With falling fixed deposit interest rates, where will I deposit 80K in May 2025? Today, I found a bank savings deposit promotion that give you 2.58% per annum. Under the falling interest rates environment, this savings promotion probably makes the bank savings account one of the best savings accounts. The return is also probably better than the best fixed deposits in May 2025. DBS Singapore and MayBank2U offer the highest fixed deposit interest rate at 2.45% per annum for a 12-months and 6-months tenure respectively.

The cut off yield for the latest issue of SGS 6-months T Bill BS25109V is only 2.30% per annum. What about Singapore Savings Bond (SSB)? The effective interest rate for SSB GX25060V is 2.56% if you held it for 10 years. If you sell SBJUN25 after 1 year, the return is only 2.20% per annum.

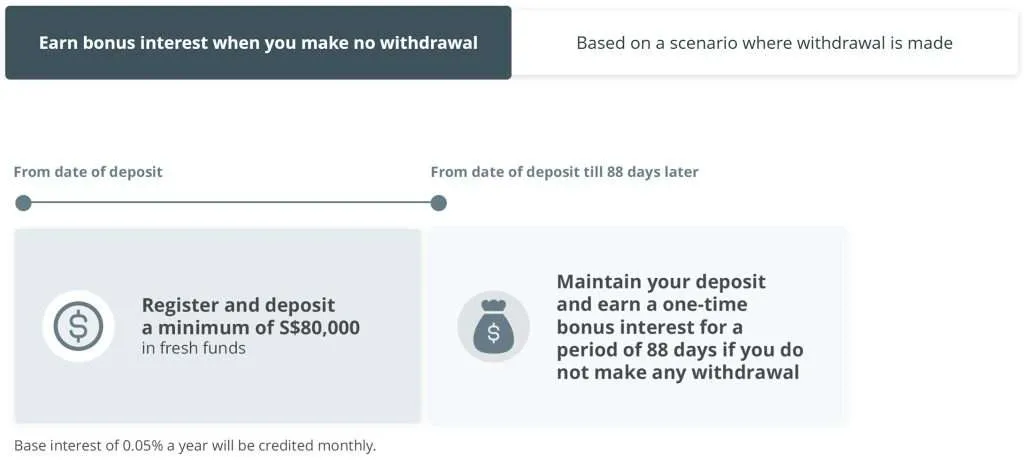

The Singapore Bank deposit promotion that I found is from OCBC Bank. This special promotion makes OCBC savings account competitive with other high interest rates savings account. To be eligible for this bank savings promotion, you need to deposit a minimum of S$80,000 in fresh funds and watch your savings grow at a higher interest rate! The other thing you need to do is to keep your funds with OCBC Bank for 88 days without making any withdrawals to enjoy this bonus interest rate. Please note that you also need to register via the form found on OCBC’s website. The promotion runs until 30th June 2025, so you need to complete the above steps by 30th June 2025.

OCBC Savings Account Promotion May 2025 Interest Rates

Let me break down the interest rates for you. Your entire account balance in your normal OCBC savings account earns you 0.05% per annum. With the fresh funds of S$80K to S$200K deposited, you will earn a bonus interest of 2.53% a year. Adding up the bonus interest and base interest earns you a total interest of 2.58% a year.

| Fresh funds deposited | Bonus interest a year | Base interest a year | Total interest a year |

| S$80,000 – S$2,000,000 | 2.53% | 0.05% | 2.58% |

If the above is too confusing for you, OCBC Bank has been transparent about its return. Also found at OCBC website, below is an illustration of the amount of bonus interest (2.58% a year) you can earn:

| Fresh funds amount | Bonus interest a year | Amount you will receive |

| S$80,000 | 2.53% | S$487.97 |

| S$150,000 | 2.53% | S$914.95 |

| S$500,000 | 2.53% | S$3,049.86 |

| S$1,000,000 | 2.53% | S$6,099.72 |

| S$2,000,000 | 2.53% | S$12,199.45 |

Protection By Singapore Deposit Insurance Corporation (SDIC)

Your savings in OCBC savings account are insured up to S$100k by Singapore Deposit Insurance Corporation (SDIC). The Deposit Insurance (DI) Scheme protects insured deposits held with a full bank or finance company. Insured depositors will be compensated up to a maximum of S$100,000 in the event a DI Scheme member fails.

Here is the link to the promotion I found: OCBC Statement Savings Account | Monthly Account Statements

This is not a sponsored post and solely based on my own research and opinion. With falling interest rates, I believe everyone like me is looking for the best place to park your money.

If you like this post, please also check out UOB Stash Account. Stash Account | UOB Singapore