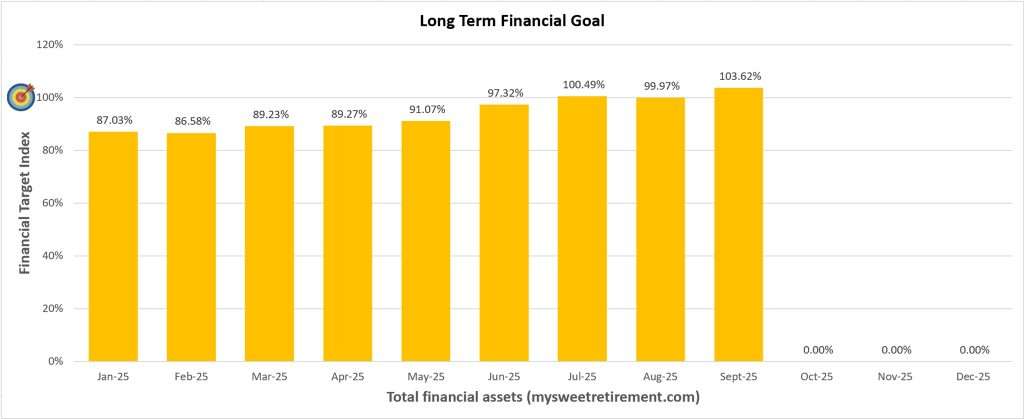

We are only a few months to end this year, and I am excited to update on my Financial Goals Progress for September 2025. In July, I finally achieved the goal that I have set for myself 5 years ago. This month, the total value of my assets reached a new high at 103.62%. I exceed my financial goal by 3.62%. The increase was attributed to my stock investments which I shall further share my transactions below. What does the above chart mean? The above chart is the total value of my financial assets represented in percentage against my financial goal (target). They comprised of my insurance savings, savings accounts, fixed deposits, Singapore Savings Bonds, Singapore Treasury Bills, current value of my stocks, and funds in Supplementary Retirement Scheme account.

What are financial goals? “Financial goals” are specific objectives you set to manage your money in a way that supports your short and long-term life plans. Setting financial goals is important as it provides direction and motivation for managing money effectively. By establishing clear financial goals, I can track my progress, make informed decisions, and work towards achieving financial stability and security. My long-term financial goal is to stash sufficient money (target) which can help me to retire early in Singapore.

How did I achieve my financial goals?

To achieve my financial goal in 5 years, you need a lot of discipline. Below are the actions I did.

Save 20 Percent of My Salary

I made a habit to stash 20 percent of my salary into the savings pocket under GSX digital bank. Every month when I receive my monthly wage, I will transfer twenty percent into this pocket. This helps to build up my cash on hand where I can use it when I need them in future. In May, when the stock market crashed, I used the money in this pocket to purchase DBS and OCBC shares. Last month, I used the money to buy MSCI (NYSE: MSCI) as well when the stock dipped.

Contribute to SRS

Needless to explain, every working adult knows the benefit of contributing to your Supplementary Retirement Scheme (SRS) account. The main benefit is for tax relief. Similar to above, I created a savings pocket under GSX digital bank. On a monthly basis, I have been transferring money into the Supplementary Retirement Scheme (SRS) Saving Pocket. In November, I shall close this pocket and transfer them into my SRS account to maximize the tax relief for this year.

Reinvest Dividends Collected

I hope you know the power of compounding. Compounding is the process of generating earnings on an asset’s reinvested earnings. To put it simply, compounding is the ability of an asset to generate earnings, which are then reinvested to generate their earnings.

Over time, compounding can lead to exponential growth in the value of an investment. This is because as the earnings are reinvested, the base on which they are generated increases, resulting in larger earnings each time.

Compounding is often referred to as the “eighth wonder of the world” and is a powerful tool for building wealth over the long term. The key to harnessing the power of compounding is to start early and be patient.

