With falling interest rates, are you wondering what is DBS Bank Singapore stock price right now? Earlier this week, the share prices of Singapore bank stocks tumbled. The selloff was triggered by investors fear of an upcoming recession caused by Trump’s tariffs and trade policy uncertainty.

Recently, Singapore Overnight Rate Average (SORA) also fell to 2.08 per cent on 13th March 2025, the lowest since December 2022. What is SORA? SORA is the volume-weighted average rate of unsecured overnight interbank SGD transactions in Singapore. In Singapore, bank interest rates, particularly for loans and savings products, are being determined by SORA. Despite no direct correlation, I believe the decline of SORA may also spark off a selloff of Singapore bank stocks.

While some investors see this as a crisis, I see this as an opportunity. Having said that, I will be looking into DBS bank historical dividend payout and DBS bank current dividend yield to decide whether it is attractive to make my maiden entry into this bank stock.

I have been keeping watch on Singapore bank stocks to add to my stock portfolio given their attractive dividend payouts. In 2024, I add OCBC and UOB bank to my stock portfolio, but I stopped when the share price went on a bull run and current dividend yield fell. I am not an expert into analysing bank stocks. But if you are keen what metrics to watch out for related to banks, Syfe has an excellent article here.

How much dividend is DBS Bank paying over the past years? DBS Bank historical dividends payout could easily be found at their investor’s relation page. As you can see from below, DBS Bank was able to constantly payout dividends year-on-year. For the last 5 years, DBS Bank increased its dividend payout every year.

Financial Year: 2024

Dividend Payout: 2.22 SGD per share

Financial Year: 2023

Dividend Payout: 1.75 SGD per share

Financial Year: 2022

Dividend Payout: 1.82 SGD per share (include special dividend of 45 cents)

Financial Year: 2021

Dividend Payout: 1.09 SGD per share

Financial Year: 2020

Dividend Payout: 0.78 SGD per share

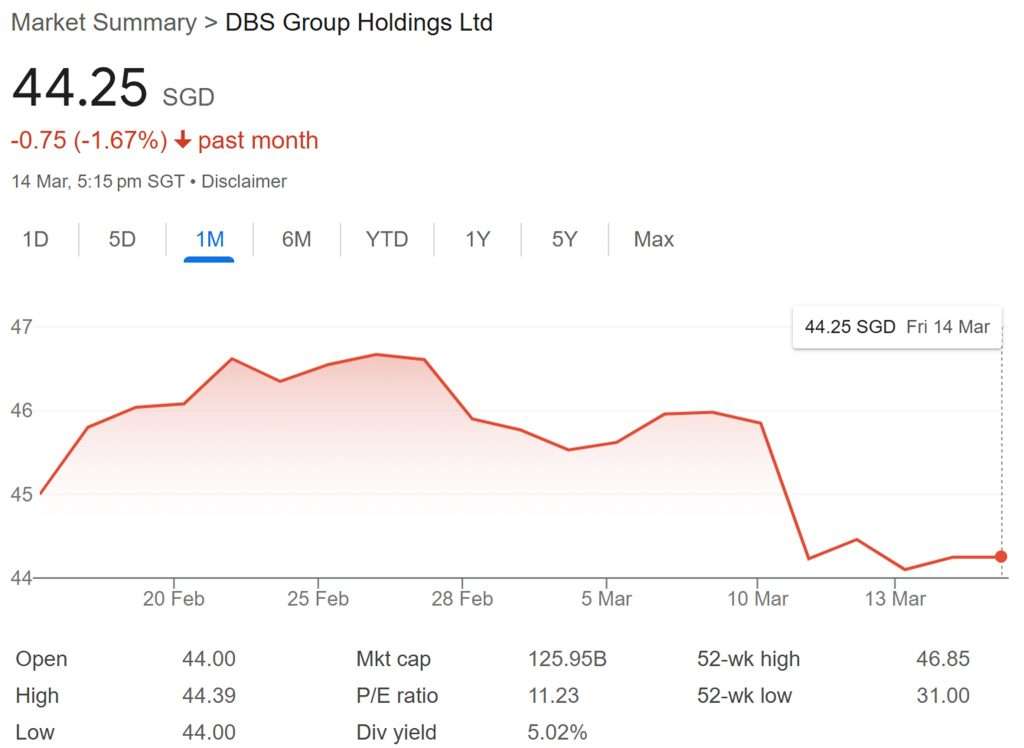

DBS Share Price and Current Dividend Yield

As you can see from the above chart, the share price of DBS Bank had declined 1.67% in a month. On Friday, DBS Bank stock price closed at S$44.25. What is DBS Bank dividend yield? Based on the current share price and 2024 full year dividend payout of 2.22 SGD per share, this translates to a current dividend yield of 5.02%.

Now, let us take a look at the 6-month trend of DBS Bank’s share price.

As you can see from the above 6-month trending chart, the share price of DBS bank is still on the uptrend. If you have bought DBS in November at S$39.15, your dividend yield would be 5.67%.

You may have heard the quote “to be fearful when others are greedy and to be greedy only when others are fearful.” Should the share price of DBS decline further, I see this as an opportunity to make my maiden entry into DBS Bank!

Thank you for write-up.