Take a look at DBS Foreign Currency Fixed Deposit Rates in July 2025 if you are looking for higher interest rates as compared to Singapore Dollar Fixed Deposits. Foreign currency fixed deposit accounts are the same as Singapore dollar fixed deposit accounts. You deposit a sum of money for a fixed period of time at a pre-determined interest rate. The money is locked in for the specified period, which can range from a few months to several years.

Foreign currency fixed deposits are considered as a low-risk investment option as they offer guaranteed returns and are not subject to market fluctuations. However, the risk involved is the exchange rate between the foreign currency and Singapore Dollar. The interest earned on a foreign currency fixed deposit is usually higher than that earned on a Singapore Dollar Fixed Deposit and also regular savings account. This makes foreign currency fixed deposits an attractive choice for individuals looking to grow their savings in a secure manner.

The minimum amount for a foreign currency fixed deposit is 5,000 SGD equivalent. For this post, I am going to take a look at DBS Foreign Currency Fixed Deposit Rates for US Dollar. Below are the rates that can be found at DBS website.

Tenure: 1 month

Interest Rate: 3.55% p.a.

Deposit Amount: Less than USD$100,000

Tenure: 1 month

Interest Rate: 3.65% p.a.

Deposit Amount: USD$100,000 to USD$500,000

Tenure: 2 months

Interest Rate: 3.57% p.a.

Deposit Amount: Less than USD$100,000

Tenure: 2 months

Interest Rate: 3.67% p.a.

Deposit Amount: USD$100,000 to USD$500,000

Tenure: 3 months

Interest Rate: 3.80% p.a.

Deposit Amount: Less than USD$100,000

Tenure: 3 months

Interest Rate: 3.95% p.a.

Deposit Amount: USD$100,000 to USD$500,000

Tenure: 6 months

Interest Rate: 3.32% p.a.

Deposit Amount: Less than USD$100,000

Tenure: 6 months

Interest Rate: 3.62% p.a.

Deposit Amount: USD$100,000 to USD$500,000

Tenure: 12 months

Interest Rate: 3.05% p.a.

Deposit Amount: Less than USD$100,000

Tenure: 12 months

Interest Rate: 3.35% p.a.

Deposit Amount: USD$100,000 to USD$500,000

As you can see from the above, the fixed deposit rates for a 3-month placement are the highest as compared to other tenure periods.

Foreign Exchange Risks Foreign Currency Fixed Deposits

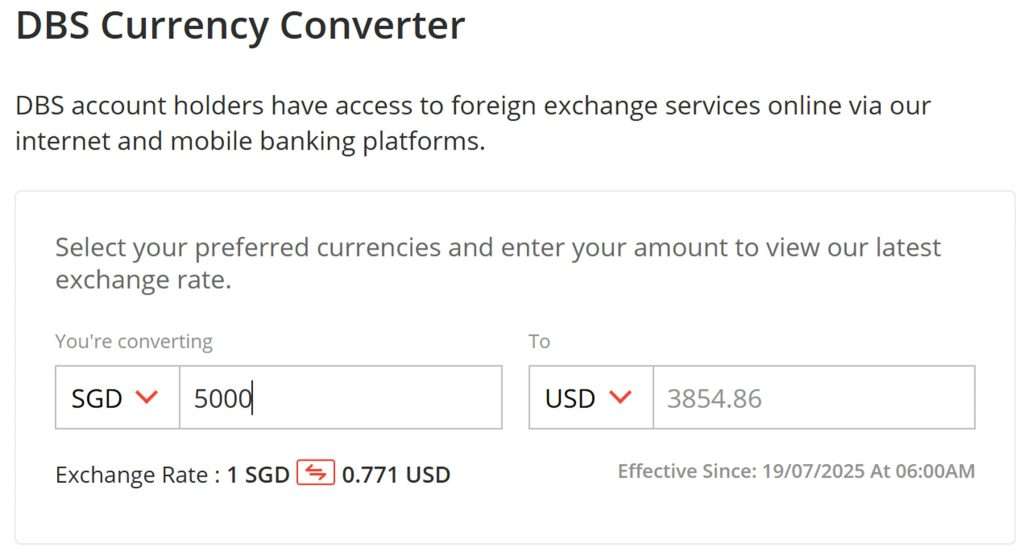

As you can see from the screenshot below, DBS foreign exchange rates are lower as what you can find on google. At this point of writing, 1 SGD convert via DBS currency converter is only equivalent to 0.771 USD. If you google, 1 SGD is equivalent to 0.78 USD.