By starting to invest early and allowing your earnings to compound over time, you can benefit from the exponential growth that compounding offers. Even small, regular contributions can grow significantly over time through the power of compounding.

It’s important to remember that while compounding can work wonders for your investments, it requires time and patience. The longer you allow your investments to compound, the greater the rewards will be.

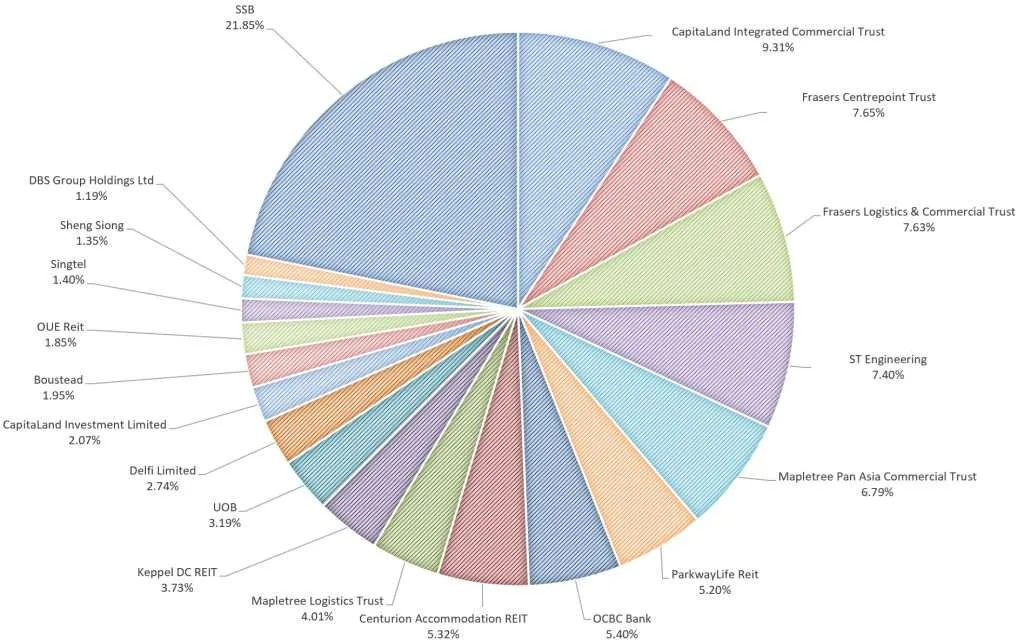

Whenever I get paid dividends from the stocks and REITs in my stock portfolio, I do not spend them away. Instead, I accumulate them and reinvest the dividends collected back into dividend yielding stocks and REITs. This helped me to increase my passive income over time. Do you know I have been doing this since 2012?

Side Hustle

What is a side hustle? A side hustle is a way to make extra money outside of your full-time job. It is typically a passion project or small business that you work on during your free time to bring in additional income. Side hustles can range from freelance work, selling products online, offering services, or even renting out property. Many people start side hustles to pursue their interests, build new skills, or save up for a specific goal.

In April, I decided to take the plunge and started a new side hustle. If you notice, I started selling stock investments and personal finance related books on my blog. Reading stock investment and personal finance books offers a range of powerful, long-term benefits, especially if you’re serious about building wealth and making informed decisions.

Reading books on stock investment and personal finance significantly enhances your financial literacy, helping you understand key concepts like budgeting, saving, investing, and risk management. These books cultivate an investor mindset, teaching discipline and long-term thinking while improving your decision-making and helping you avoid common financial mistakes.

They encourage wealth-building habits and provide diverse strategies from seasoned investors, allowing you to find approaches that align with your goals. Ultimately, they empower you to take control of your money, build financial independence, and make informed choices that support lasting financial well-being.

Have you read the latest book “Take Back Control of Your Money” written by Singapore SG Babe Dawn Cher? Please also take a look at the items listed at my sweet retirement shop right now!

