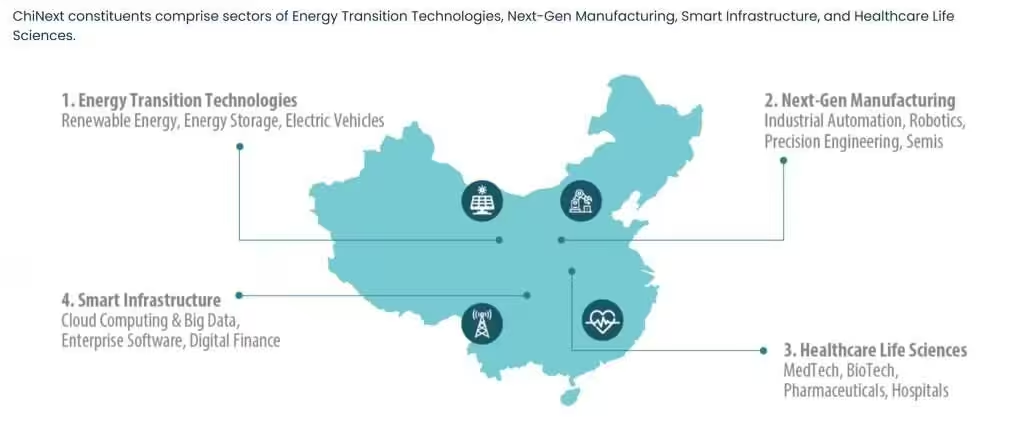

In a rapidly evolving financial landscape, savvy investors are constantly on the lookout for promising avenues to unlock opportunities. One investment vehicle that deserves your attention is the Amova ChiNext Index ETF. This exchange-traded fund offers a unique gateway into China’s dynamic growth sectors, particularly in technology and innovation.

As the ChiNext board focuses on emerging industries, the ETF provides diversification while tapping into the potential of high-growth stocks that are reshaping the global economy. With its distinctive positioning, the Amova ChiNext Index ETF not only stands out as a bold investment choice but also as a strategic option for those keen on harnessing the power of the Chinese market.

Whether you’re a seasoned investor or just starting out, understanding the nuances of this ETF can be the key to navigating the complexities of modern investing. Join me as I explore why this ETF may be the missing piece in your investment strategy.

Understanding the ChiNext Market: An Overview

The ChiNext Market, often referred to as China’s answer to the NASDAQ, is a sub-market of the Shenzhen Stock Exchange, specifically designed to facilitate the growth of innovative and fast-growing enterprises. Launched in 2009, ChiNext aims to support high-potential companies, particularly in the fields of technology, healthcare, and renewable energy. By providing a platform for these companies to raise capital, ChiNext plays a pivotal role in China’s broader strategy to transition from a manufacturing-driven economy to an innovation-driven one. The companies listed on ChiNext are typically smaller, with higher growth prospects compared to those on the main board, making it a fertile ground for high-growth investments.

Investors are drawn to the ChiNext market for its potential to deliver substantial returns, driven by the rapid growth of its constituent companies. These firms are often at the forefront of technological advancements and are well-positioned to capitalize on emerging trends such as artificial intelligence, biotechnology, and green energy. As China continues to invest heavily in these sectors, the ChiNext market offers a unique opportunity to gain exposure to some of the most dynamic and innovative companies in the world. However, it is worth noting that the ChiNext market is also characterized by higher volatility and risk, given the nascent stage of many of its listed companies.

The regulatory environment of ChiNext is designed to be more flexible compared to other segments of the Chinese stock market, which allows for a faster listing process and less stringent listing requirements. This flexibility is intended to attract a broader range of companies, particularly those that may not yet meet the criteria for listing on the main board. As a result, the ChiNext market is home to a diverse array of companies, spanning various industries and stages of development. For investors, this means that the ChiNext market offers not only high growth potential but also a wide range of investment opportunities.

