Have you heard of the CPF Matched Retirement Savings Scheme (MRSS)? Last year, I topped up S$600 to my parent’s Retirement Account (RA). In 2025, there are significant changes to the maximum allowed amount that I can top up to my parent’s Retirement Account (RA). This year, I have topped up S$2000 to each of my parent’s CPF Retirement Account (RA) as the maximum allowed was increased from S$600 dollars in the past years to S$2000.

Have you heard of the CPF Matched Retirement Savings Scheme (MRSS)? Last year, I topped up S$600 to my parent’s Retirement Account (RA). In 2025, there are significant changes to the maximum allowed amount that I can top up to my parent’s Retirement Account (RA). This year, I have topped up S$2000 to each of my parent’s CPF Retirement Account (RA) as the maximum allowed was increased from S$600 dollars in the past years to S$2000.

Singapore’s CPF system has long been a cornerstone of retirement planning, but for many older citizens, reaching the Basic Retirement Sum (BRS) remains a financial hurdle. To address this gap, the government introduced the Matched Retirement Savings Scheme (MRSS), a targeted initiative designed to help seniors build up their CPF Retirement Account (RA) balances through matched contributions. In 2025, the age cap of 70 years old has been removed.

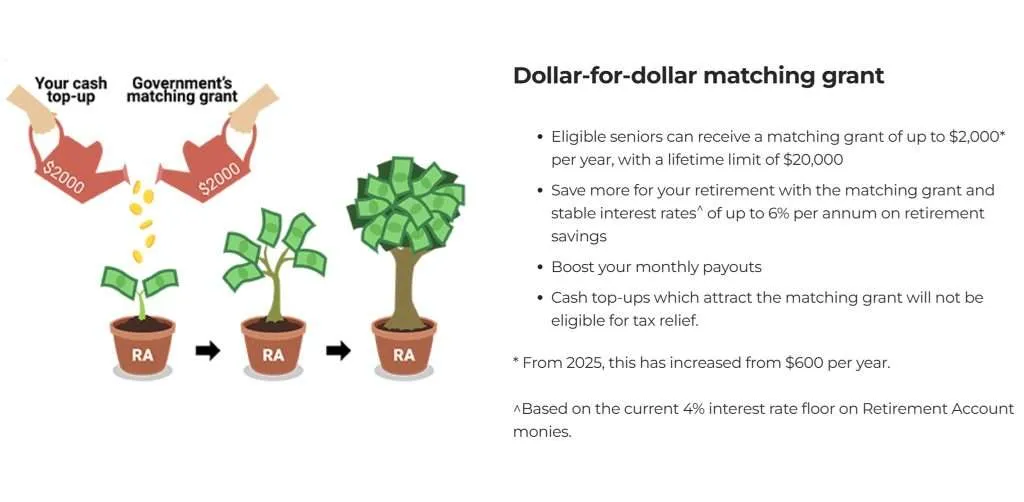

Launched in 2021 and extended through 2025, the MRSS offers a compelling incentive. For every dollar of cash top-up made to an eligible senior’s Retirement Account (RA), the government matches it up to a generous annual cap. Initially set at S$600 per year, the scheme was enhanced in 2025 to allow up to S$2,000 in matching annually, with a lifetime cap of S$20,000. This means that a S$2,000 top-up could result in a total boost of S$4,000 to the recipient’s retirement savings, making it one of the most impactful CPF enhancements in recent years.

Eligibility for MRSS is automatically assessed by CPF each year, so there is no need to apply. Seniors must have Retirement Account (RA) savings below the prevailing BRS (which stands at $102,900 in 2025), earn an average monthly income of S$4,000 or less, live in a property with an annual value under S$13,000, and own no more than one property. Even if you do not meet these criteria yourself, you can still make top-ups to eligible family members such as parents or grandparents, and they will receive the matching grant.

To qualify for the match, top-ups must be made in cash under the Retirement Sum Topping-Up (RSTU) Scheme. Transfers from your CPF Ordinary Account would not count. Contributions can be made as a lump sum or through monthly GIRO payments. At the end of each calendar year, CPF calculates the total eligible top-up amount and credits the matching grant to the recipient’s Retirement Account (RA) in the first quarter of the following year.

The MRSS is more than just a financial boost. It is a strategic tool for retirement adequacy. For seniors who fall short of the BRS, monthly CPF LIFE payouts may be insufficient to cover basic living expenses. The matched grant helps bridge that gap, offering a meaningful increase in retirement income without placing the full burden on individuals or their families. It also encourages intergenerational support, allowing younger family members to contribute to their elders’ financial security in a structured and impactful way.

From a planning perspective, MRSS top-ups may also qualify for income tax relief, making it a win-win for contributors. For financial advisors, estate planners, or anyone managing family wealth, the scheme presents a rare opportunity to optimize CPF balances while leveraging government support.

Ultimately, the CPF Matched Retirement Savings Scheme is a quiet powerhouse in Singapore’s retirement landscape. Whether you’re a senior looking to strengthen your financial foundation or a younger Singaporean supporting your loved ones, MRSS offers a simple yet powerful way to double your impact. It is a scheme that rewards foresight, generosity, and smart financial planning all with the backing of the state.

If you have not topped up your parent’s CPF Retirement Account (RA), check out the link to CPF’s website below on details of the CPF MRSS and the instructions on how to top up your parent’s Retirement Account (RA).

Source: CPFB | Matching grant for seniors who top up, accessed on 13th September 2025.

Hi, for info, the current MRSS has no age cap limit. Seniors above 55 are eligible.

https://www.cpf.gov.sg/service/article/who-is-eligible-for-the-matched-retirement-savings-scheme

Thanks for pointing this out. Really appreciate it. I have updated the post to highlight that the age cap of 70 years old has been removed.