Do you want to know Citibank Fixed Deposit Interest Rates in May 2025? Every month, I will look through most of the banks in Singapore that offer the best fixed deposit interest rates. Beside investing into stocks and REITs, I also park my spare cash with fixed deposits to earn higher interests as compared to our regular savings account. I will be including Citibank Fixed Deposit Interest Rates starting from next month.

The Fed announced that they will be keeping interest rates unchanged for the moment because President Donald Trump’s tariffs have created “so much uncertainty”. Fixed deposit interest rates in Singapore have recently seen a decline, with many banks lowering their rates, including UOB, OCBC, and CIMB. This drop is attributed to a combination of factors, including easing inflation, slowing economic growth, and a cautious approach from banks in response to global uncertainty.

Do you know what are fixed deposits? Fixed deposits are sometimes also termed as time deposits. Fixed deposits or time deposits are a type of investment offered by banks and financial institutions where an individual deposits a sum of money for a fixed period of time at a pre-determined interest rate. The money is locked in for the specified period, which can range from a few months to several years.

Fixed deposits are considered a safe investment option as they offer guaranteed returns and are not subject to market fluctuations. The interest earned on a fixed deposit is usually higher than that earned on a regular savings account, making it an attractive choice for individuals looking to grow their savings in a secure manner.

What is Citibank Fixed Deposit Interest Rates? Let us take a look below.

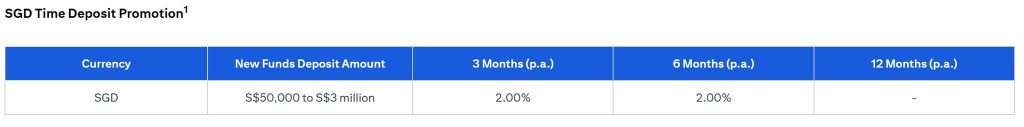

Citibank Fixed Deposit Interest Rates in May 2025

Tenure: 3 months

Interest Rate: 2.00% p.a.

Minimum Amount: S$50,000 to S$3 million

Tenure: 6 months

Interest Rate: 2.00% p.a.

Minimum Amount: S$50,000 to S$3 million

Deposit Insurance Scheme

It is good to know that your savings are protected by Singapore Deposit Insurance Scheme.

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance

Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign

currency deposits, dual currency investments, structured deposits and other investment products are not insured. For more information, please visit www.sdic.org.sg.

Citibank Fixed Deposit Interest Rates versus Singapore Savings Bond (SBJUN25)

The effective interest rate for SSB GX25060V is 2.56% if you held it for 10 years. If you sell SBJUN25 after 1 year, the return is 2.20% per annum. If you have S$200,000, I will purchase SBJUN25 as the return from Singapore Savings Bond is higher than Citibank Fixed Deposit Promotion (2.20% versus 2.00%).

Below is the interest per year for SSB SBJUN25 GX25060V.

| Year from issue date | Interest % | Average return per year %* |

| 1 | 2.20 | 2.20 |

| 2 | 2.20 | 2.20 |

| 3 | 2.20 | 2.20 |

| 4 | 2.40 | 2.25 |

| 5 | 2.53 | 2.30 |

| 6 | 2.59 | 2.35 |

| 7 | 2.74 | 2.40 |

| 8 | 2.88 | 2.45 |

| 9 | 3.01 | 2.51 |

| 10 | 3.12 | 2.56 |

*At the end of each year, on a compounded basis.

Citibank Fixed Deposit Interest Rates versus Singapore T Bills

The cut off yield for Singapore T Bill BS25109V 6-Month T-bill is 2.30% per annum. Singapore Treasury Bills are short-term debt instruments issued by the Singapore government to raise funds for its financing needs. These bills are typically sold at a discount from their face value and mature in 3, 6, or 12 months. They are considered a safe investment as they are backed by the Singapore government’s creditworthiness.

As you can see, the return from BS25109V 6-Month T-bill is also higher than Citibank Fixed Deposit promotion in May. I do not see a reason why we want to put our money into a time deposit with lower returns.

Conclusion

In my opinion, DBS Singapore offer the highest fixed deposit interest rate at 2.45% per annum for a 12-months tenure. If you are looking for a shorter tenure, MayBank2U offered 2.45% per annum for 6-months. Take a look at Best fixed deposit rates in May 2025.

Personally, I am keeping my money in the UOB Stash Savings Account where the estimated interest rate is around 2.20% to 2.30% per annum. Where is the best place to park your money? If you have 100K, please look at my review on UOB Stash Savings Account.

If you find this post useful, do subscribe to my blog to continue receiving money ideas on places to park your money!