Updates to My Stock Portfolio

In September, I applied for Centurion Accommodation REIT IPO but failed to get allocated any lots. Thus, I have to buy it from Singapore Stock Exchange (SGX). There is definitely investment risks involved in Centurion Accommodation REIT such as changes in foreign work policy, forex risks etc. Nevertheless, I am positive about the growing demand of foreign workers in Singapore to repair our roads and manpower in constructions. Similarly, demand for student accommodation is also growing internationally.

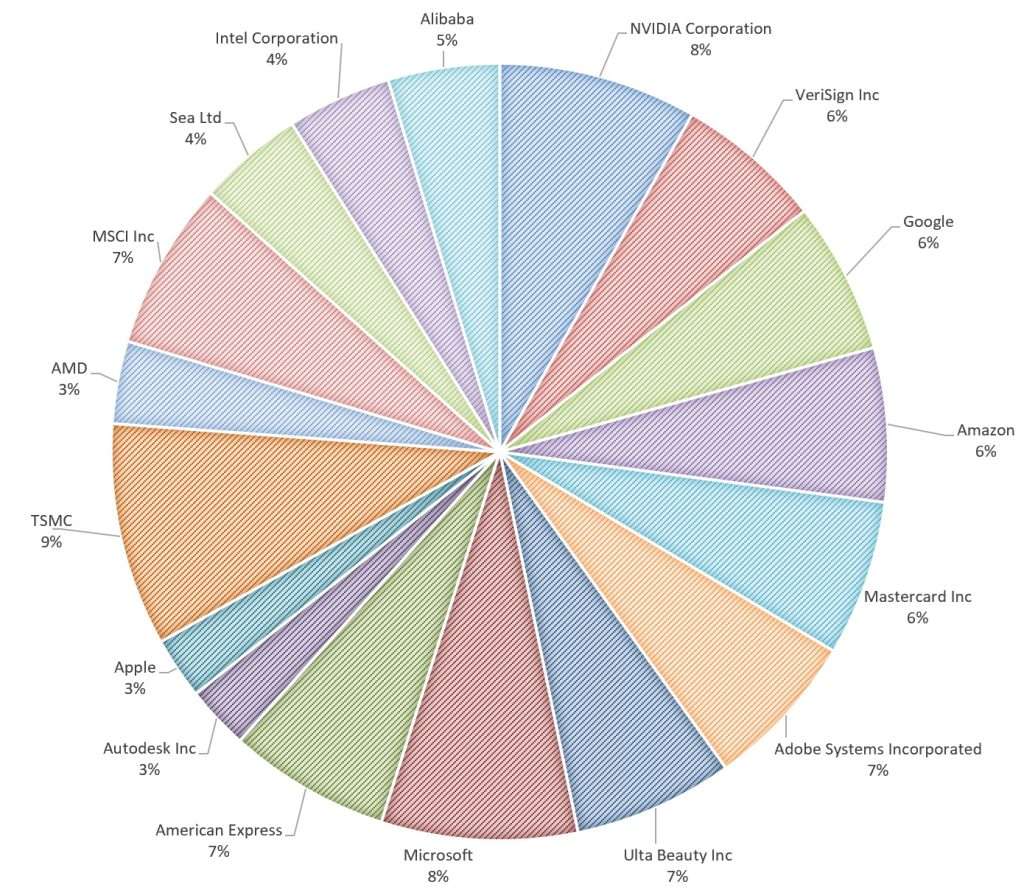

Regarding my US stock portfolio, I added Sea Ltd, Alibaba and Intel Corporation. These companies are in my watchlist for years, but I only initiate a position in them this month. You can read the recent news about these companies on why their share prices rocketed.

Financial Goals Progress for September 2025

This is an exciting month as I never made so many stock transactions in a single month. I hope Artificial Intelligence will continue to give the technology sector a bull run. I see huge potential in technological companies adopting AI. Even data centres are benefiting from the uptrend in AI adoption.

As I looked at my stock portfolio, it seems that I am both a dividend investor and growth stock investor. My Singapore stock portfolio continue to reward me with dividends while my US stock portfolio continue to grow in value.