Find out what are the best REITs in Singapore to buy in July 2025. Buying Singapore REITs is a good source of building your passive income. Investing in Singapore REITs also helped me reach my financial goals. In 2024, I collected a total of S$19K in passive income. REIT investing is an excellent and easy way to build our passive income because REITs payout dividends either quarterly or half yearly.

Find out what are the best REITs in Singapore to buy in July 2025. Buying Singapore REITs is a good source of building your passive income. Investing in Singapore REITs also helped me reach my financial goals. In 2024, I collected a total of S$19K in passive income. REIT investing is an excellent and easy way to build our passive income because REITs payout dividends either quarterly or half yearly.

How do you build a resilient Singapore REIT stock portfolio? The important thing in terms of building a resilient Singapore REIT portfolio is to be able to identify high quality REITs are those that constantly pay you dividends and are able to grow their Distribution Per Unit (DPU) year-on-year.

Every time Trump announced that he is going to impose tariffs on various countries, the stock market will either dip or crash. The Federal Reserve had also kept the funds rate at 4.25% to 4.50% for a third consecutive meeting in May 2025. At this point of writing, it is uncertain whether the Fed will cut rates in July. If the Fed does cut rates in July, the share prices of REITs may rally. This is where keeping a watchlist of quality REITs to buy comes in handy.

How do I build a dividend yielding REITs portfolio? Before that, read up on 6 important terms to know in REIT investing. Do you know what is Distribution Per Unit (DPU), Rental Reversions, Weighted Average Lease Expiry (WALE), Aggregate Leverage (Gearing Ratio), Weighted Average Debt Maturity and Dividend Yield? Stock screening only help you narrow down to a shorter list of Singapore REITs to look at. It is important to know the above terms. Usually, you will come across these terms in the financial results or annual reports.

How to Find Singapore REITs to Buy?

In REIT investing, I use a common technique called stock screening. Singapore Stock screening is the process of filtering a large number of stocks based on specific criteria to identify potential investment opportunities. There are many stock screening tools out there. As such, it is not difficult to obtain a shorter list of good REITs and their current dividend yield for further analyse and decision making. Stock Screening tools allow you to screen REITs based on specific factors like P/E ratio, dividend yield, and other financial metrics.

For me, I use Stocks Café Stock Screener to screen for a list of REITs that meet my predefined criteria so that I have a shorter list of REITs to analyse. Below are the criteria that I used to screen for dividend stocks. You can adjust them to fit your risk appetite.

- Market Capitalization >= 1B

- Current Yield (%) >= 5 and <= 10

- Price / Book <= 3

Market capitalization

Market capitalization, often referred to as “market cap”, is a critical metric in evaluating stocks. It represents the total market value of a company’s outstanding shares of stock. You calculate it by multiplying the company’s current share price by the total number of its outstanding shares.

Market cap helps categorize companies into large-cap stocks, mid-cap stocks and small-cap stocks. Large-cap stocks are usually established companies with a long history of stable performance (e.g., global giants like Apple or Microsoft). These are considered less risky investments.

Mid-cap stocks are companies that are in the growth phase and offer higher growth potential but may carry more risk than large-cap stocks.

Small-cap stocks are smaller companies, often newer and less stable, which have the potential for significant growth but come with higher risk.

Investors use market cap to assess a company’s size and stability, compare it with its peers, and diversify their portfolios across different cap categories depending on their risk tolerance and investment goals. While market cap is important, it’s not the only factor to consider; fundamentals like revenue, profitability, industry trends, and future growth prospects are also crucial.

Current Dividend Yield

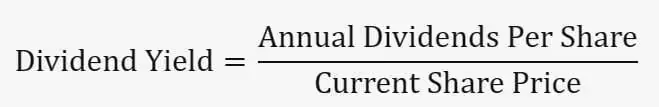

Dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. It’s calculated as: Dividend Yield (%) = (Annual Dividends Per Share / Current Stock Price) × 100

Price / Book (PB Ratio)

The price-to-book (P/B) ratio is a valuation metric used to assess whether a stock is undervalued or overvalued relative to its book value. It’s calculated as: P/B Ratio = Market Price Per Share / Book Value Per Share

A P/B ratio lower than 1 could indicate that the stock is undervalued, while a higher P/B ratio might suggest it’s overvalued, assuming other factors remain constant.

