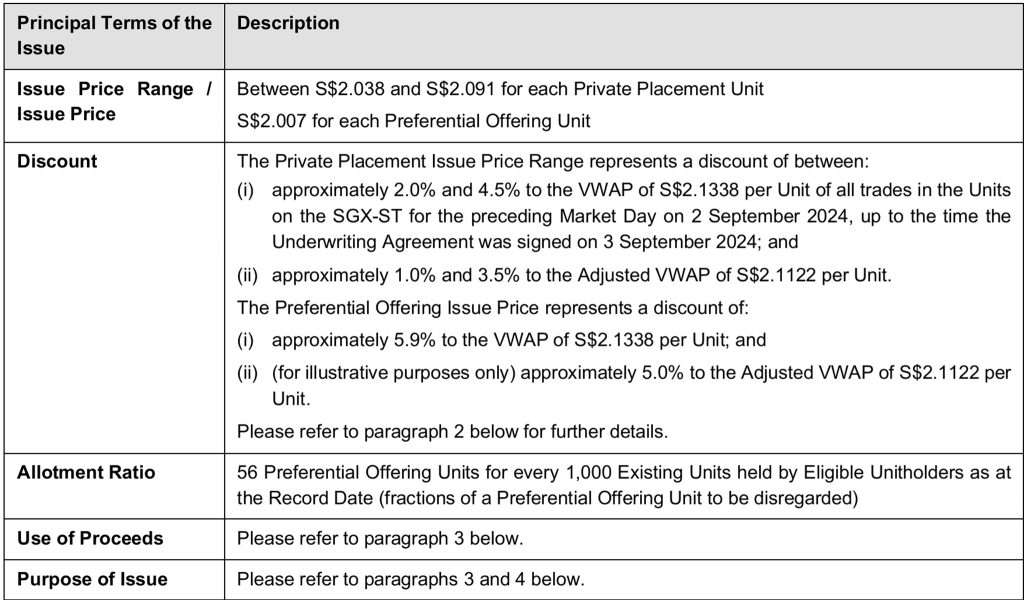

CapitaLand Integrated Commercial Trust (CICT) is offering shareholders the rights (rights issue) to buy 56 new preferential offering units for every 1000 units, at S$2.007 each. The subscription to the rights and payment was already open on 16th September and will close tomorrow on 24th September 2024. The new Preferential Offering units are expected to be allotted and traded from 2nd October 2024.

Rights issue and preferential offering are less of the mentioned activities to investors. In fact, it has been quite some time I have seen a Rights issue and preferential offering. If the terms are alien to you, find out more below on what they mean.

If you have read so far but still do not know why CICT is raising capital, in short, CICT is raising capital to fund its acquisition of 50% stake in ION Orchard. This Equity Fund Raising is expected to raise gross proceeds of no less than approximately S$1.1 billion.

What is Rights Issue?

Rights issue is a way for a company to raise additional capital by offering existing shareholders the opportunity to purchase new shares at a discounted price. This allows current shareholders to maintain their ownership percentage in the company by purchasing more shares, while also providing the company with much-needed funds for growth, debt reduction, or other purposes.

Rights issues are typically offered on a pro-rata basis, meaning that shareholders can buy a certain number of new shares based on their existing holdings. It is a common method used by companies to raise capital without taking on additional debt or diluting the ownership of existing shareholders.

What is Preferential Offering?

Preferential offering is a type of offering made to existing shareholders of a company before it is offered to the general public. This allows current shareholders to purchase additional shares at a discounted price, giving them the opportunity to maintain or increase their ownership stake in the company.

Preferential offerings are often used by companies to raise additional capital while giving priority to their loyal shareholders. Shareholders who choose not to participate in the preferential offering may see their ownership stake diluted as new shares are issued to other investors.

Apply for Excess Rights Issue

An excess rights issue allows existing shareholders to purchase additional shares beyond their original allocation. This provides shareholders with the opportunity to increase their stake in the company at a discounted price.

By applying excess rights, shareholders can take advantage of the offering and potentially increase their ownership in the company. It is important for shareholders to carefully consider their financial situation and investment goals before deciding to apply for excess rights in order to make an informed decision that aligns with their long-term investment strategy.

In this case of CICT rights issue, you can apply for additional new preferential offering units on top of what was issued to you (56 new preferential offering units for 1,000 existing units held). Why not grab to chance to obtain additional units given that there are no brokerage fees?

I have applied for CICT preferential offering. Tomorrow is the last day of the application. Have you applied yours?