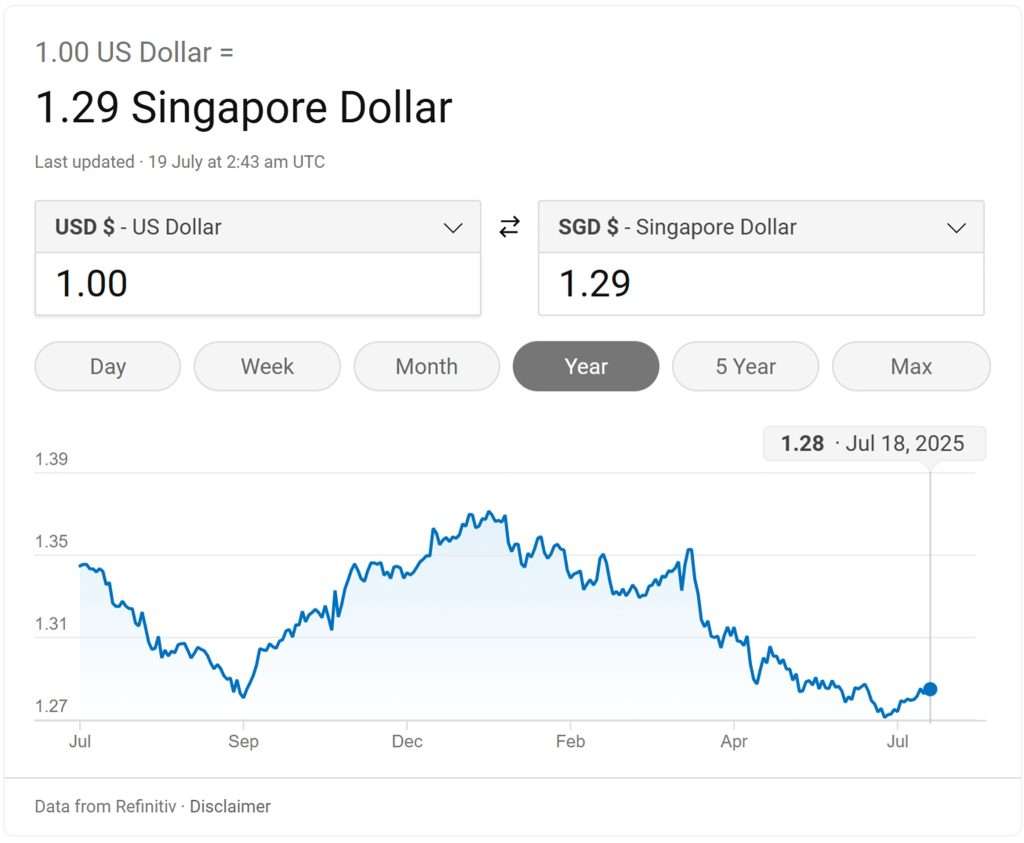

If you look at the below chart on USD to SGD exchange rates, Singapore Dollar is strengthening against the US dollar. In 2025, the Singapore dollar has strengthened 6 per cent to 7 per cent against a weakening US dollar in 2025. This is the strongest year-to-date performance in the last 20 years. It is important to consider the exchange rates from US dollar back to Singapore dollar when your fixed deposit matures.

Conclusion: DBS Foreign Currency Fixed Deposit Rates in July 2025

The higher interest rates offered by DBS foreign currency fixed deposit on US dollar is attractive. However, the weakening US dollar against Singapore dollar is a dismay when you deposit matures. If there are no plans to convert your US dollar when your current deposit matures, you can renew the principal and interest at the new rates and wait until US dollar is favourable before converting the money back to Singapore dollar.