Key Features of the Amova ChiNext Index ETF

The Amova ChiNext Index ETF is specifically designed to track the performance of the ChiNext Index, which comprises a basket of the top-performing companies listed on the ChiNext Market. One of the primary features of this ETF is its focus on high-growth sectors, such as technology, healthcare, and renewable energy. By investing in the Amova ChiNext Index ETF, investors gain exposure to a diversified portfolio of companies that are driving innovation and growth in China’s economy. This diversification helps to mitigate the risks associated with investing in individual stocks, while still offering the potential for high returns.

Another key feature of the Amova ChiNext Index ETF is its low expense ratio, which makes it an attractive option for cost-conscious investors. The expense ratio is a measure of the annual fees associated with managing the ETF, and a lower expense ratio means that more of the investor’s money is working for them, rather than being eaten up by fees. This is particularly important in the context of long-term investing, as even small differences in fees can add up over time and significantly impact overall returns. The Amova ChiNext Index ETF’s competitive expense ratio makes it an efficient vehicle for gaining exposure to the high-growth potential of the ChiNext Market.

Liquidity is another important feature of the Amova ChiNext Index ETF. As an exchange-traded fund, it can be bought and sold like a stock on the stock exchange, providing investors with flexibility and ease of access. This liquidity ensures that investors can enter or exit their positions quickly and at a fair market price, which is crucial in a rapidly changing market environment. Additionally, the ETF’s structure allows for real-time pricing, which means that investors have up-to-date information on the value of their investment, enabling them to make informed decisions based on current market conditions.

Below are the top 10 constituents of the Amova ChiNext Index ETF.

| Name | Sector | Weightage |

| CATL | Industrials | 20.79 |

| EastMoney | Financials | 8.34 |

| Inovance | Industrials | 3.98 |

| Mindray | Healthcare | 3.92 |

| Wens | Consumer Staples | 2.91 |

| Sungrow Power Supply | Industrials | 2.82 |

| Zhongju Innolight | Telecommunication Services | 2.61 |

| Eoptolink | Telecommunication Services | 2.51 |

| EVE | Industrials | 1.84 |

| Aier Eye Hospital | Healthcare | 1.74 |

| Total | 51.46 |

Benefits of Investing in the Amova ChiNext Index ETF

One of the primary benefits of investing in the Amova ChiNext Index ETF is the opportunity to gain exposure to China’s burgeoning technology and innovation sectors. These sectors are at the forefront of global economic growth and are expected to continue to drive significant advancements in the coming years. By investing in the Amova ChiNext Index ETF, investors can capitalize on the growth potential of these high-performing industries without having to pick individual stocks. This not only simplifies the investment process but also reduces the risk associated with investing in a single company.

Another significant benefit of the Amova ChiNext Index ETF is its diversification. The ETF comprises a wide range of companies from various industries, which helps to spread risk and reduce the impact of any single company’s poor performance on the overall portfolio. This diversification is particularly important in the context of high-growth markets like ChiNext, where individual stocks can be highly volatile. By holding a diversified portfolio, investors can achieve a more stable return profile, while still benefiting from the growth potential of the underlying companies.

The Amova ChiNext Index ETF also offers the advantage of professional management. The ETF is managed by a team of experienced investment professionals who are responsible for selecting and weighting the constituent stocks to best represent the ChiNext Index. This means that investors can benefit from the expertise and insights of these professionals, who are well-versed in the intricacies of the ChiNext Market and the broader Chinese economy. This professional management helps to ensure that the ETF remains well-balanced and aligned with its investment objectives, providing investors with peace of mind that their investment is being actively monitored and managed.

Performance Analysis: Historical Returns and Trends

To understand the potential of the Amova ChiNext Index ETF, it’s essential to examine its historical returns and trends. Over the past decade, the ChiNext Index has delivered impressive returns, driven by the rapid growth of its constituent companies. These companies have benefited from China’s strategic focus on innovation and technology, which has led to increased investment and favorable government policies. The result has been a robust performance that has outpaced many other market segments, making the ChiNext Index an attractive option for growth-oriented investors.

