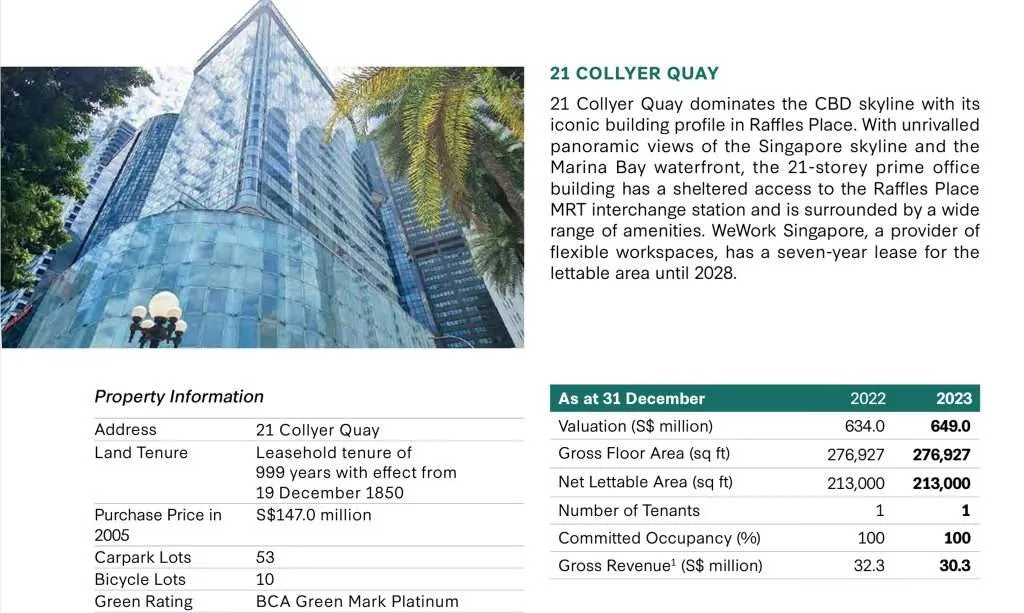

On 11 November 2024, CICT (CapitaLand Integrated Commercial Trust) divests 21 Collyer Quay for S$688 million. 21 Collyer Quay is a 21-storey office building located in Raffles Place with a leasehold tenure of 999 years. After taking into account the divestment related expenses and certain completion adjustments, the net proceeds from the divestment would be approximately S$681.7 million.

I am a current unitholder of CICT (CapitaLand Integrated Commercial Trust) and the REIT makes up 9.71% of my stock portfolio. Recently, CICT had launched a preferential offering, and I have applied for excess units as well.

Based on CICT FY2023 annual report, WeWork Singapore Pte. Ltd. makes up 2.4% of CICT’s gross rental income. WeWork Singapore Pte Ltd’s income contribution comprised the tenant’s lease at Funan and 21 Collyer Quay. WeWork Singapore, a provider of flexible workspaces, has a seven-year lease at 21 Collyer Quay until 2028.

Below are some of the common questions that I will ask whenever a REIT announce any divestments of the properties in its portfolio.

What will the proceeds from the divestment used for?

According to the announcement, the divestment proceeds of S$688 million will be used to repay debt, finance any capital expenditure, asset enhancement works and investments and/or to finance general corporate and working capital requirements.

Assuming the divestment was completed, and the net proceeds were fully used to repay existing debt on 30 June 2024, CICT’s pro forma aggregate leverage as at 30 June 2024 is expected to reduce from 39.9% to approximately 38.3%.

What does pro forma mean? Pro forma is a Latin term that translates to “for the sake of form” in English. In business, the term is commonly used to describe financial statements that are prepared on a hypothetical basis. These statements project how a company’s financial performance would look if certain events or transactions had occurred in the past or are expected to occur in the future.

Pro forma financial statements are often used by businesses to provide investors, analysts, and other stakeholders with a better understanding of the company’s financial health and potential future performance.

Is there any impact to Distribution Per Unit (DPU)?

According to the announcement, the Divestment of 21 Collyer Quay is not expected to have any material effect on the distribution per unit of CICT and the net asset value per unit of CICT for the financial year ending 31 December 2024.

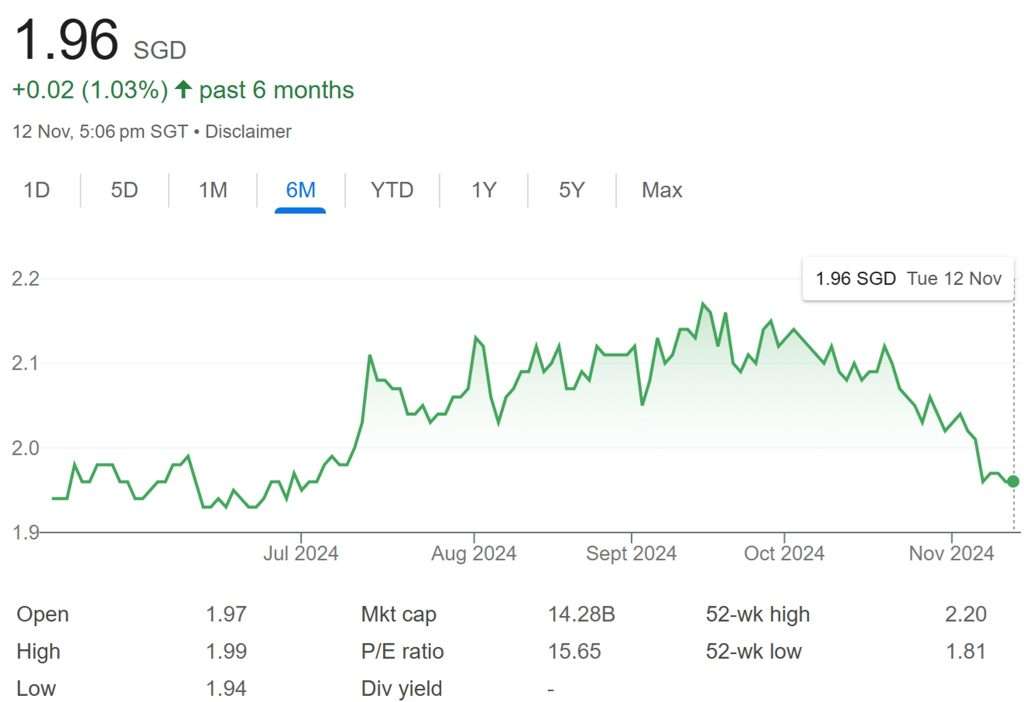

What is CICT Share Price?

After the announcement, CICT share price closed at S$1.96. As you can see from the above chart, CICT share price has been on a downtrend since October 2024. The announcement of the divestment of 21 Collyer Quay does not seem to have any impact on the trend.

What is CICT’s current dividend yield? Based on CICT’s share price of S$1.96 on FY23 full year DPU of 10.75 cents, this translates to a current dividend yield of 5.48%.