Best REITs Singapore to Buy in July 2025

Do watch my video 6 Terms to Know as A REIT Investor before investing in them. Also watch my video on different type of REITs in Singapore so that you know how to diversify your REITs portfolio. Last, grab a few books from my Shop to improve your financial knowledge.

Remember, REITs that pay the highest dividend yield may not be the best REIT. Please do your due diligence and read up their financial reports before investing into them. Below are the best REITs in Singapore to buy in July 2025.

Ascendas REIT (SGX:A17U)

Market Capitalization: SGD 12.4B

Current Dividend Yield: 8.06%

Price to Equity: 15.676

Price to Book: 1.148

Net Asset Value (NAV): SGD 2.343

Closing Price (30-Jun-25): SGD 2.68

Frasers Logistics & Commercial Trust (SGX:BUOU)

Market Capitalization: SGD 3.2B

Current Dividend Yield: 7.48%

Price to Equity: 23.675

Price to Book: 0.78

Net Asset Value (NAV): SGD 1.083

Closing Price (30-Jun-25): SGD 0.855

AIMS APAC (SGX:O5RU)

Market Capitalization: SGD 1.1B

Current Dividend Yield: 7.27%

Price to Equity: 32.829

Price to Book: 0.715

Net Asset Value (NAV): SGD 1.847

Closing Price (30-Jun-25): SGD 1.32

Far East Hospitality Trust (SGX:Q5T)

Market Capitalization: SGD 1.1B

Current Dividend Yield: 7.21%

Price to Equity: 24.159

Price to Book: 0.615

Net Asset Value (NAV): SGD 0.919

Closing Price (30-Jun-25): SGD 0.565

Starhill Global Reit (SGX:P40U)

Market Capitalization: SGD 1.2B

Current Dividend Yield: 7.16%

Price to Equity: 17.6

Price to Book: 0.675

Net Asset Value (NAV): SGD 0.756

Closing Price (30-Jun-25): SGD 0.51

CapitaLand Ascott Trust (SGX:HMN)

Market Capitalization: SGD 3.4B

Current Dividend Yield: 6.93%

Price to Equity: 14.732

Price to Book: 0.7

Net Asset Value (NAV): SGD 1.257

Closing Price (30-Jun-25): SGD 0.885

Mapletree Logistics Trust (SGX:M44U)

Market Capitalization: SGD 5.9B

Current Dividend Yield: 6.88%

Price to Equity: 32.299

Price to Book: 0.821

Net Asset Value (NAV): SGD 1.425

Closing Price (30-Jun-25): SGD 1.18

Lendlease Reit (SGX:JYEU)

Market Capitalization: SGD 1.3B

Current Dividend Yield: 6.79%

Price to Equity: 22.27

Price to Book: 0.577

Net Asset Value (NAV): SGD 0.909

Closing Price (30-Jun-25): SGD 0.52

Mapletree Industrial Trust (SGX:ME8U)

Market Capitalization: SGD 5.8B

Current Dividend Yield: 6.68%

Price to Equity: 17.239

Price to Book: 1.115

Net Asset Value (NAV): SGD 1.82

Closing Price (30-Jun-25): SGD 2.04

Mapletree Pan Asia Commercial Trust (SGX:N2IU)

Market Capitalization: SGD 6.6B

Current Dividend Yield: 6.37%

Price to Equity: 11.361

Price to Book: 0.69

Net Asset Value (NAV): SGD 1.825

Closing Price (30-Jun-25): SGD 1.26

Keppel Reit (SGX:K71U)

Market Capitalization: SGD 3.5B

Current Dividend Yield: 6.29%

Price to Equity: 34.568

Price to Book: 0.659

Net Asset Value (NAV): SGD 1.351

Closing Price (30-Jun-25): SGD 0.885

Suntec Reit (SGX:T82U)

Market Capitalization: SGD 3.3B

Current Dividend Yield: 5.53%

Price to Equity: 29.275

Price to Book: 0.52

Net Asset Value (NAV): SGD 2.174

Closing Price (30-Jun-25): SGD 1.13

Frasers Centrepoint Trust (SGX:J69U)

Market Capitalization: SGD 4.6B

Current Dividend Yield: 5.36%

Price to Equity: 19.885

Price to Book: 0.997

Net Asset Value (NAV): SGD 2.276

Closing Price (30-Jun-25): SGD 2.28