A closer look at the historical performance of the Amova ChiNext Index ETF reveals a pattern of strong returns, particularly during periods of economic expansion and technological advancement. For example, during the period from 2016 to 2020, the ETF saw significant gains as technology and healthcare companies on the ChiNext Market experienced rapid growth. This growth was fueled by a combination of factors, including increased consumer demand for innovative products, government support for key industries, and the global shift towards digital transformation. These trends have continued to drive the performance of the ETF, making it a compelling choice for investors seeking high-growth opportunities.

However, it is important to note that the Amova ChiNext Index ETF has also experienced periods of volatility, reflecting the inherent risks associated with investing in high-growth markets. For instance, during times of economic uncertainty or market corrections, the ETF has seen sharp declines in value. This volatility can be attributed to the higher risk profile of the underlying companies, many of which are still in the early stages of development and are more susceptible to market fluctuations. Despite this, the long-term trend for the Amova ChiNext Index ETF has been positive, with the potential for significant returns outweighing the short-term risks for many investors.

Risk Factors Associated with the Amova ChiNext Index ETF

While the Amova ChiNext Index ETF offers significant growth potential, it is not without its risks. One of the primary risk factors is the inherent volatility of the ChiNext Market. Companies listed on ChiNext are typically smaller and less established than those on the main board, making them more susceptible to market fluctuations and economic uncertainty. This volatility can lead to significant short-term swings in the value of the ETF, which may be challenging for some investors to manage. As such, it is important for investors to have a high risk tolerance and a long-term investment horizon when considering the Amova ChiNext Index ETF.

Another key risk factor is the regulatory environment in China. While the ChiNext Market is designed to be more flexible and supportive of high-growth companies, it is still subject to regulatory changes that can impact the performance of the ETF. For example, changes in government policies, such as increased scrutiny of certain industries or tighter regulations on capital markets, can have a significant impact on the companies listed on ChiNext and, by extension, the performance of the Amova ChiNext Index ETF. Investors need to be aware of these potential regulatory risks and stay informed about developments that could affect their investment.

Currency risk is another important consideration for investors in the Amova ChiNext Index ETF. As the ETF is denominated in Chinese yuan, fluctuations in exchange rates can impact the value of the investment for foreign investors. For example, if the yuan depreciates against the investor’s home currency, the value of the ETF may decline, even if the underlying companies are performing well. This currency risk adds an additional layer of complexity to investing in the Amova ChiNext Index ETF and requires investors to carefully consider their exposure to currency fluctuations and their potential impact on overall returns.

How to Invest in the Amova ChiNext Index ETF

Investing in the Amova ChiNext Index ETF is a straightforward process that can be done through most brokerage accounts. The first step is to open a brokerage account with a firm that offers access to international markets, including the ChiNext Market. Many major brokerage firms provide this service, allowing investors to buy and sell shares of the Amova ChiNext Index ETF just like any other stock. Once the account is set up, investors can place an order to purchase shares of the ETF, specifying the number of shares and the desired purchase price when the ETF is listed on 22nd July 2025.

It is important for investors to conduct thorough research before investing in the Amova ChiNext Index ETF. This includes understanding the ETF’s investment objectives, the composition of its holdings, and its historical performance. Investors should also consider their own investment goals, risk tolerance, and time horizon when deciding whether the Amova ChiNext Index ETF is a suitable addition to their portfolio. By taking the time to carefully evaluate these factors, investors can make informed decisions and increase their chances of achieving their investment objectives.

Once the investment is made, it is crucial to monitor the performance of the Amova ChiNext Index ETF and stay informed about developments in the ChiNext Market. This can involve regularly reviewing the ETF’s performance reports, keeping up with news and analysis related to the underlying companies, and staying aware of any changes in the regulatory environment. By staying engaged and proactive, investors can better manage their investment and make adjustments as needed to ensure that it continues to align with their goals and risk tolerance.

It is important to note that applications for the IPO (Initial Public Offering) close at 5pm on Monday, 14th July 2025.

