Centurion confirms REIT IPO after announcing they have entered into letter agreements in connection with the proposed listing of Centurion Accommodation REIT, a real estate investment trust which would be sponsored by the Company. Centurion Accommodation REIT will be listed on the Main Board of the Singapore Exchange Securities Trading Limited (SGX-ST).

Do you know what business Centurion Corporation Limited does? Centurion is a leading provider of purpose-built worker accommodation assets in Singapore, Malaysia and China, and student accommodation assets in Australia, the United Kingdom (“UK”), United States (“US”) and China, with build-to-rent assets in China. As of 31st March 2025, Centurion manages a strong portfolio of 37 operational accommodation assets totalling 69,929 beds.

The upcoming new REIT, Centurion Accommodation REIT’s principal investment strategy will be to invest, directly or indirectly, in a portfolio of income-producing real estate assets which are used primarily for purpose-built worker accommodation (PBWA) purposes, purpose-built student accommodation (PBSA) purposes or other accommodation purposes located globally (excluding Malaysia), as well as real estate-related assets.

Centurion Accommodation REIT Portfolio

What assets will the REIT IPO initial portfolio consist of? Centurion Accommodation REIT’s initial portfolio will comprise of 14 assets, with five PBWA assets located in Singapore, eight PBSA assets located in the United Kingdom (“UK”), and one PBSA asset located in Australia. As of 31st March 2025, Centurion’s PBWA and PBSA assets have 21,282 and 2,772 beds respectively.

After the listing of Centurion Accommodation REIT, the manager has plans to acquire Epiisod Macquarie Park, a PBSA asset located in Australia. Upon completion of the acquisition of Epiisod Macquarie Park, Centurion Accommodation REIT’s portfolio will comprise of 15 assets.

The amount payable by Centurion Accommodation REIT for the above-mentioned initial portfolio is estimated to be approximately S$1,477.8 million. The enlarged portfolio after acquisition of Epiisod Macquarie Park is estimated to be approximately S$1,758.0 million. To demonstrate the support for Centurion Accommodation REIT, the sponsor Centurion Corporation Limited will subscribe to the Sponsor Units worth S$687.0 million.

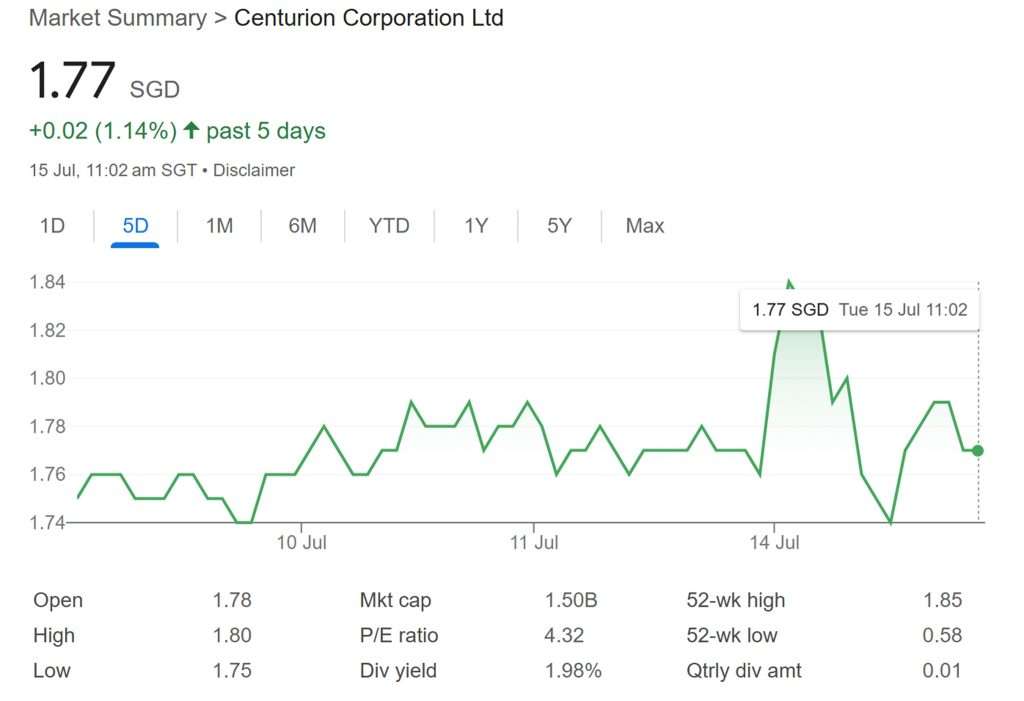

Centurion Share Price

The share price of Centurion jumped 4% to S$1.83 upon news of the REIT IPO. At this point of writing, the share price has subsided to S$1.77.

What is Centurion Accommodation REIT’s Dividend Payout Policy?

Centurion Accommodation REIT’s dividend distribution policy is to distribute 100.0% of annual distributable income for the period from the Listing Date to the Projection Year 2027. Thereafter, Centurion Accommodation REIT will distribute at least 90.0% of its annual distributable income on a semi-annual basis for each financial year.

Conclusion: Centurion Confirms REIT IPO

In my opinion, with the growing number of foreign workers and students, accommodation is a business with huge growth potential. I shall be following Centurion Accommodation REIT IPO closely.

Are you keen on Centurion REIT IPO as well?