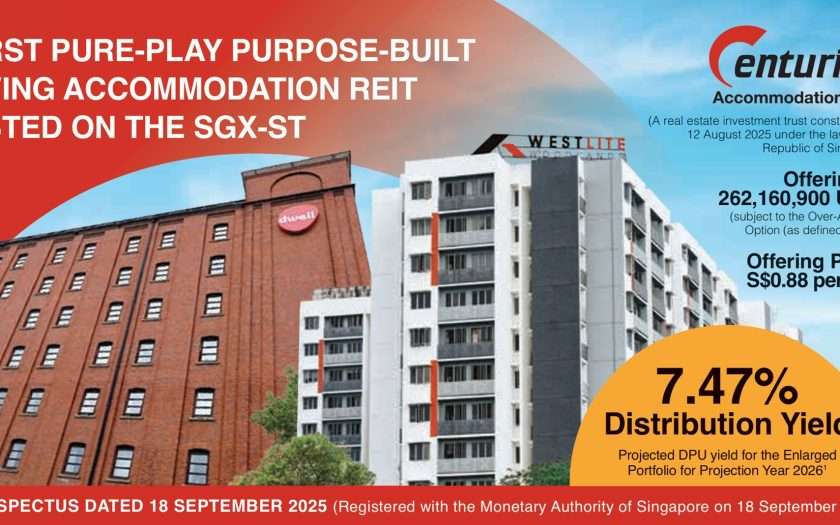

Centurion Accommodation REIT IPO was 16.6 times oversubscribed. Centurion Accommodation REIT (CAREIT) made a confident entrance onto the Singapore Exchange (SGX) on September 25, 2025, marking one of the largest IPOs of the year and a significant milestone for Singapore’s REIT landscape. Spun off from Centurion Corporation, CAREIT is Singapore’s first pure-play REIT focused on purpose-built worker and student accommodation across three markets—Singapore, the United Kingdom, and Australia.

Centurion Accommodation REIT IPO was 16.6 times oversubscribed. Centurion Accommodation REIT (CAREIT) made a confident entrance onto the Singapore Exchange (SGX) on September 25, 2025, marking one of the largest IPOs of the year and a significant milestone for Singapore’s REIT landscape. Spun off from Centurion Corporation, CAREIT is Singapore’s first pure-play REIT focused on purpose-built worker and student accommodation across three markets—Singapore, the United Kingdom, and Australia.

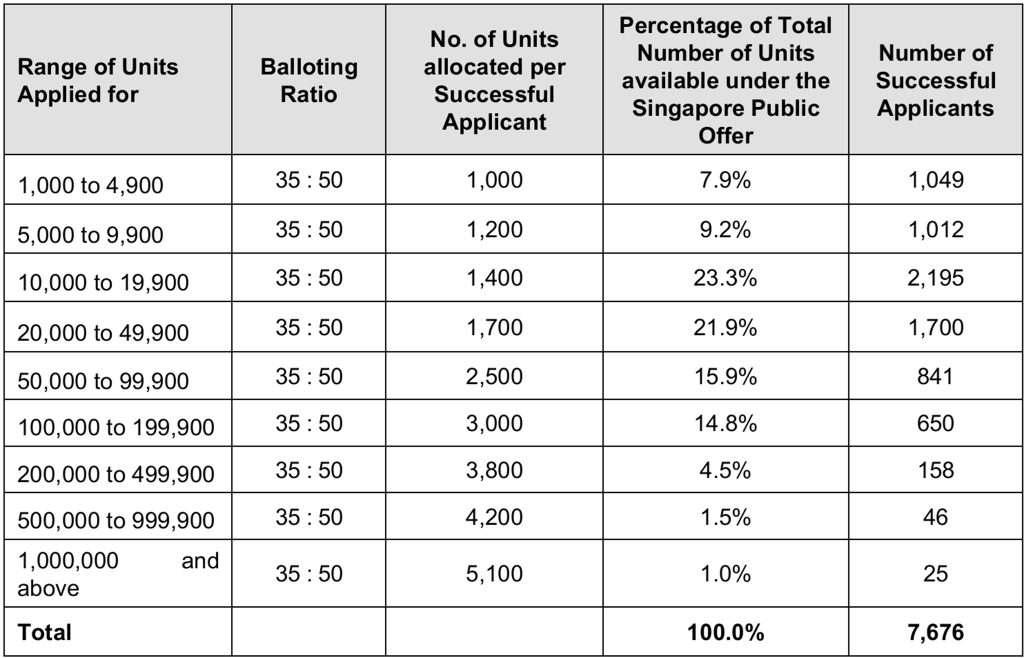

The IPO raised approximately S$771.1 million through the issuance of 262.2 million units at S$0.88 per unit. Investor appetite was robust: the offering was oversubscribed by 16.6 times, with the Singapore public tranche alone seeing a 30.9 times oversubscription. This overwhelming demand underscores the market’s confidence in CAREIT’s defensive asset class, high occupancy rates, and attractive yield profile.

CAREIT’s debut performance reflected this optimism. The REIT opened at S$0.98, 10 cents above its IPO price, representing a 11.4% premium and a solid vote of confidence from the market. By the end of its first trading day, the stock had settled at a modest gain of 1.1%, suggesting a stabilised entry rather than speculative volatility. This measured rise aligns with expectations for yield-focused REITs, which typically attract long-term institutional and retail investors rather than short-term traders.

The REIT’s cornerstone support was another highlight. Sixteen institutional investors including FIL Investment Management, Aberdeen Asia, DBS Bank, UBS, and Eastspring Investments collectively subscribed to 614 million units, accounting for 35.7% of the total offering. Their involvement not only provided price stability but also signalled institutional endorsement of CAREIT’s long-term growth prospects.

CAREIT’s initial portfolio comprises 14 assets valued at S$1.8 billion, including five purpose-built worker accommodations (PBWA) in Singapore, eight purpose-built student accommodations (PBSA) in the UK, and one PBSA in Australia. A second Australian student housing asset, Epiisod Macquarie Park in Sydney, is expected to be injected into the REIT in early 2026, expanding the portfolio to 15 properties worth S$2.1 billion.

The REIT’s projected distribution yields are compelling: 7.47% for FY2026 and 8.11% for FY2027. These figures are underpinned by high occupancy rates averaging around 97% and structural demand in both the worker and student accommodation sectors. In Singapore, the migrant worker population is expected to rise significantly due to infrastructure and property development, while student housing in the UK and Australia continues to face supply constraints amid growing enrolments.

CAREIT’s balance sheet is conservatively geared, with borrowings amounting to just 31% of assets post-acquisition. The REIT has no debt repayments due until 2028 and retains a borrowing capacity of approximately S$550 million before hitting the regulatory cap of 45%. This financial flexibility positions CAREIT well for future acquisitions and asset enhancements.

From a strategic standpoint, CAREIT benefits from its sponsor Centurion Corporation’s deep expertise and operational track record in specialised accommodation. The REIT also enjoys a right-of-first-refusal pipeline from the sponsor, offering avenues for inorganic growth.

In summary, Centurion Accommodation REIT’s IPO and debut performance reflect a well-calibrated launch backed by strong fundamentals, institutional support, and market demand. Its focus on resilient, income-generating assets in underserved segments makes it a compelling addition to Singapore’s REIT ecosystem. For yield-seeking investors, CAREIT offers both stability and upside potential in a sector poised for long-term growth.