Comparison with Other ETFs: What Sets It Apart

When comparing the Amova ChiNext Index ETF to other ETFs, several factors set it apart. One of the most notable differences is its focus on the ChiNext Market, which is unique in its emphasis on high-growth, innovative companies. While other ETFs may offer exposure to broader Chinese markets or specific sectors, the Amova ChiNext Index ETF provides a concentrated investment in some of the most dynamic and rapidly growing companies in China. This focus on the ChiNext Market gives the ETF a distinct growth-oriented profile, which can be particularly appealing to investors seeking high returns.

Another factor that sets the Amova ChiNext Index ETF apart is its competitive expense ratio. Many ETFs that offer exposure to high-growth markets come with higher fees, which can erode returns over time. The Amova ChiNext Index ETF, however, is designed to be cost-effective, with a low expense ratio that allows investors to keep more of their gains. This cost advantage makes it an attractive option for long-term investors who are looking to maximize their returns while minimizing costs.

The professional management of the Amova ChiNext Index ETF is another distinguishing feature. Managed by a team of experienced investment professionals, the ETF benefits from their expertise in selecting and weighting the constituent stocks. This active management helps to ensure that the ETF remains aligned with its investment objectives and is well-positioned to capitalize on emerging trends in the ChiNext Market. For investors, this means that they can benefit from the insights and experience of professional managers, which can enhance the overall performance of the ETF.

Expert Insights: Opinions from Financial Analysts

Financial analysts have offered a range of insights and opinions on the Amova ChiNext Index ETF, highlighting both its potential and its risks. Many analysts are optimistic about the ETF’s growth prospects, citing the strong performance of the ChiNext Market and the favorable macroeconomic environment in China. They point to the rapid advancements in technology and innovation as key drivers of growth, and believe that the companies in the ChiNext Index are well-positioned to benefit from these trends. As such, they view the Amova ChiNext Index ETF as a compelling option for growth-oriented investors.

However, analysts also caution that the Amova ChiNext Index ETF is not without its risks. They emphasize the volatility of the ChiNext Market and the potential for significant short-term fluctuations in the ETF’s value. They also highlight the regulatory risks associated with investing in China, noting that changes in government policies can have a profound impact on the performance of the ETF. As such, they advise investors to carefully consider their risk tolerance and investment horizon before investing in the Amova ChiNext Index ETF, and to be prepared for potential volatility.

Overall, the consensus among financial analysts is that the Amova ChiNext Index ETF offers a unique and attractive investment opportunity, particularly for those with a high risk tolerance and a long-term perspective. They believe that the ETF’s focus on high-growth, innovative companies provides significant upside potential, while its diversification and professional management help to mitigate some of the risks. For investors who are looking to capitalize on the growth potential of the ChiNext Market, the Amova ChiNext Index ETF is seen as a strategic and well-positioned investment option.

Conclusion: Is the Amova ChiNext Index ETF Right for You?

In conclusion, the Amova ChiNext Index ETF presents a unique opportunity for investors to gain exposure to some of the most dynamic and rapidly growing companies in China. With its focus on high-growth sectors such as technology and innovation, the ETF offers significant upside potential, making it an attractive option for growth-oriented investors. The diversification and professional management provided by the ETF further enhance its appeal, helping to mitigate some of the risks associated with investing in individual stocks.

However, it is important for investors to carefully consider their own investment goals, risk tolerance, and time horizon before investing in the Amova ChiNext Index ETF. The ChiNext Market is characterized by higher volatility and regulatory risks, which may not be suitable for all investors. Those who are willing to accept these risks and have a long-term perspective may find that the Amova ChiNext Index ETF is a valuable addition to their investment portfolio.

Ultimately, the decision to invest in the Amova ChiNext Index ETF should be based on a thorough evaluation of the ETF’s features, performance, and risks, as well as an understanding of how it aligns with your overall investment strategy. By taking the time to conduct this analysis, you can make informed decisions and increase your chances of achieving your investment objectives. If you believe in the growth potential of China’s innovative sectors and are prepared for the associated risks, the Amova ChiNext Index ETF could be the key to unlocking significant investment opportunities.