DBS share price crashed today after I made my maiden purchase and add DBS to my stock portfolio last Friday. As you can see from the above stock chart, DBS opened at S$37.10 and fell to its lowest price at S$36.30. Coincidentally, DBS ex-dividend date falls on today 7th April 2025. DBS Group Holdings shareholders who own DBS (SGX:D05) stock before this date will receive DBS Group Holding’s next dividend payment of S$0.60 per share on 16th April 2025.

Why did DBS share price crashed today? All major stock markets globally crashed today, and investors feared that today is another repeat of the Black Monday. Black Monday was a global unexpected stock market crash that happened on Monday, 19th October 1987. Today’s stock market crash was triggered by sparked by fears of Trump’s tariffs whereby global investors feared an economic meltdown.

As shared previously, I am looking to buy DBS in tranches. When the share price falls further, I will be averaging down. However, DBS is really a hot stock. Within seconds, DBS rebounded from its day low of S$36.30 and hovered above S$39 before ending the day at S$39.28. That was a -9.28% change as compared to the previous trading day.

What is DBS Bank’s current dividend yield? Based on the current share price and 2024 full year dividend payout of 2.22 SGD per share, this translates to a current dividend yield of 5.65%.

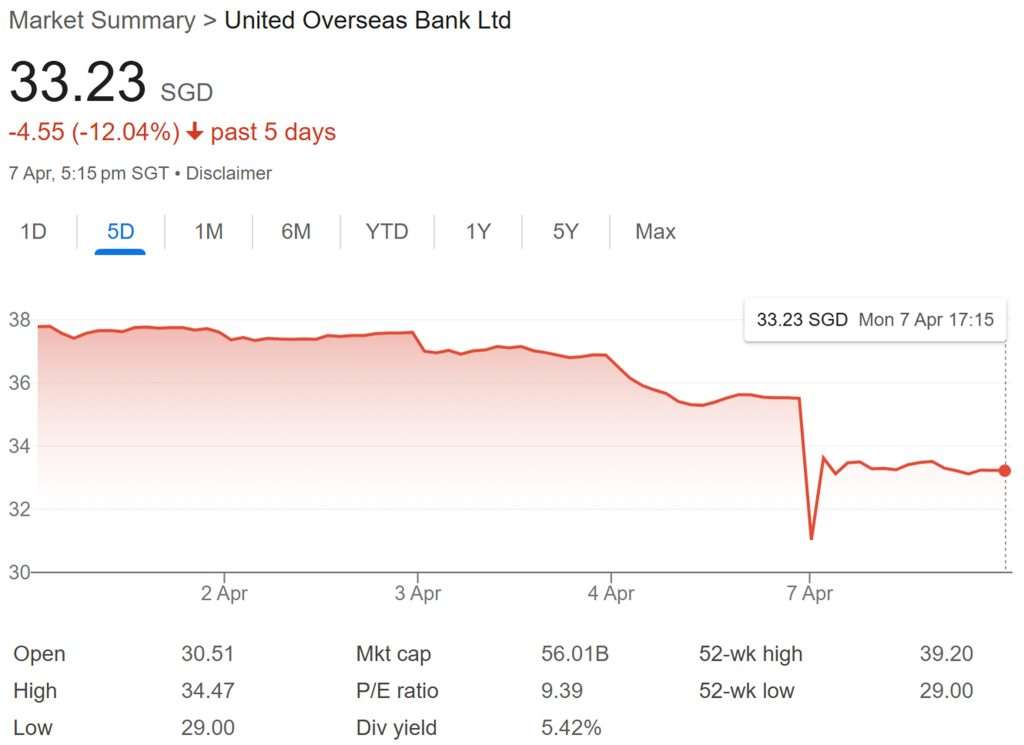

Besides DBS, UOB share price was not spared from the carnage either. UOB share price open at S$30.51 and hit its low of S$29.00. UOB closed at S$33.23. That was a -6.29% change as compared to the previous trading day.

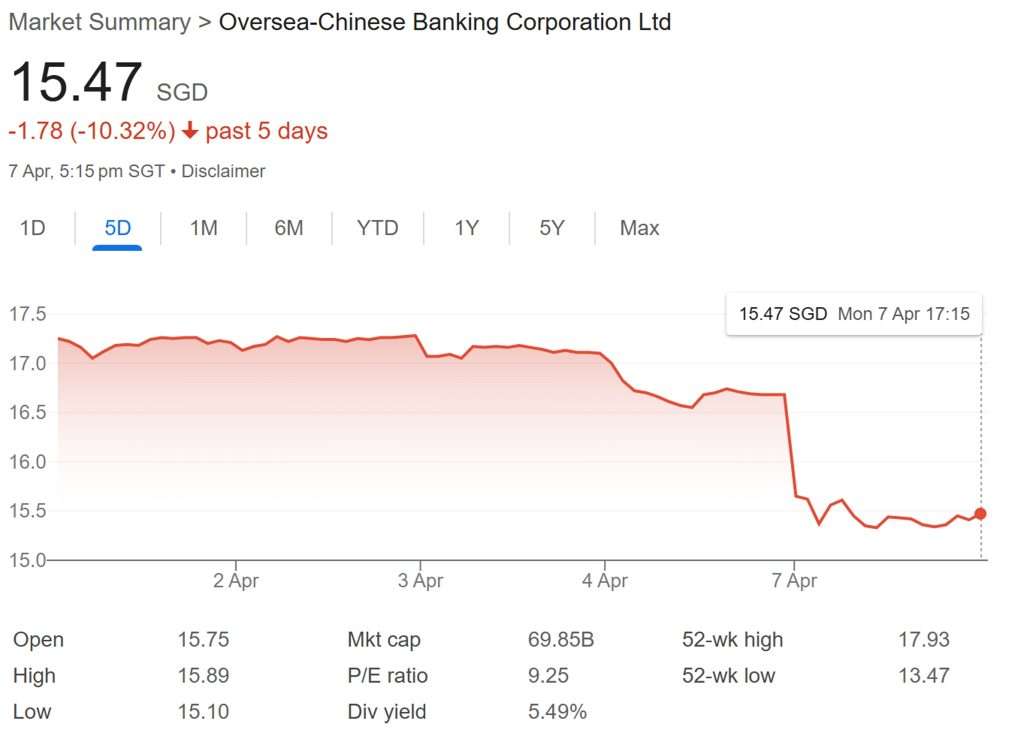

Next, let us take a look at OCBC bank and whether OCBC share price was spared.

As you can see from the above, OCBC share price opened at S$15.75 and hit the low of S$15.10. OCBC share price closed at S$15.47. That was a -6.92% change as compared to the previous trading day.

In terms of daily losses, DBS (SGX:D05) led the decline among the 3 Singapore Banks. This was followed OCBC Bank and UOB Bank. While other see this as a crisis, I see this as an opportunity to increase my position in the 3 banks in my stock portfolio.