Do you know UOB Stash Account interest rate and how UOB Stash Account works? UOB Stash Account lets you earn up to 2.04 percent per annum. Based on S$100,000 savings stashed with UOB Stash Account, you can get up to S$2,040 in interest a year when you maintain or increase your monthly average balances. Since UOB Stash is a simple savings account, there is no lock-in period on your cash deposits. The minimum initial deposit to get started is low at S$1,000. Youths and students from 15 years old can also apply for this account. Do take note that there is a S$30 early account closure fee if you close UOB Stash Account within 6 months from opening.

Do you know UOB Stash Account interest rate and how UOB Stash Account works? UOB Stash Account lets you earn up to 2.04 percent per annum. Based on S$100,000 savings stashed with UOB Stash Account, you can get up to S$2,040 in interest a year when you maintain or increase your monthly average balances. Since UOB Stash is a simple savings account, there is no lock-in period on your cash deposits. The minimum initial deposit to get started is low at S$1,000. Youths and students from 15 years old can also apply for this account. Do take note that there is a S$30 early account closure fee if you close UOB Stash Account within 6 months from opening.

At this point of writing, I have yet to find any savings account that gives a higher return as compared to UOB Stash Account. If you are comparing UOB Stash Account with Fixed Deposits, DBS Singapore offers the highest fixed deposit interest rate at 2.45% per annum for a 12-months tenure but the maximum amount allowed is only S$19,999. Other savings account from banks such as OCBC are complicated as you need to fulfil multiple conditions to earn a higher interest. For example, OCBC 360 account will offer up to 5.45% a year on your first S$100,000 if you credit salary, save, spend, insure and invest with them.

Do you know how UOB Stash Account works, as in how UOB Stash Account calculate the interests? Let me explain deeper into how UOB Stash Account calculate the interests. UOB Stash Account interest is actually based on Tiers. As you can see from the table below, the base interest of the UOB Stash Account is actually 0.05% per annum. You will always earn this interest, regardless of what you deposit into your account. When you maintain or increase your Monthly Average Balance (MAB), you can earn up 3% per annum.

Based on an initial deposit balance of S$100,000 in your UOB Stash Account, you can earn up to S$2,040 interest a year by simply maintaining or increasing your Monthly Average Balance (MAB) each month. Below is how your bonus interest will add up.

| Monthly Average Balance | Base interest (p.a.) | Bonus interest (p.a.) | Total interest (p.a.) |

| First S$10,000 | 0.05% | 0.00% | 0.05% |

| Next S$30,000 | 0.05% | 1.55% | 1.60% |

| Next S$30,000 | 0.05% | 2.15% | 2.20% |

| Next S$30,000 | 0.05% | 2.95% | 3.00% |

| Above S$100,000 | 0.05% | 0.00% | 0.05% |

In my opinion, stashing S$100K into UOB Stash Account is the sweet spot because any amount above this will only give you 0.05% per annum. If you have surplus cash on hand above S$100K, I suggest you make a 12-month fixed deposit placement with DBS to earn 2.45% per annum.

UOB Stash Account Interest Calculator

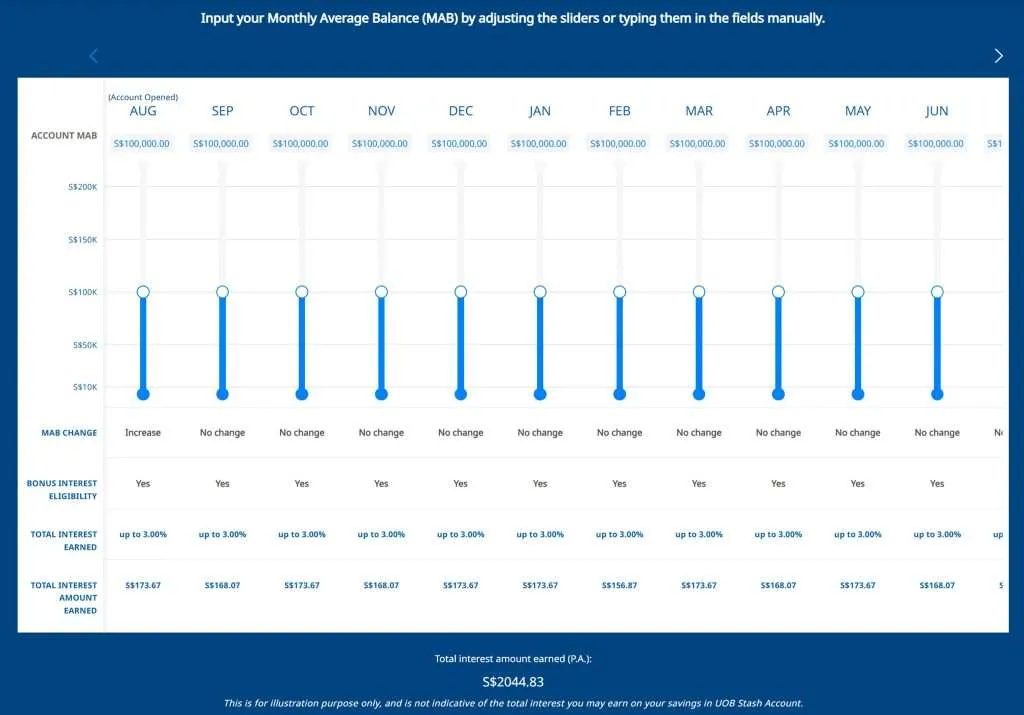

If the above table looks complicated to you, do not worry. UOB has a calculator that can be found at their UOB Stash Account website that helps you estimate the interest that you will earn.

As you can see below, I entered S$100K as the monthly average balance from August 2025 to August 2026. Based on the calculator, the total interest I will earn per annum is S$2,044.83.

My Opinion of UOB Stash Account Interest Rate (2.04 Percent Per Annum)

In my opinion, UOB Stash Account is a simple, no frills savings account that gives you 2.04% per annum. Having said that, this account is not for low ballers because any deposit amount below S$30,000 only give you 0.05% p.a. according to the interest rate table shared above. To earn that 2.04% per annum, you need to deposit S$100K and maintain this amount throughout.

If you have surplus cash on hand above S$100K, I suggest you use the surplus and make a 12-month fixed deposit placement with DBS to earn 2.45% per annum.

If you are keen to open a UOB Stash Account, please head over to UOB Singapore website. There are no referral links in this point because this is not a sponsored post.

Disclaimer: This is Not a sponsored post, and the opinions are solely based on My Sweet Retirement’s own research and opinion.