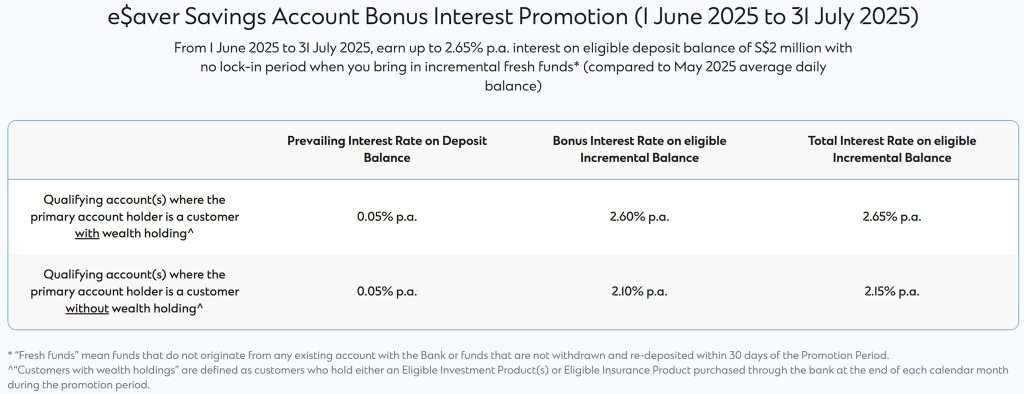

eSaver is a high yield savings account by Standard Chartered Bank (SCB) Singapore. It gives you up to 2.65% per annum. I consider eSaver as one of the best high interest savings accounts out there. From 1st June 2025 to 31st July 2025, you can earn up to 2.65% per annum interest. This applies to an eligible deposit balance of up to S$2 million, with no lock-in period. You must bring in incremental fresh funds. But wait, there is a criterion that you need to fulfill to earn this high-interest rate. I shall share further below.

Only customers with wealth holdings are eligible to earn the promotional interest rate of 2.65% per annum. “Customers with wealth holdings” are defined as customers who hold an Eligible Investment Product(s). Alternatively, they can hold Eligible Insurance Product purchased through the bank. This must occur at the end of each calendar month during the promotion period.

An Eligible Investment Product refers to Unit Trust(s), Bonds, Structured Notes or Equities, with exclusion of foreign currency exchange transactions; and investments using the Central Provident Fund Investment Scheme / Supplementary Retirement Scheme.

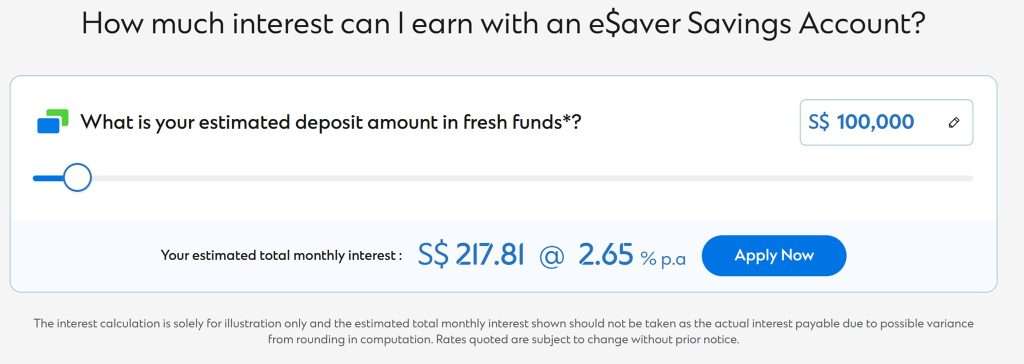

How much interest can I earn with an eSaver Savings Account?

What is the interest rate offered by eSaver Standard Chartered Bank (SCB) Singapore if you are not a customer with wealth holdings? Based on the table below, you can still earn up to 2.15% per annum.

With the eSaver Savings Account under Standard Chartered Bank (SCB) Singapore, I can earn up to S$2,150 interest a year with a deposit balance of S$100,000 by also simply maintaining a minimum average daily balance of S$1,000. Average daily balance (ADB) is the sum of end-of-day account balances of all days in a particular calendar month, divided by the number of days in that month.

If I am a customer with wealth holdings with Standard Chartered Bank (SCB) Singapore, I can earn up to S$2,613.72 interest a year with a deposit balance of S$100,000.

eSaver Savings Account versus UOB Stash Account

Effective from 1st July 2025, UOB Stash Account will be revising their interest rates across the tiers. With the revised interest rates, I will be earning S$2,040 interest a year. This is with a deposit balance of S$100,000 in your UOB Stash Account. You can achieve this by simply maintaining or increasing your Monthly Average Balance (MAB) each month.

Even if you are not a customer with wealth holdings with Standard Chartered Bank (SCB) Singapore, the interest rate offered by eSaver Savings Account is higher at 2.15% per annum. This is compared to the 2.04% per annum offered by UOB Stash Account.

eSaver Savings Account is Protected Under Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Standard Chartered Bank (SCB) eSaver Savings Account 2.65% per annum

If I have another 100K, I probably will park my money in eSaver Savings Account given the attractive interest rates. I like the fact that this is only a savings account and there is no lock in period! Having said that, there is a fall below fee of S$5 per month if the minimum average daily balance falls below S$1,000.

This is not a sponsored post and solely based on my own research and opinion. With falling interest rates, I believe everyone like me is looking for the best place to park your money to earn extra cash.

If you like this post, do check out Standard Chartered Bank’s eSaver Savings Account.

e$aver Savings Account: No Lock-in Period with 2.65% p.a. interest – Standard Chartered Singapore